Hey, Ross here:

Welcome to the start of a new trading week. Let’s review what happened last week – and where I see the market going from here.

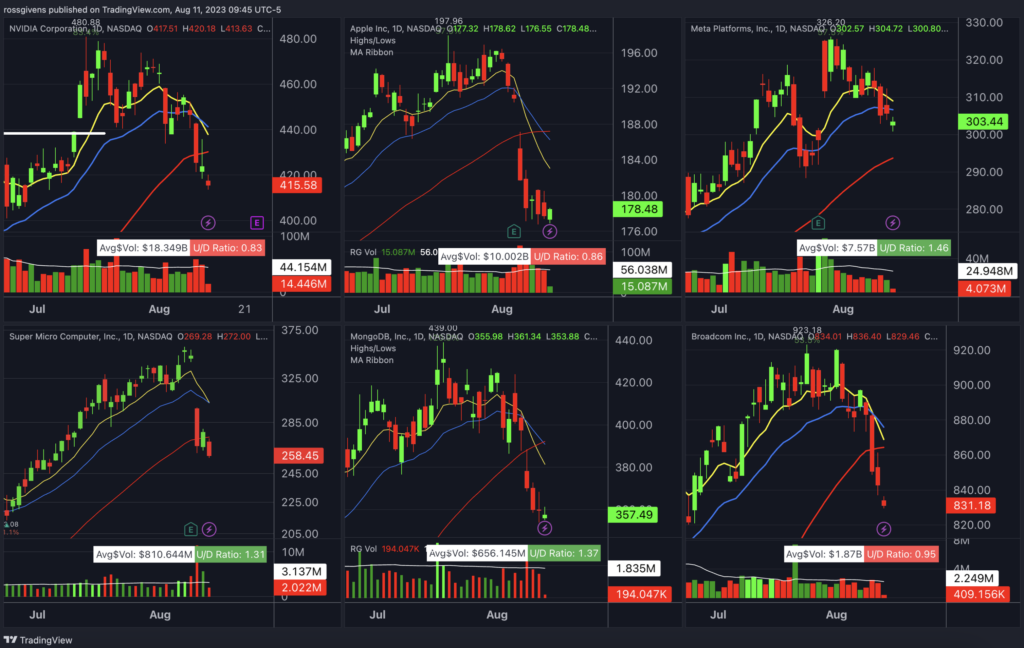

Chart of the Day

Leadership is retreating…

As I often talk about, every bull market has a “theme” – a specific sector or group of stocks that lead the rest of the market.

This one has been no different. And the theme is artificial intelligence.

Stocks with exposure to AI have been the top performers in 2023. Meta, Nvidia, Super Micro Computer, MongoDB, and several others have all seen spectacular gains this year.

These are the market leaders… the institutional favorites… the Wall Street darlings… whatever you want to call them.

When these stocks begin to pull back, the rest of the market does too. So, we always want to keep an eye on them.

Last week, leadership began to weaken. NVDA, MDB, AAPL, AVGO and a few others closed below their 21-day EMA for the first time in months (see chart).

As I’ve been saying over and over again – this is both normal and expected. Stocks do not go straight up.

I believe we’re still in a bull market, and that all this is just prices “resetting” to digest the rapid upward price action we’ve seen and knock the froth off the market.

And as the Insight of the Day shows, there’s a way we can intelligently take advantage of this retreating market leadership.

Insight of the Day

Certain market conditions favor certain strategies

When market leadership is retreating, we can use it as “proving grounds” for the next winners.

If the selloff in AI and software stocks continues, what will take its place as the next hot sector?

Which names are holding up the best? Which tickers are pulling back the least and doing so on the lightest volume?

These are the questions smart traders ask during times like these – because these are the questions that will help us spot the winners on the next leg higher.

My analyst and I are watching the markets closely to see where money – especially the big institutional money – is flowing.

If you want to stay updated on where these flows are going – here’s how you can do so.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily