Hey, Ross here:

Markets are likely going to open significantly lower today on the back thanks to Israel’s surprise strike on Iran.

Sentiment will be impacted.

But as I explain below – that may be a good thing.

Chart of the Day

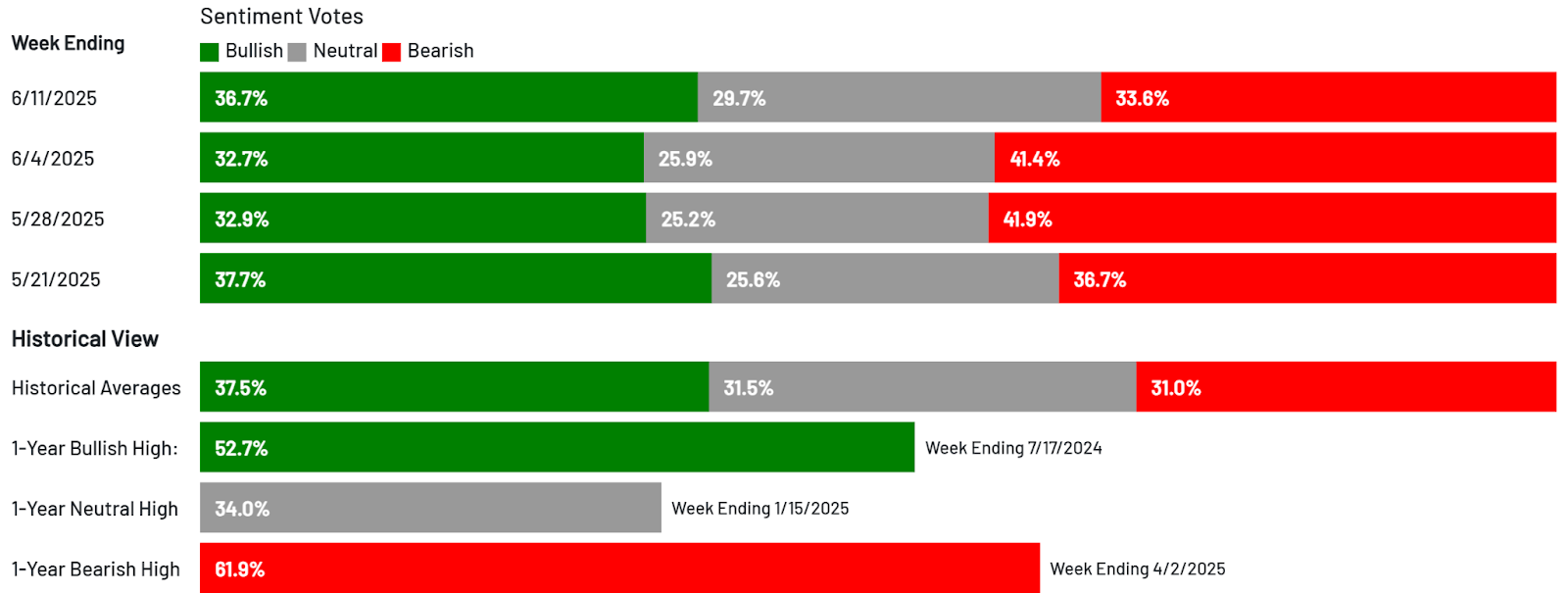

Yesterday, I shared this chart showing that – based on the weekly survey by the American Association of Individual Investors – the retail bulls are finally outpacing the bears.

This was clearly lagging the market, considering the textbook constructive price action we’ve been seeing.

That’s the retail side.

On the institutional side, well, take a look.

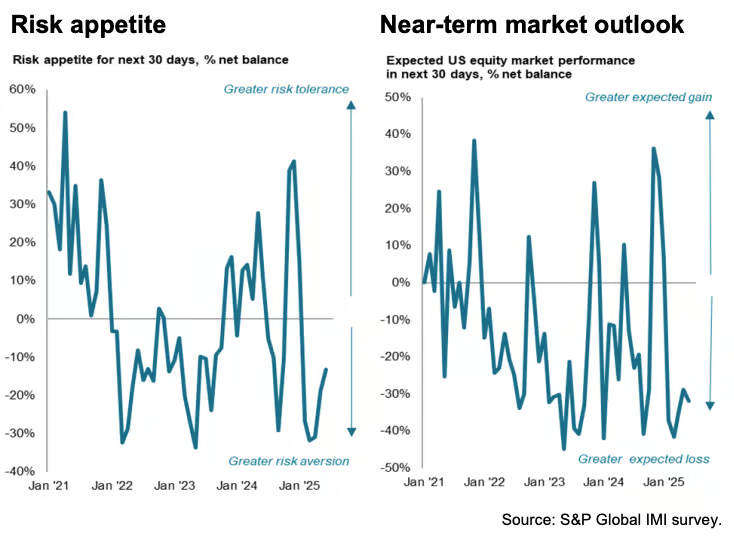

This chart is sourced from the S&P’s Investment Managers Index, which is created based on the surveys of active fund managers at institutional investment firms.

As you can see, while risk appetite has recovered – it’s still nowhere near the highs seen during this bull market.

And with the recent escalation in the Middle East, I wouldn’t be surprised if risk appetite – both retail and institutional – takes a near-term dip.

I consider that an opportunity. I explain why below.

Insight of the Day

The more politicized the issue, the more extreme the sentiment swings.

The narrative around Israel has always been politically charged.

With this escalation, it will only become more so.

And the more charged the narrative, the more exaggerated the market reaction.

Couple this with how far behind sentiment is lagging price action this time around…

And that means any near-term dip is likely to be exaggerated.

In markets, exaggerated moves create opportunities.

This new conflict has only just started to play out.

Uncertainty is at its peak, because no one knows how any retaliation will play out yet.

That is when you want to position yourself. This is the opportunity window.

And since it’s Father’s Day weekend…

You can get a full year of access to my Traders War Room for just 99 cents.

Every week, we’ll go LIVE to break down what’s going on in the markets in real time…

And with markets looking to enter a turbulent period…

One full of uncertainty and opportunity, there’s never been a better time to take advantage of this deal.

You’ll also get the name of my AI “Wonder Stock” – which could have a ton of profit potential remaining, even though it could already have delivered huge returns to those who got in early.

It’s all yours for under a dollar.

It’s a total no-brainer…

So, before the weekend hits – click here to grab this deal today.

Customer Story of the Day

“Ross and the Traders Agency team are trustworthy.

I watched from the sidelines for several months before joining. My wife was still skeptical after I signed up.

But now, after a month in, she sees the gains I am getting and she’s becoming much more optimistic.

This is important to me, because I have signed up for other services that didn’t work. Ross’ strategy is the best (and most consistent) I have ever used.

I appreciate his straightforward approach to teaching. He’s clear and easy to understand.

I currently have The Insider Effect and Alpha Stocks. I am looking forward to the future, when I can also sign up for The Black Edge and Fire Traders.

Thank you Traders Agency for helping me and all the other “little guys” out there.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily