Hey, Ross here:

Hope you had a great Fourth of July weekend.

To start the week, let’s look at a couple of charts that could give us some clue as to what’s coming down the pipeline.

Chart of the Day

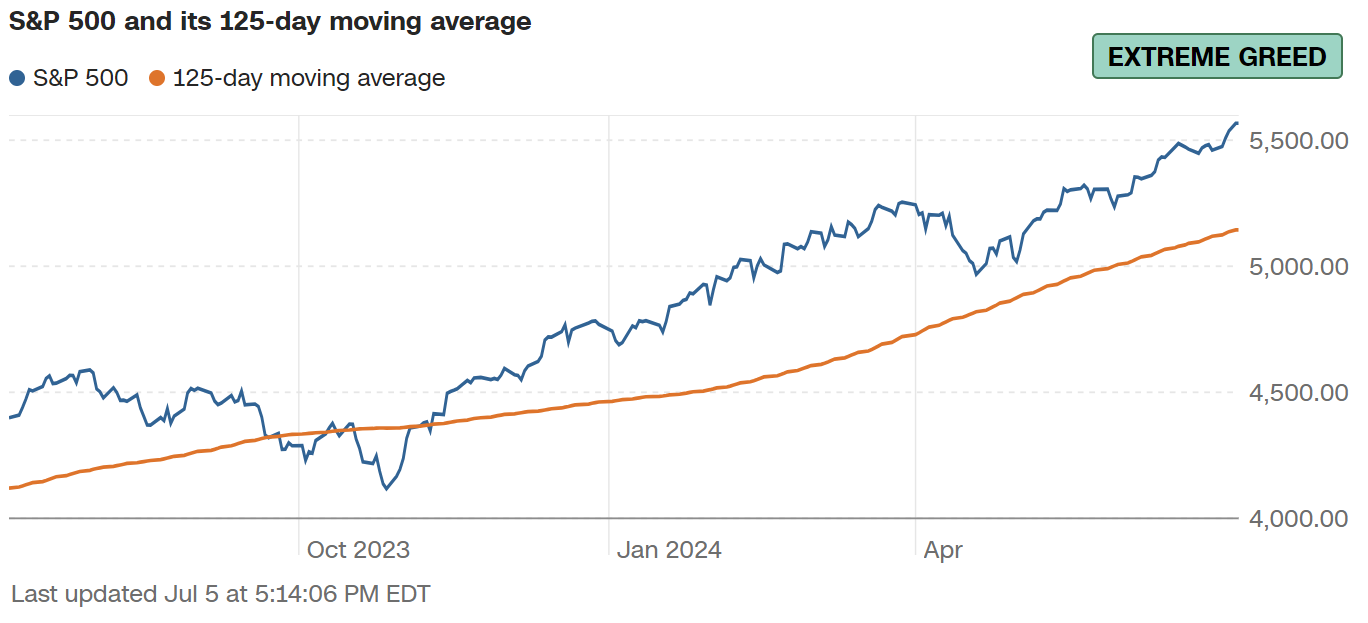

This chart is an indication of market momentum based on the 125-day moving average. It’s one of the indicators that go into CNN’s Fear and Greed Index.

Personally I prefer using the 50 and 200-day moving averages myself, but even with those benchmarks, there’s no denying the S&P 500 has strong momentum.

Now, let’s look at another indicator that goes into that same index.

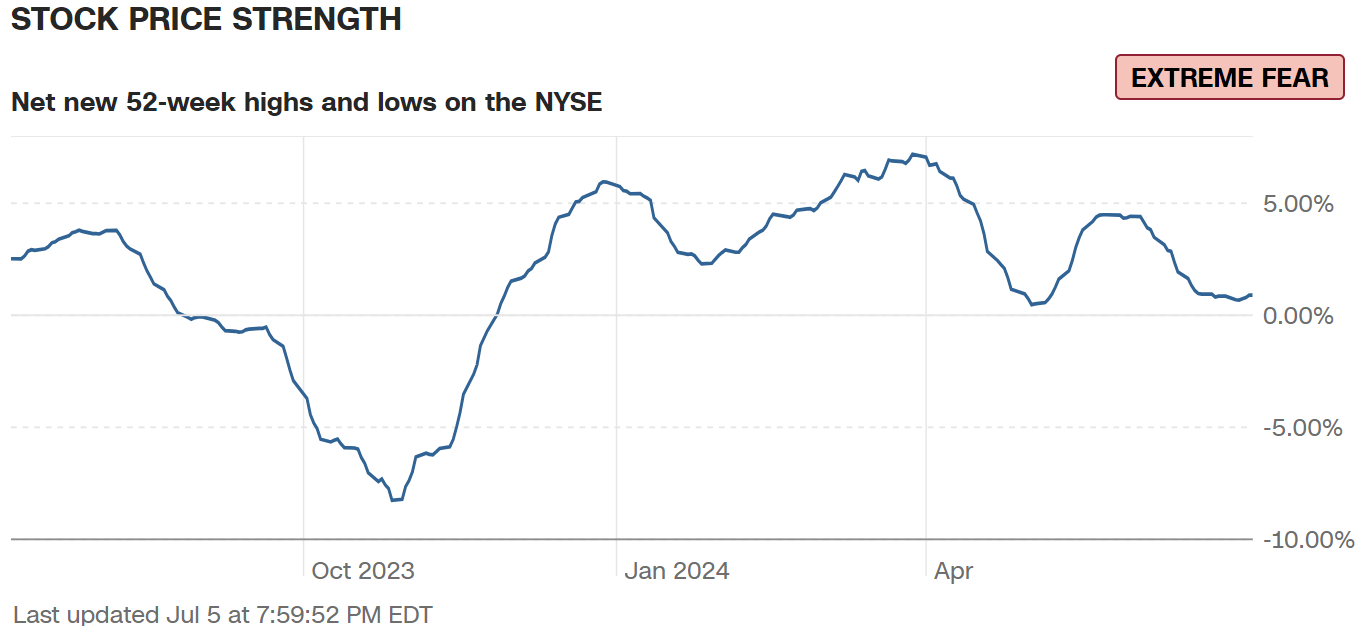

This chart shows what percent of stocks are at 52-week highs compared to 52-week lows. 0% means they’re about equal.

And as you can see, right now, there are about just as many 52-week highs as there are lows – which is typically not a sign of strength.

So, one indicator is showing Extreme Greed – while another is showing Extreme Fear.

No wonder so many traders are worried that this bull market can’t possibly continue.

I explain what I think below.

Insight of the Day

To profit from this bull market – follow the buyers.

We’re in an extremely divergent bull market.

And with the question of rate cuts still up in the air, signs of a weakening economy – plus sentiment still whipsawing back and forth…

It can all seem a bit too complicated.

But let’s keep it simple with some first-principles thinking.

There’s only one thing that creates bull markets – buyers.

No matter what kind of bull market it is, the action is where the buyers are.

If you know where the buyers are going, you know where the price is going.

I built all my trading strategies upon this truth.

And tomorrow morning at 11 a.m. Eastern…

I’m going LIVE for a brand-new masterclass that will show you how to detect when the biggest buyers in the market are flooding into a stock…

Which will allow you to use their money for your profit.

After my new live masterclass tomorrow, you’ll know:

- How to detect when buying pressure is building up in a specific stock…

- Why most traders are blind to this buildup of pressure (causing them to miss out on big gains)…

- And the exact point to jump into one of these “pressurized” stocks to go for maximum gains.

So make sure you click here to save your seat for my NEW live masterclass…

And watch out for the login info in your inbox before it starts.

I can’t wait to see you tomorrow morning at 11 a.m. Eastern.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily