Hey, Ross here:

As markets sold off, the “R-word” – recession – has come back in force.

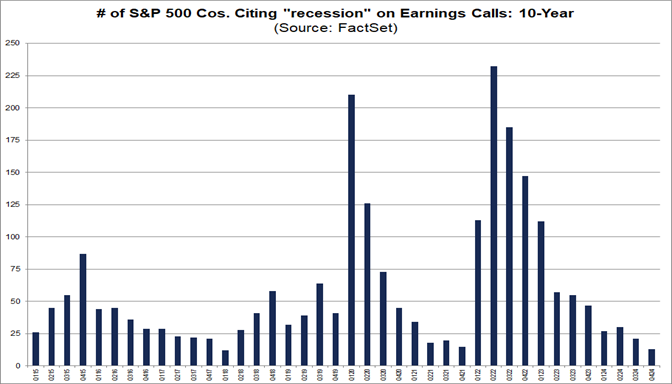

But as today’s chart shows, just like all the times recession fears have been invoked during this bull market…

They are very likely being exaggerated.

Chart of the Day

This is the number of S&P 500 companies citing the word “recession” on earnings calls from December 5 through March 6.

If a recession is in the cards, you would likely see these companies seriously discussing the possibility with their investors.

That doesn’t seem to be the case.

In fact, recession worries appear to be the lowest they’ve ever been.

Does this guarantee there won’t be a recession? Of course not.

But it tells us the biggest, most important companies in the US – the ones on the ground selling billions in goods and services – aren’t worried.

Don’t let the fear-mongering media confuse you.

Insight of the Day

Diverging views of the market is what creates opportunity.

There are more than a few people who believe that we’re about to fall into a deep recession.

They’ve been swayed by the bombastic headlines, by their own political leanings, by not understanding the nature of the market.

Their view of the market is likely a total 180 from those who read this newsletter.

And yet, that’s exactly what’s required to create big opportunities.

The more “divergent” traders’ views on the market are, the bigger the opportunities.

And right now, with so much talk of bear markets, crashes, and recessions…

I’m seeing some of the highest levels of divergences out there.

That’s why in a few hours at 11 a.m. Eastern later this morning…

I’m going LIVE to expose a group of traders who are taking maximum advantage of these divergences…

The corporate insiders.

They already have the most accurate picture of what’s going on in their own companies…

And they’re gleefully exploiting the market’s overreaction by snapping up shares of their own companies at bargain prices.

I’m going to show you how to follow in their footsteps – so you too can turn the market’s divergence into profits.

If you haven’t yet, click here now to “lock in” your spot for my free insider training later…

And I’ll see you in a bit at 11 a.m. ET.

Keep an eye out for the login info in your inbox.

Customer Story of the Day

“I’m happy I recently opted into the Ross Givens’s Trading Club at Traders Agency (at the best and fairest offer I could possibly get).

I’m new to trading U.S. stocks and options on a regular basis but it doesn’t matter, Ross does all of the hard work for me while I’m trading at my own pace (he knows how to trade successfully most of the time and I know that I won’t win every trade. Fair enough).

He and his great team share a lot of their trading experience in live sessions.

Great job. Thanks a lot!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily