Hey, Ross here:

No one loves a roaring bull market more than me.

Now, make no mistake – I believe we’re firmly in a bull market.

But if we take a peek under the hood, we can see why we should hold off on celebrating the S&P 500 hitting closing above 5,000 for the first time in history.

Chart of the Day

An abundance of pessimism is what triggers bull markets. Once everyone has sold, the market finds its bottom and quietly begins pushing higher.

On the other side of the coin, too much optimism often means we are near the top. If everyone is fully invested because they think prices will go higher, there is no one left to do the buying.

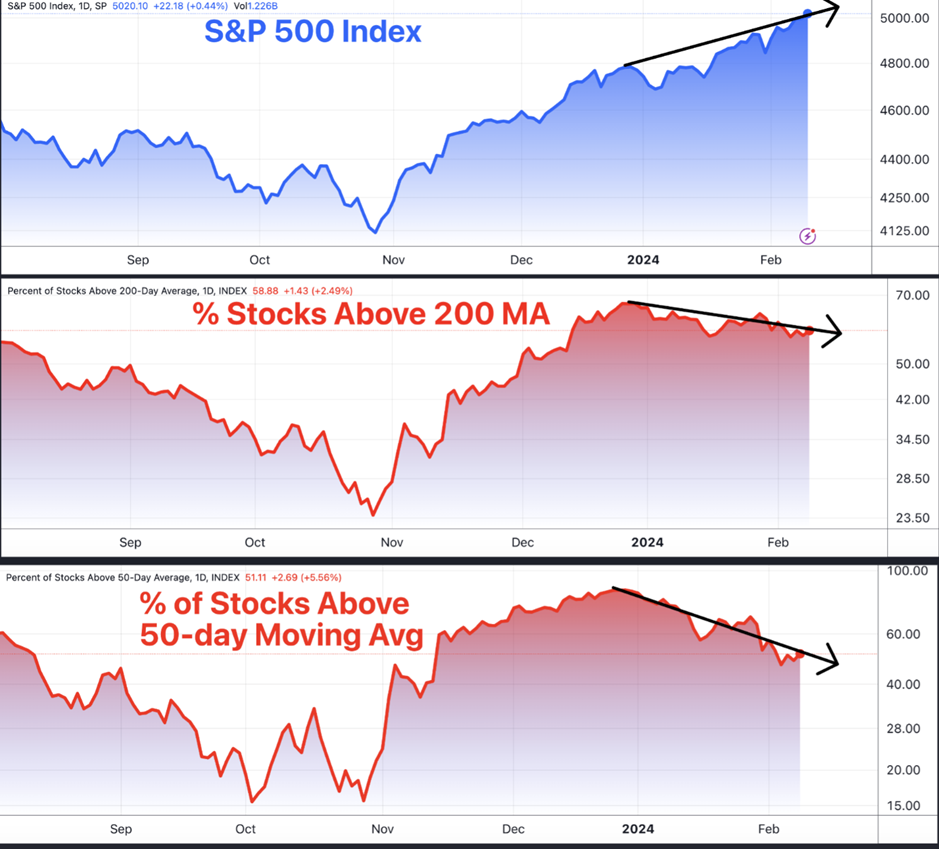

Over the past six weeks, we’ve seen a 5% increase in the S&P 500.

When the stock market is rallying, we should see more and more stocks trading above their 200-day and 50-day moving averages.

But as you can see, right now, we’re seeing divergence instead.

This is not what you would expect to see when markets are at all-time highs. We saw a similar divergence leading up November 2021 – and we all know what happened after.

Let me be clear – I do NOT think we are on the verge of a bear market. In fact, I expect just the opposite. But in the near term, markets are extended.

The stock market has risen too much too fast, and some of the underlying data that triggered this rally is proving to be weaker than anticipated.

After the move we have seen over the last three and a half months, we are due a pullback… or at the very least a pause.

Stay ready.

Insight of the Day

Too many traders overstay their welcome in a hot market.

The rally that kicked off in November last year has been a great party. Those who had access to my recommendations could have seen lots of nice gains over the past few months.

But don’t make the mistakes so many traders do. Don’t overstay your welcome.

There is nothing wrong with decreasing your exposure a little, nailing down good profits while you have them, and waiting for the next big opportunity.

Because make no mistake, a market correction WILL create big opportunities – but you have to prepare for them NOW.

My Stealth Trades strategy allows you to target stocks that are correcting – pulling back like a loaded slingshot ready to spring higher.

Those who had access to this strategy could have just booked this sweet gain:

And if you had taken the recommended option trade instead, that gain would have skyrocketed to between 800% – 1,000% instead.

But with a true market correction in sight, gains like this could just be the start.

If you want to target gains like these, you need to position yourself NOW.

So make sure you click here to watch my presentation explaining how my Stealth Trades strategy works…

Or just click here to head straight to the Order Form.

Your investment is a mere $5 to access my Stealth Trades strategy…

But as you can see, the payoff could be exponential.

Ross Givens

Editor, Stock Surge Daily