Hey, Ross here:

The biggest market news yesterday had nothing to do with the stock market…

It had to do with gold instead.

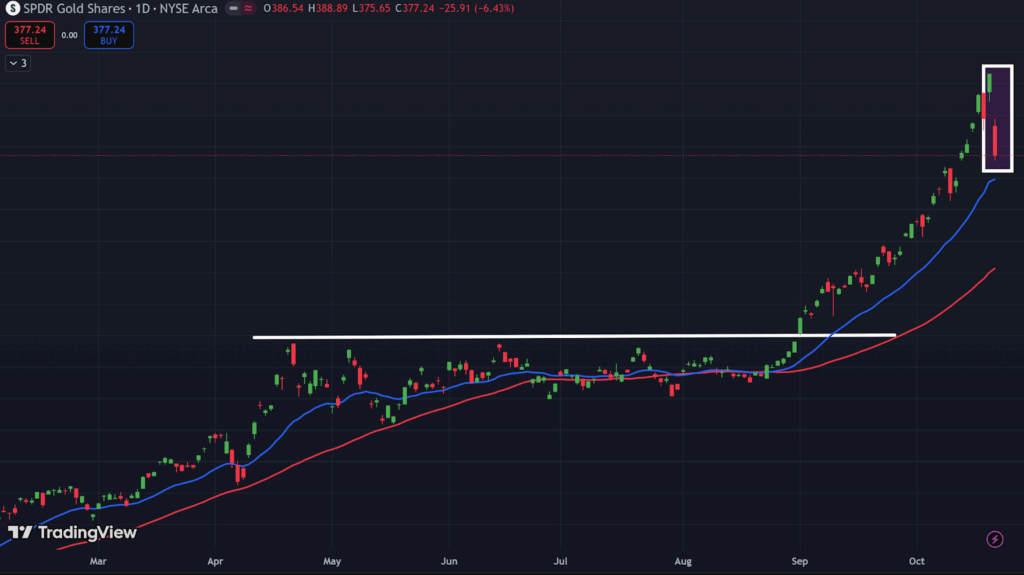

Take a look.

Chart of the Day

Gold suffered its worst day in 12 years yesterday, with its price dropping 6.5%.

This move caught many traders by surprise…

Because given the ballooning deficit, continued money printing, declining US dollar, and the Fed cutting rates despite elevated inflation…

You would expect this shiny metal to just keep going up.

But nothing goes up in a straight line – not stocks and not gold.

I mean, just look at the chart above.

Since it broke out at the end of August, gold shot up 26% in less than two months.

A consolidation was always coming – despite what the goldbugs would have you believe.

In fact, you can see that gold largely chopped around sideways from April to August – over four months.

Now don’t get me wrong, I’m still highly bullish on gold.

But the gold pullback was always coming.

That’s my take on gold.

As for stocks…

We’re also seeing certain sectors pull back – and others surge.

Take a look below.

Insight of the Day

A rotation is a perfect chance to target the sectors that are moving to the fore.

The chart below shows the percent of stocks in each sector trading above their 50-day moving average (a sign of medium-term direction).

It compares said percentages at present and as of one month ago.

As you can see, there are big differences in the numbers now versus one month ago.

Certain sectors have seen drastic drops in the percentage of stocks trading above their 50-day averages…

While others have seen huge jumps.

That’s a classic rotation in action.

Yes, it might cause a short-term pullback in the broader markets.

But underneath the surface, it gives us a chance to go after the strongest stocks in those sectors that are just now coming to the front…

Especially with the Fed set to cut rates again next week.

The key to doing so is spotting the institutional money flows…

Because they’re the ones causing the rotation in the first place.

That’s why in just a few hours at 12 p.m. Eastern today…

I’m hosting a training session showing you how to identify the exact stocks seeing these institutional inflows…

So you can basically leverage these flows for your own returns.

The method I’ll be showing has identified stocks that have shot up over 500% in recent months…

But with the rotation happening – not to mention the institutional investors aggressively buying any dip…

These could just be the start.

My team will send you the login details for this training session in a bit…

So keep a look out for that.

See you soon.

Customer Story of the Day

“Ross is always current, on top of market trends and why they move. It’s because of the “why” that I am an Alpha and Fire Trader ‘s member.

Well worth the investment! You will be glad you joined!”

Ross Givens

Editor, Stock Surge Daily