Hey, Ross here:

Here’s another actionable trading idea for you.

Chart of the Day

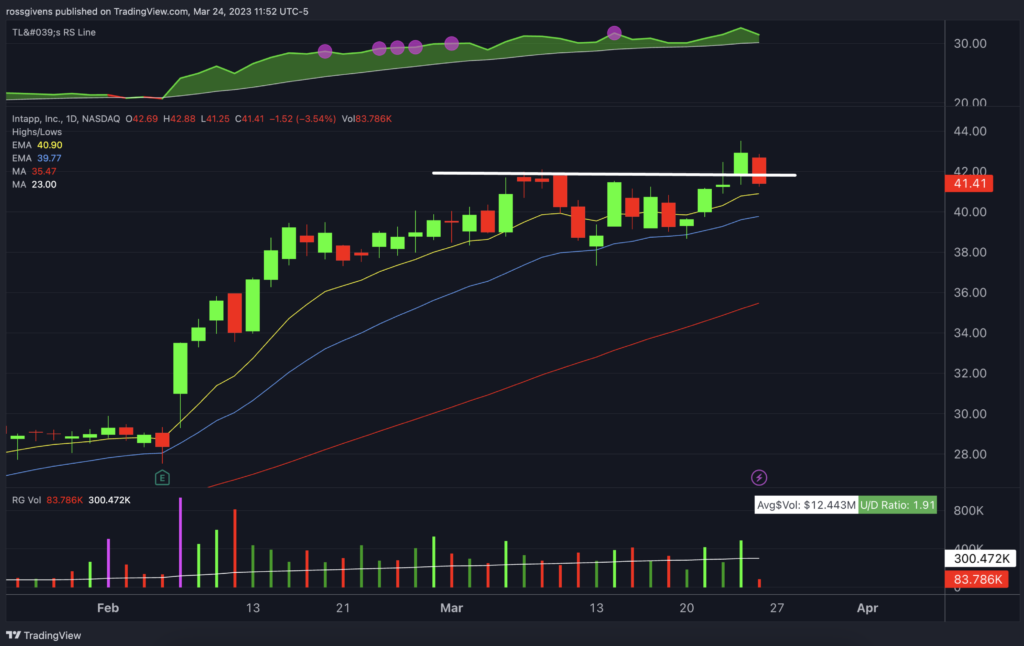

I bought shares of Intapp (INTA) last week.

This company provides cloud-based services for the financial services industry.

Business is booming. Sales grew by 25-30% in each of the last four quarters and the company is finally turning profitable.

The stock is up almost 200% over the last six months with no sign of slowing down.

It put in a small pivot near the $42 mark, and has broken out to new highs on above-average volume.

INTA should hold above its 21-day Exponential Moving Average (blue line on the chart) if the uptrend is to continue.

If it closes below that mark – currently at $40.40 – I’d consider getting out.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Insight of the Day

The banking crisis could actually turn out to be a net positive by killing inflation without the need for higher interest rates.

The banking “crisis” that started with SVB’s collapse has so far been negative for the stock market.

But over the longer term, as long as the crisis doesn’t spread (and it looks like it won’t) – it could actually turn out to be a positive.

Here’s why in a nutshell – it will constrain the banks’ lending and tighten credit, which will put downward pressure on inflation. And the best part is that it can do so without the need for drastic market-crashing rate hikes.

This is a probable scenario that could be good for the market – and your trading account.

That’s why it’s best to start preparing now by positioning yourself in high-potential stocks.

And in my opinion, one of the best types of stocks to position yourself in now are those with a very special kind of buyers. These are buyers with the power to send the stock surging just from buying in alone.

Being able to spot when these buyers could be about to get in on a stock is one of the most powerful advantages in all of trading. And I’m sharing how you can get this advantage for yourself here.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily