Hey, Ross here:

Let’s look at what market sentiment data tells us about entry opportunities.

Chart of the Day

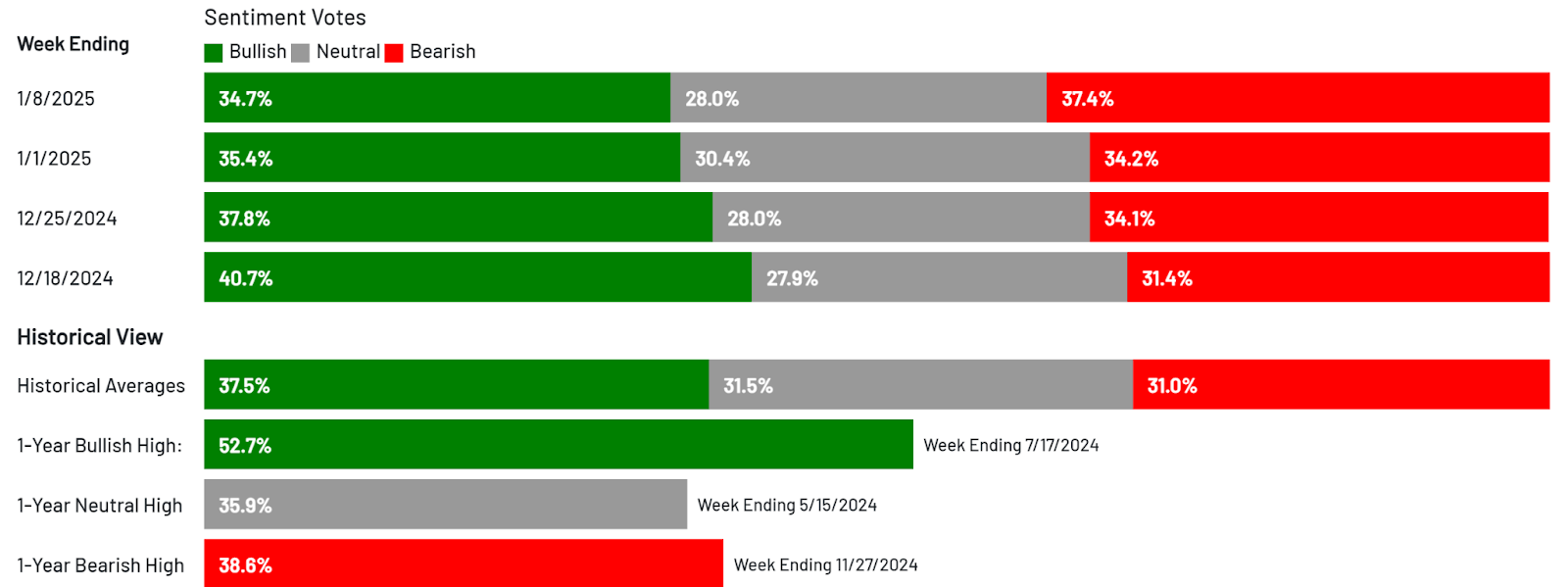

As of last Wednesday, 37.4% of members of the American Association of Individual Investors (AAII) was bearish.

The last time it was that high was during October 2023 – when the market had already been pulling back for two months.

And if you recall, the market surged strongly when bearish sentiment was at its peak…

A trend that’s repeatedly played out during this bull market.

There’s no sure thing in the markets…

But as I said yesterday, don’t be surprised if the market stages a rapid rebound soon.

So the question is – is it time to strike?

I explain more below.

Insight of the Day

Focus on highly-targeted, high conviction plays.

The negative sentiment above by individual traders is an encouraging sign…

But there’s still a lot of uncertainty on where the broader market is headed next – especially in the near term.

In my opinion, the best bet right now is to focus on highly-targeted, extremely high conviction plays.

The reason is because these plays can be highly uncorrelated with the broader market…

Which would allow you to “rise” above all this uncertainty – and still have the odds on your side.

And later this morning at 11 a.m. Eastern…

I’m going LIVE for a special training session that will show you exactly how to target the highest conviction plays in the market.

This will allow you to go after 2X, 4X, even 8X gains on repeat…

No matter what’s happening in the markets.

So, if you haven’t yet, click here to “lock in” your spot for this morning’s session…

And I’ll see you at 11 a.m. ET in a bit.

Act before the big inflation print comes out tomorrow.

The login info will be in your inbox shortly – try to login early if you can.

Customer Story of the Day

“Very down to earth people. Within a month I got my investment back signing up with these guys. They help me get some of my investments on a better track.

I’ve now been with Traders Agency for eight months now. In this time period to my investment profile from a 6% return on my own. With their help going over my etrade profile to a 66% return in eight months.

Yes you’re using money to invest but, listen to these people and follow their directions you do just fine.

My first seven trades with them were a 7% loss but I stuck with it and it is life changing. Also other members are just like me and they also put hints out to look into.

Traders Agency is no joke these guys are very smart and a very happy client with them.”

Ross Givens

Editor, Stock Surge Daily