Hey, Ross here:

Everyone’s waiting with bated breath for the Fed’s decision later today. But that doesn’t mean there aren’t opportunities you can exploit right now. Here’s one below.

Chart of the Day

The copper market is hot right now, and a lot of the copper mining names are making big moves to the upside.

One of the cleanest charts I’ve seen is Cooper-Standard Holdings (CPS).

Notice the huge, steady accumulation from late December through mid-January – 13 trading days in a row of higher highs and lower lows.

This is a clear sign of institutional accumulation. After a brief pullback to its 10-day EMA, the stock is again turning higher.

This looks like the start of a big uptrend in copper.

Insight of the Day

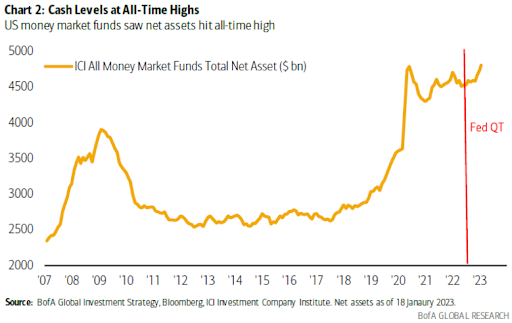

Money waiting on the sidelines is a major opportunity – don’t waste it.

Everyone’s waiting for the Fed. That means there’s a lot of cash sitting on the sidelines just waiting for a chance to jump in (check out the chart below).

This is a major opportunity for savvy traders. Because when that cash floods into the market, it can result in some big price moves.

You just need to know where all that money is going to flow. And if you know what to look for, it can be surprisingly easy (hint: it has to do with certain “moves” these big players like to make before they buy). I explain everything here.

Embrace the surge,

Ross Givens