Hey, Ross here:

Hope y’all had a great Easter weekend. Let’s start the trading week with a quick yet actionable trade idea.

Chart of the Day

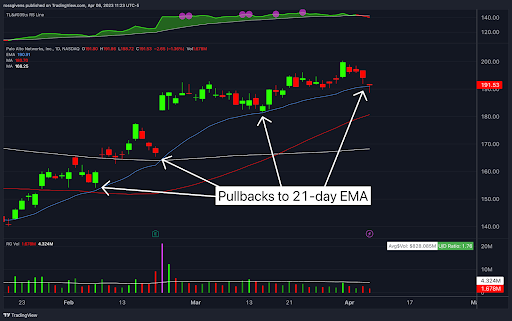

Palo Alto Networks (PANW) is one of, if not the top software security stocks in the market. It ranks in the top 3 out of the entire sector in earnings per share, relative strength, and composite ranking.

Shares have been surging since the start of the year – up 50% with minimal pullbacks. As I have highlighted on the chart above, each pullback was contained to its 21-day exponential moving average.

Last week’s pullback looks like another opportunity to buy the short-term dip in PANW.

There is an unfilled gap at $177. I doubt it gets filled, but even if you placed a stop below that at $175 or so, the risk would still be less than 9% on the trade.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Insight of the Day

There’s a big difference between healthy pullbacks and institutional liquidation.

Institutional liquidation, i.e. heavy selling from large funds, is usually the beginning of the end.

When a stock has its biggest down week since the uptrend started on very high volume, get out of the way. That’s the smart money heading for the exit.

On the other hand, shallow retracements on light or average volume can be great places to buy leading stocks on a pullback.

Knowing the difference between the two is critical to knowing which stocks to hold and which to sell.

The data is telling me that last week’s market movement was just a healthy pullback – making it a great opportunity to buy leading stocks.

I’m sharing many of these leading stocks right here on this very newsletter. But if you’d like to skip the line and get a hold of these fast-moving opportunities before you see them here – click this link to become a member of my Stealth Trades Gold service.

Because we’re extending our Easter special – meaning for a very limited time, you can get a full year for just $0.99 – an absolute steal.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily