Hey, Ross here:

And here’s a chart highlighting the market indecision caused by the Fed yesterday.

Chart of the Day

The Fed paused hikes as expected yesterday. But it was also more hawkish than expected in its statement, hinting that it might hike rates two more times this year.

This has created a bit of contradiction, which you can see reflected in yesterday’s candlestick.

It’s called a doji candlestick, which describes a candlestick with a very small “body” – meaning the open and close price are very close to each other.

That’s what happened yesterday. But look at how long the “wick” on the candlestick was on both ends. This means the market saw huge fluctuations during the trading day, even though it closed largely flat.

This shows buyers and sellers fighting it out (with the buyers getting a very slight edge) over their interpretation of the Fed’s decision.

I expect this to keep playing out over the next few days before a more definitive direction is established.

But this “indecision” can be our opportunity.

P.S. Would you like special trade prospects and potential market moves just like the above sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Market indecision can be our opportunity.

When the buyers and sellers are fighting it out – the price stays largely flat and the market looks indecisive.

But if you know what you’re looking for, you can spot when the buyers are slowly edging out the sellers…

Giving you the chance to position yourself while the market is still “deciding” – and the price is still flat.

Then, when the sellers are exhausted, the buyers completely take over and send the price flying.

This is what’s happening right now…

And my current top strategy is pinging me with all sorts of breakout opportunities…

Opportunities I’m planning to share with you LIVE later today at 12 p.m. Eastern.

So make sure you click here to save your seat…

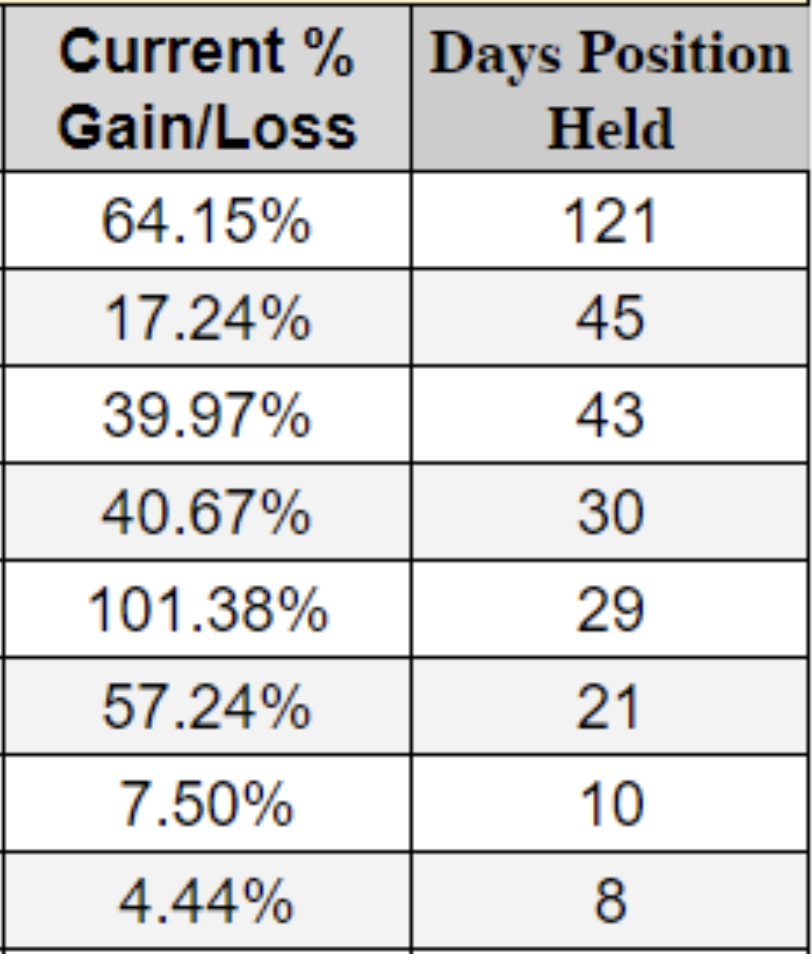

Because this strategy has already delivered gains like:

And that’s before this impending breakout…

Meaning I expect the room to fill up fast.

Here’s the link again to confirm you’re coming.

See you soon.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily