Hey, Ross here:

And let’s start the day with a chart that shows the dangers of being too focused on the “headline-making” stocks.

Chart of the Day

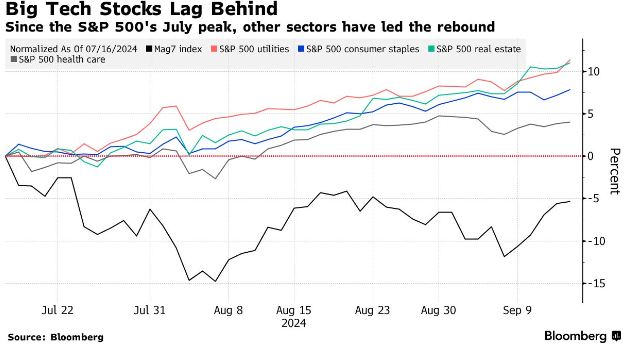

This chart shows the performance of the Magnificent Seven since the market peak in July versus the rest of the S&P 500.

As you can see since then, the Magnificent Seven has severely underperformed the other market sectors.

If all you did was pay attention to the headline-making Magnificent Seven stocks, you might think we’re dangerously close to a bear market.

But the truth is, we’re still very much in a bull market – so act accordingly.

Insight of the Day

There are sectors that are doing great while the rest of the market is doing good – focus your efforts there.

The Big Tech stocks may be faltering – but other stocks are flying.

Focusing on the less-popular stocks in these high-flying sectors is how you make the most of this bull market while it’s still there.

Especially once the Fed starts cutting rates – something that’s likely to happen tomorrow – certain sectors could outpace the market even more.

The issue with the less-popular stocks in these sectors is that there are just so many stocks to choose from (that’s also why traders get lazy and just focus on the names everybody already knows).

So that’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a masterclass that will show you how to use the strongest buying signal I know – the buying activity of the corporate insiders.

Their unbeatable informational edge means they already know what’s most likely to happen with their own company stock.

So when they move, we follow.

That’s why the insider strategy I’ll be demonstrating in this morning’s masterclass has never had a losing year…

And it’s had a compounded return of over 1,900% since inception.

After tomorrow morning’s masterclass, you’ll have everything you need to start using this insider strategy for yourself, including:

- Where you can find the complete records of all these insider trades…

- The obscure SEC loophole these insiders are exploiting…

- What compels these insiders to buy…

- Why so many traders fail when trying to follow these insiders (not all insiders are worth following)

- And the 3 most powerful – yet counterintuitive – insider buying signals you must know about to be successful

So if you haven’t yet, make sure you click here now to guarantee your spot for my masterclass later.

The login details will be in your inbox shortly.

Set yourself up for success before the Fed acts.

See you at 11 a.m. ET in a bit.

Customer Story of the Day

“A couple weeks in with a small account, and I’m up significantly! I love the information sharing, the teaching, and all the data that is given to me to allow me to make my own judgments should I choose.

The actual stocks that are chosen, and the reasons behind why they are chosen are fantastic. Get involved and you will make money accidentally. 100% totally worth the investment!”

Ross Givens

Editor, Stock Surge Daily