Hey, Ross here:

Yesterday’s close marked the fourth consecutive day the S&P 500 closed at a record high.

That hasn’t happened since November 2021 – and we all remember what happened after.

But I’m not worried about a repeat of the 2022 bear market. Today’s chart helps explain why.

Chart of the Day

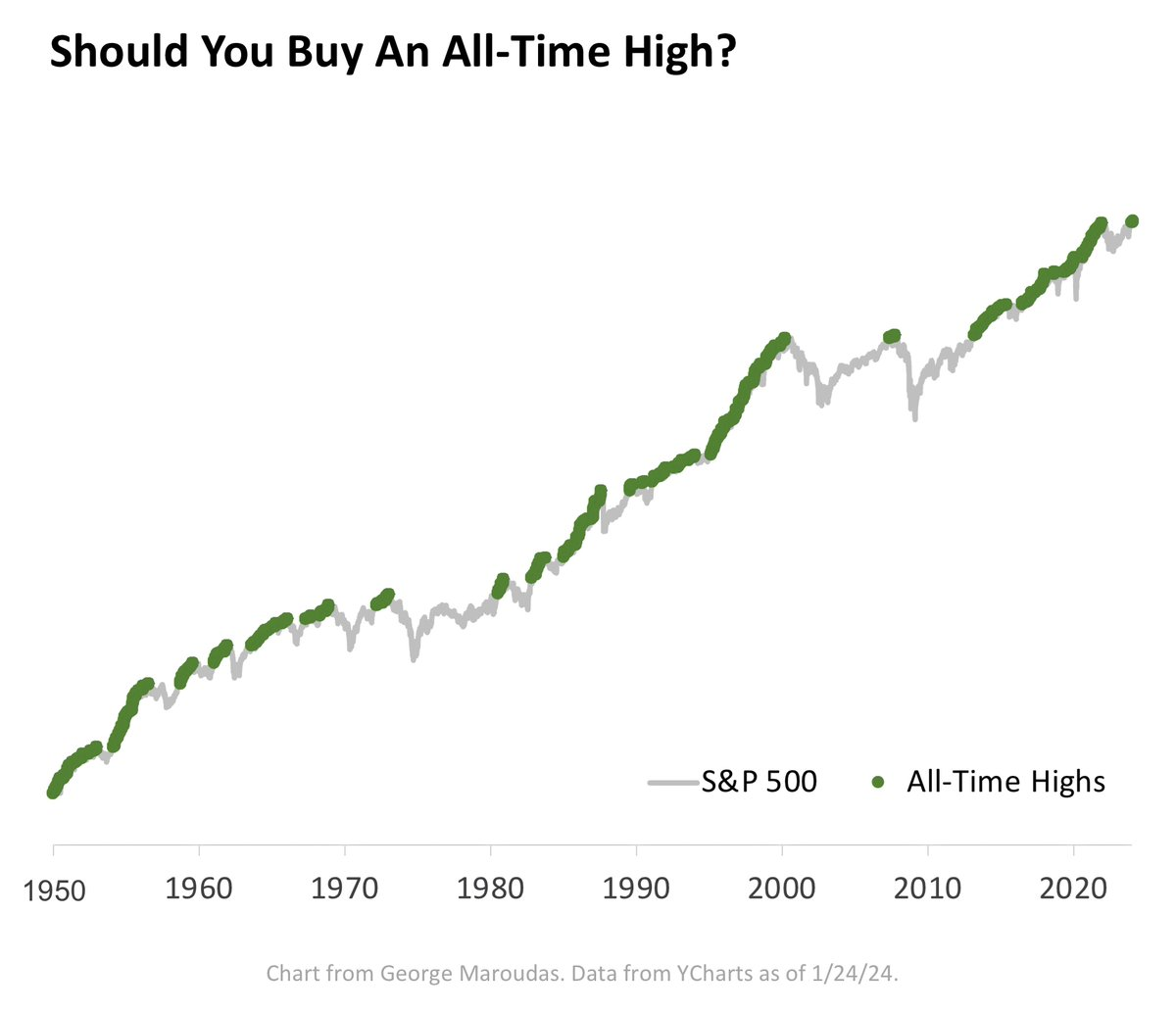

This chart looks at the S&P 500 dating back to 1950, highlighting the all-time highs in green.

Two important observations here.

One, new all-time highs are not rare – they’re exceedingly common. Over 40% of the time, the S&P 500 is at a new all-time high.

Second, new all-time highs are often followed by more new all-time highs – not a crash. In fact, the data shows that returns following new all-time highs are higher than average.

Add the fact that the Fed is planning on cutting rates – not raising them – and it’s highly unlikely we’ll see a repeat of 2022.

And that leads us to the Insight of the Day – why I’m generally unconcerned with the tired mantra of “buying low and selling high”.

Insight of the Day

Getting fixated on “buying low and selling high” will rob you of opportunities.

Everyone wants to buy low and sell high. Nothing wrong with that.

Too often though, traders get so fixated on buying low and selling high that they’re afraid of buying any stock that’s at a new high.

But as today’s chart shows, new all-time highs often follow all-time highs – and the same tends to apply for individual stocks.

It’s perfectly ok to buy high and sell higher.

In fact, it’s actually a higher percentage strategy than trying to pick out “cheap” stocks that could soar.

That’s why I preach focusing on the market leaders so much.

Yes, by their very definition, you won’t be able to buy these market leaders at lows.

But you can buy them at current highs – right before they surge to hit even higher highs. I do it all the time.

This is what will allow you to target maximum profits even in a market that’s sitting at record highs.

So, if you want to find out the key for doing exactly that…

Then click here to watch my masterclass on this topic right now.

Ross Givens

Editor, Stock Surge Daily