Hey, Ross here:

Welcome back.

In case you weren’t aware, stock markets were closed yesterday in remembrance of late President Jimmy Carter, so this newsletter was on a break as well.

This is a long-established tradition, with the last similar market closure happening in December 2018 in honor of late President George HW Bush.

Let’s start the day with a chart showing how counterintuitive market sentiment could be predicting a rally.

Chart of the Day

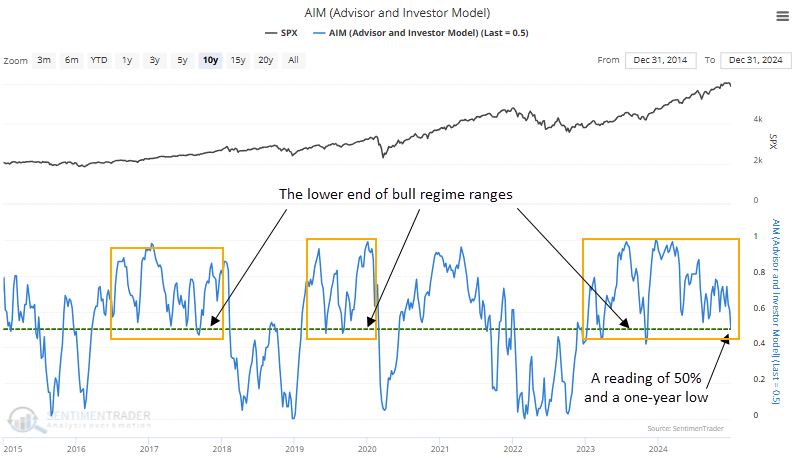

This chart shows how investor sentiment – including both individuals and advisors – have shifted through the years.

Right now, such sentiment is at the lower end of what we typically see during bull markets…

Something that has historically preceded market rallies.

The last time sentiment dipped this low during this bull market, we saw the blistering rally of November 2023.

Now, there is an important caveat to this – which I explain below.

Insight of the Day

Using negative investor sentiment as a counterintuitive bullish signal only works in healthy bull markets.

In bear markets, investor sentiment is naturally negative – so such negative sentiment shouldn’t be taken as a bullish signal.

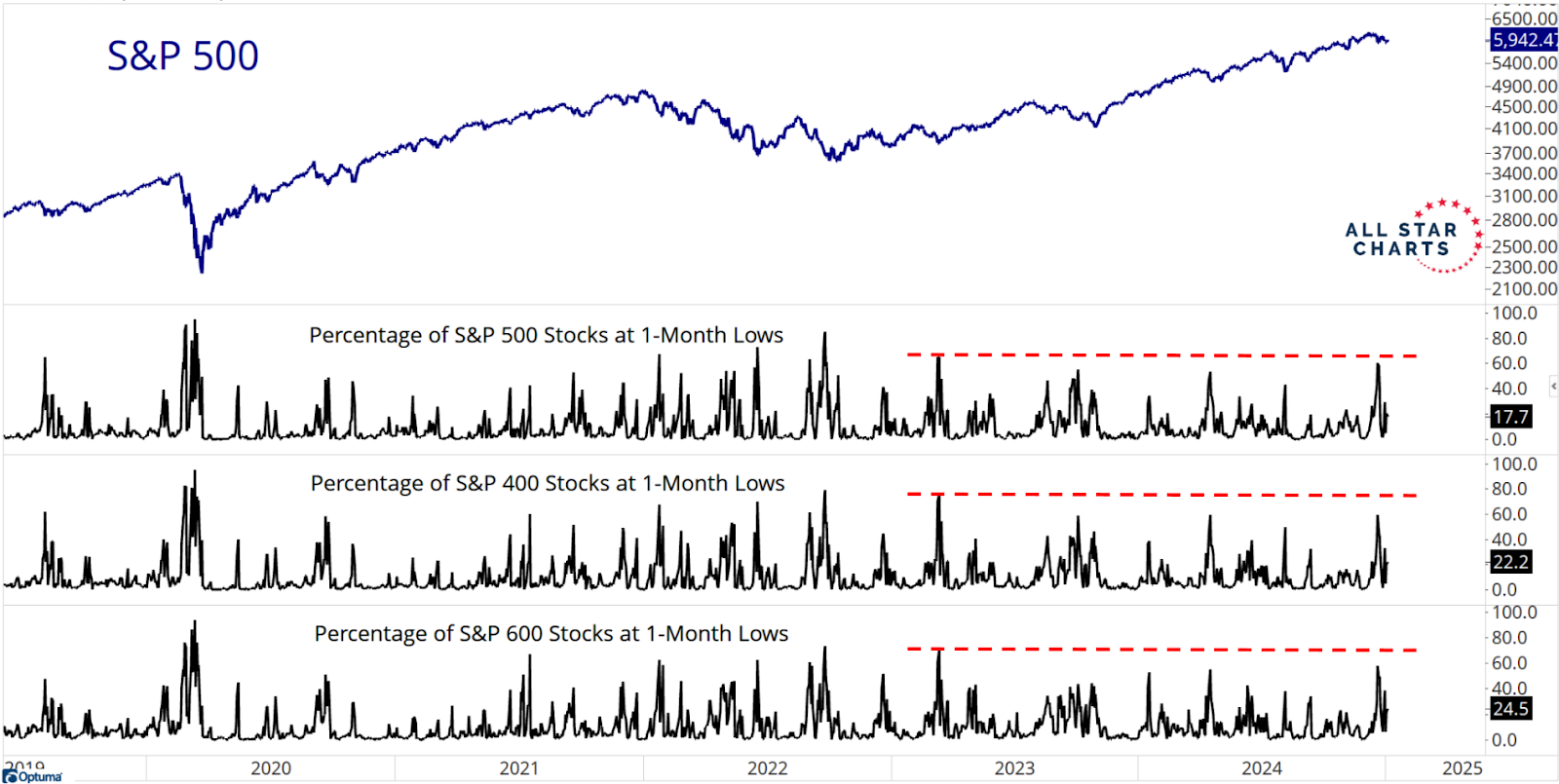

But as I showed on Wednesday, new 1-month lows are NOT increasing – whether in large, medium, or small caps.

That means we’re likely not entering a real bear market anytime soon…

And the negative sentiment we’re seeing is a counterintuitive signal we should stay in the game.

Of course, this doesn’t mean we should repeat what worked in the past.

The catalysts for the next rally will likely be different…

Meaning the setups we use should be different as well.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE to demo a new market strategy that’s already helped one trader make over $2k with two trades in just a matter of days.

This year, we have a hesitant Fed, Trump coming into power, more people believing the market is “overvalued” – all amid a robust economy.

I created this new strategy specifically to take advantage of these shifting winds.

So if you haven’t yet, click here to “lock in” your seat for my live strategy demo now…

And I’ll see you at 11 a.m. ET in just a bit.

The login info will be in your inbox shortly – try to login early if you can.

Customer Story of the Day

“Top drawer recommendations for portfolio growth and trade advice. Good for learning how to manage the bank.”

Ross Givens

Editor, Stock Surge Daily