Hey, Ross here:

Welcome back to a new trading week.

The biggest news over the weekend was the U.S. entering the Israel-Iran conflict by directly bombing suspected Iranian nuclear sites.

This will heighten uncertainty in the markets…

And make the bears even more vocal.

So, to start the day, let’s look at a counterintuitive chart that shows why the actual effects on the stock market may not be what most expect.

Chart of the Day

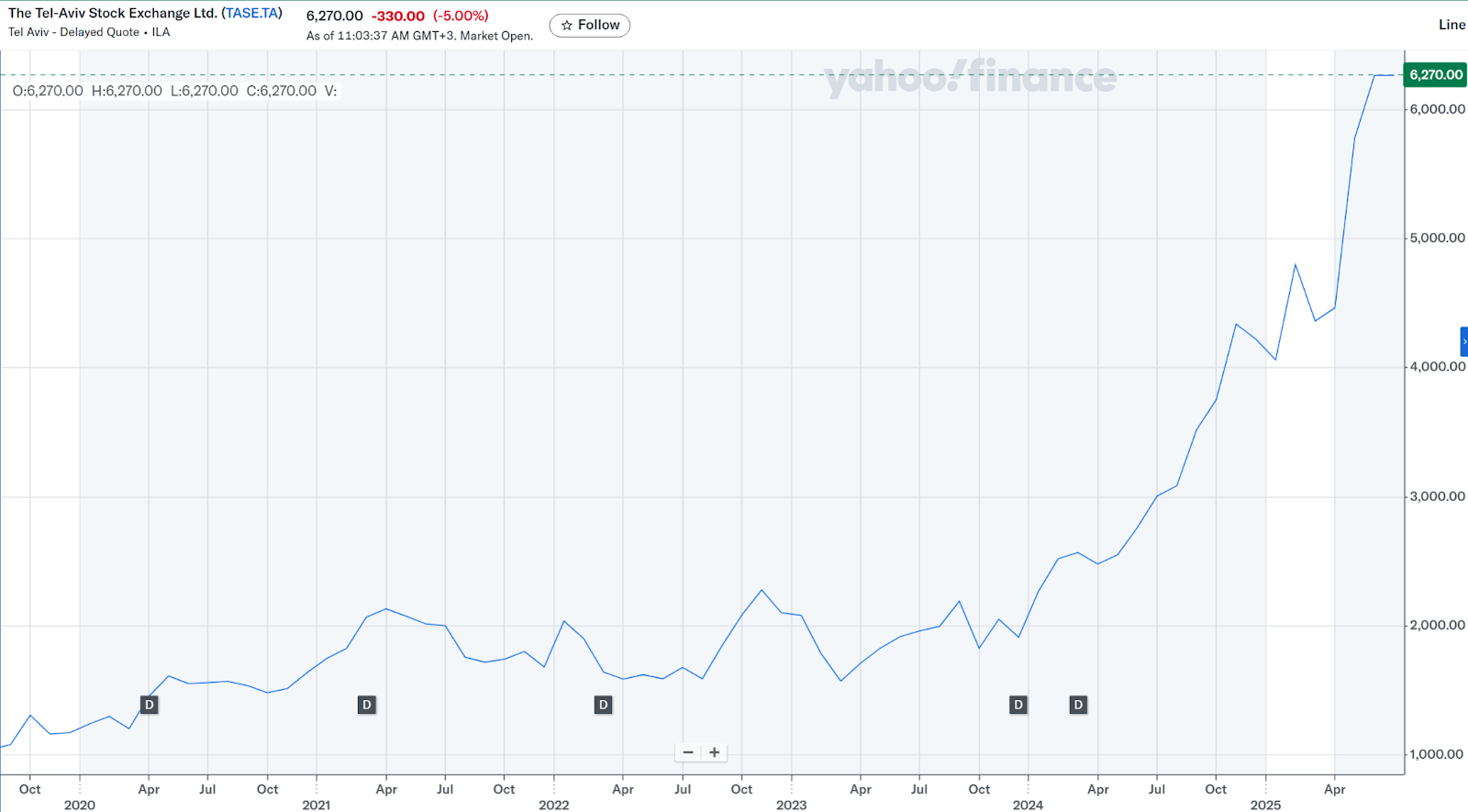

This is the chart for the Tel-Aviv Stock Exchange – essentially a gauge of Israel’s entire stock market.

You would expect that, as conflict in the region intensifies, stocks would drop.

Instead, the opposite has happened. Israeli stocks have instead surged to all-time highs (with a slight pullback over the weekend).

It’s not the only one. Markets in Egypt, Kuwait, and Qatar have also moved higher.

Remember, markets trade on expectations.

The price action of the stocks in the region show that investors expect American involvement to bring about a swifter end of the conflict.

Those expectations are being priced-in accordingly.

Again, this newsletter is about the markets, not politics.

So what this means is that – despite what the headlines are saying…

The impact on the stock market may be far more counterintuitive than what most expect.

We can play off that.

Insight of the Day

Near-term market turbulence will be seen as a sign the sky is falling for the bears – but a positioning opportunity for the savvy traders.

Make no mistake, near-term market turbulence is almost inevitable.

And considering how charged the situation is – not to mention the word “nuclear” being screamed from every headline…

Many bears will no doubt see the turbulence as a sign of a prolonged downturn.

But as the example of the Israeli stock market shows…

That is NOT the most likely scenario at all.

The data tells me the US stock market is still healthy.

So take any short-term turbulence as a positioning opportunity.

I’m sure there are many investors in Israel who are kicking themselves for missing out on the rally in their stock market.

Don’t let something similar happen to you.

Use this mayhem to position yourself in the most explosive stocks before the next breakout.

Tomorrow, Tuesday morning, at 11 a.m. Eastern…

I’m going LIVE for a broadcast on the best way to profit from all this mayhem.

We want to identify the hidden “pressure points” in the market…

The tell-tale signs that the “smart money” is piling into a stock – so we can use their money to ride the wave to the top.

Remember, the “smart money” are blatant opportunists.

They will be taking advantage of the situation.

Tomorrow, I’ll show you how to take advantage of them.

Click here to save your seat for my live broadcast…

And I’ll see you tomorrow morning at 11 a.m. ET.

Don’t wait for the conflict to end. By then, the opportunity would have already passed you by.

P.S. If you’re planning to attend on a mobile device, download the presentation app now so you don’t miss anything when it starts.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Been with these guys for two years, they’re the real deal, they helped me gain a 238 percent investment in my stocks. Where doing it myself I was only making a 9 percent return investment.

Very down to earth people. Within a month I got my investment back signing up with these guys. They help me get some of my investments on a better track.

Traders Agency is no joke these guys are very smart and a very happy client with them. They have helped me understand why they take a trade and why there is a stop loss.

They explain the math so it is easy to understand. Sometimes in the War Room and Stealth Trade we as clients bring trade we see and they can cover it with us.

Thanks Ross Etrade profile is doing very well.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily