Hey, Ross here:

Welcome to the start of another trading week. I’m going to open it with a saying that I believe everybody on earth loves to say – I told you so.

Chart of the Day

I have been pounding the table since March that this is a new bull market.

Week after week my message has been the same…

BUY. The bear market is over.

The signal for me to buy back in March was something called an “upside reversal”. It’s one of my favorite buy signals.

Typically, I’m not a fan of buying stocks when they are at the lows. This setup is the exception.

The upside reversal works great on the indexes. It works even better on individual stocks.

If you like buying low when stocks are “on sale” you need to know this strategy.

Here’s one that formed in TSLA back in April:

Here are the rules…

On a daily chart (each candle is 1 day) the stock needs to make a new low. It doesn’t have to be a new 52-week low, but you want to see a downtrend of at least 6-8 weeks and the stock to trade below the low of that period.

Next, and this is the important part, the stock must rally back up and close the day in the green.

In other words, it made a new 2-month low in the morning, and then finished the day above the previous day’s close.

Here is a closer look at the TSLA example I mentioned earlier:

Notice how the first few times it made a new low it closed the day in the red – below the previous day’s close.

Then, in the last candle, TSLA made a new low but surged higher to finish the day up 4%.

That is a valid upside reversal buy signal.

The execution is simple…

Buy the stock the next morning.

Set a stop loss a few cents beneath the low of the previous day (see image below).

The risk is usually less than 10% on the trade.

It was only 5% for TSLA.

The upside was substantially higher…

It’s not going to work every time.

Nothing does.

But it is a low risk/high reward setup that every trader should know.

P.S. Would you like special trade prospects and potential market moves just like the above sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Small-cap participation = big profit opportunities

When you’ve been doing this as long as I have, you develop a “feel” – and intuition – about the mood of the market.

And right now, I can sense the optimism flowing back into the market.

It starts as a trickle – but soon turns into a flood.

In times like these, when the tide is turning, one strategy in particular shines.

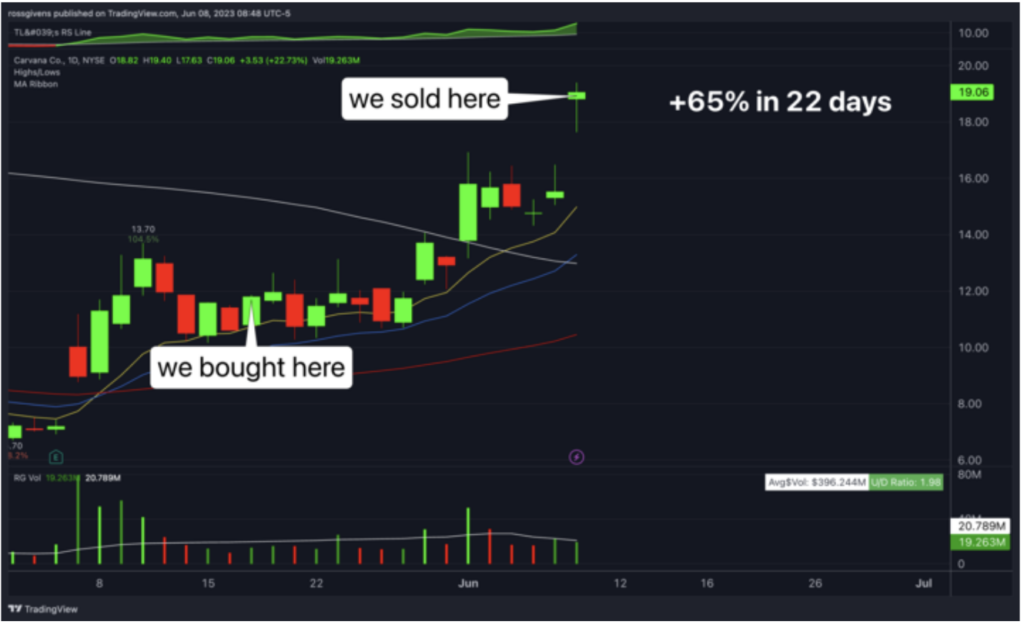

This strategy could have netted you gains like 60% in 12 days and 65% in 22 days just in the past few weeks…

And that’s just the beginning.

Because as the optimism comes rushing back into the market, I believe this strategy could spot setups like these all over the place…

So if you don’t have this strategy in your back pocket, I’m sorry to say that you’re probably going to miss out on a lot of profits.

Don’t let that happen to you…

Click here now to see how to instantly add this powerful strategy to your trading arsenal now.

Remember, the market waits for no man.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily