Hey, Ross here:

Despite some respite on Friday, last week was another market bloodbath.

The Nasdaq is officially in a correction and has fallen below its 200-day moving average for the first time since October 2023.

Here’s my current plan.

Chart of the Day

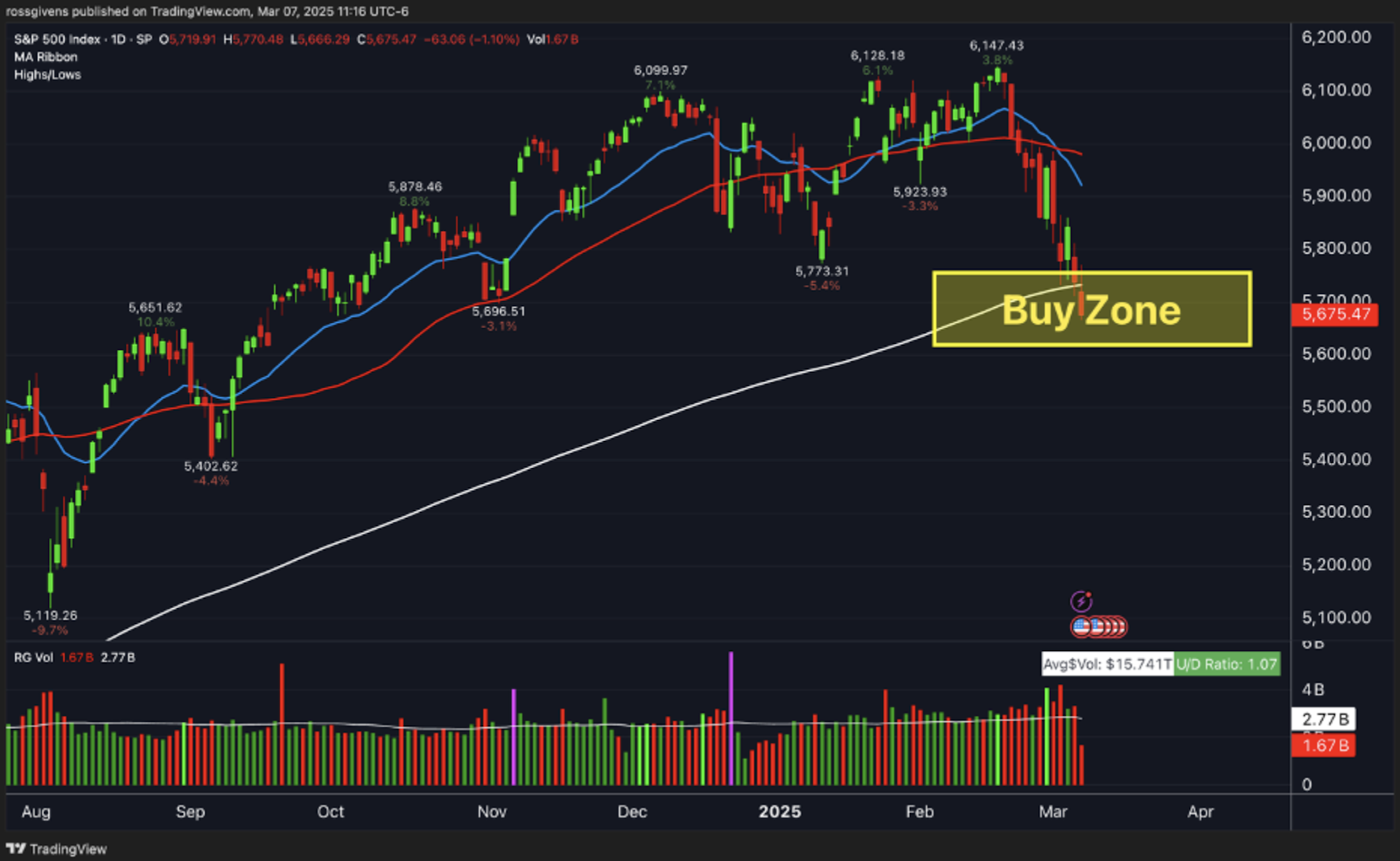

Here’s an updated chart of the S&P 500 highlighting where I wanted to “buy the dip”.

As you can see, right now, the market is squarely in the middle of my buy zone.

Do I feel like buying? Heck no.

As Walter Deemer – one of the best technical analysts who ever lived – said:

“When the time comes to buy, you won’t want to.”

Good trading often involves going against your own – and the crowd’s – emotions.

And while everybody theoretically “knows” this…

Buying when everybody is panicking is much easier said than done. Even I still struggle with it.

So, even though I don’t feel like buying, I’m planning to add money to my longer-term accounts here.

Insight of the Day

Rapid sell offs lead to highly oversold markets.

Rapid selling tends to set off a chain reaction of further selling.

This is especially true when it comes to the retail side of the market.

Just pay attention to how people are talking about the current market, and you can experience it yourself.

But, in most cases, these rapid sell offs lead to markets being highly oversold…

Which actually sets the market up for a big bounce.

I expect to see such a bounce this week.

Only time will tell if it turns out to be short-lived.

But even if it’s just a temporary spike, we can and should position ourselves to capture some fast profits.

That’s why tomorrow, Tuesday morning, at 11 a.m. Eastern…

I’m going LIVE to show you how to uncover “pressure points” in individual stocks.

These “pressure points” could tell us that the big Wall Street institutions are piling into a stock, allowing us to leverage their capital for rapid gains.

Tomorrow, I’ll break down how to spot these “pressure points” step-by-step…

And explain how to use them in this turbulent market.

With the market being oversold, now is the best time to put this strategy to work.

So click here to save your seat for my live breakdown tomorrow…

And I’ll see you at 11 a.m. ET Tuesday.

Remember, while retail traders are panicking…

The institutional traders are positioning themselves to profit.

Which side would you rather be on?

This “pressure points” strategy could have you sitting on a 183% open gain currently, and this could just be the start.

See you tomorrow.

Customer Story of the Day

“Ross Givens is an excellent teacher, and his trading techniques work very well. I have been with him for about one and a half years and have made excellent money.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily