Hey, Ross here:

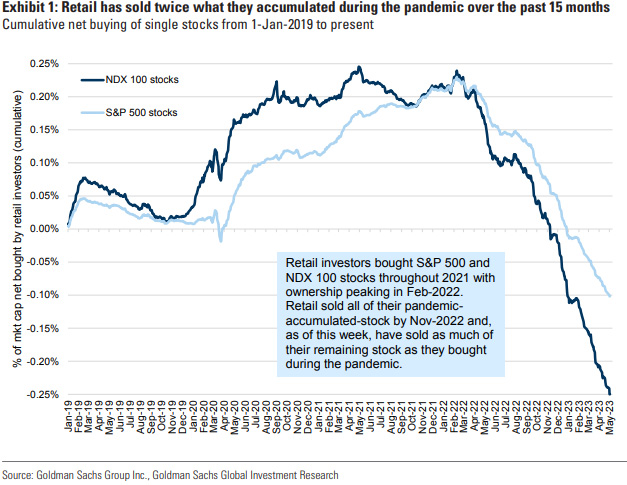

And here’s an interesting chart that shows you just how fickle most retail traders are.

Chart of the Day

Essentially, retail investors’ stock holdings have actually gone back to below pre-pandemic levels as they quickly learned that stocks don’t only go up.

That’s why the pros like to call them the “dumb money” in the backrooms.

Fortunately, because you’re subscribed to this newsletter – no one will ever be able to lump you in with them.

And the more you understand the rules of the game – the more you’ll be able to distance yourself from the fickle crowd.

P.S. Would you like special trade prospects and potential market moves sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Trading is a game of expectations – and there are rules

If the market expects one thing – and it gets exactly that thing – prices will barely budge.

But if the market expects one thing – and it gets the complete opposite – prices will go crazy.

Look at what happened yesterday. Markets were expecting a 0.25% increase – and that’s exactly what happened.

Sure, they fell a little. But that was more to do with Powell’s statement ruling out rate cuts (not pauses). So some mega-bulls who were expecting cuts to be right over the horizon had to adjust their expectations downward a little, which affected prices.

That’s the rules of the expectations game demonstrated on a broad market level.

But the rules of this expectations game also apply to individual stocks. If a company’s earnings beat expectations, the stock rises. If it falls below, the stock also falls.

And just like any game, there is an optimal strategy for beating it.

That’s why, in just a couple hours – at 12 p.m. Eastern today – Ross Givens is going LIVE to show you his secret strategy for beating the expectations game.

Click here to save your spot (or to join him in the room if it’s already time).

Ross Givens

Editor, Stock Surge Daily