Hey, Ross here:

The latest CPI inflation print just came in an hour ago.

This will influence how much the Fed cuts next week…

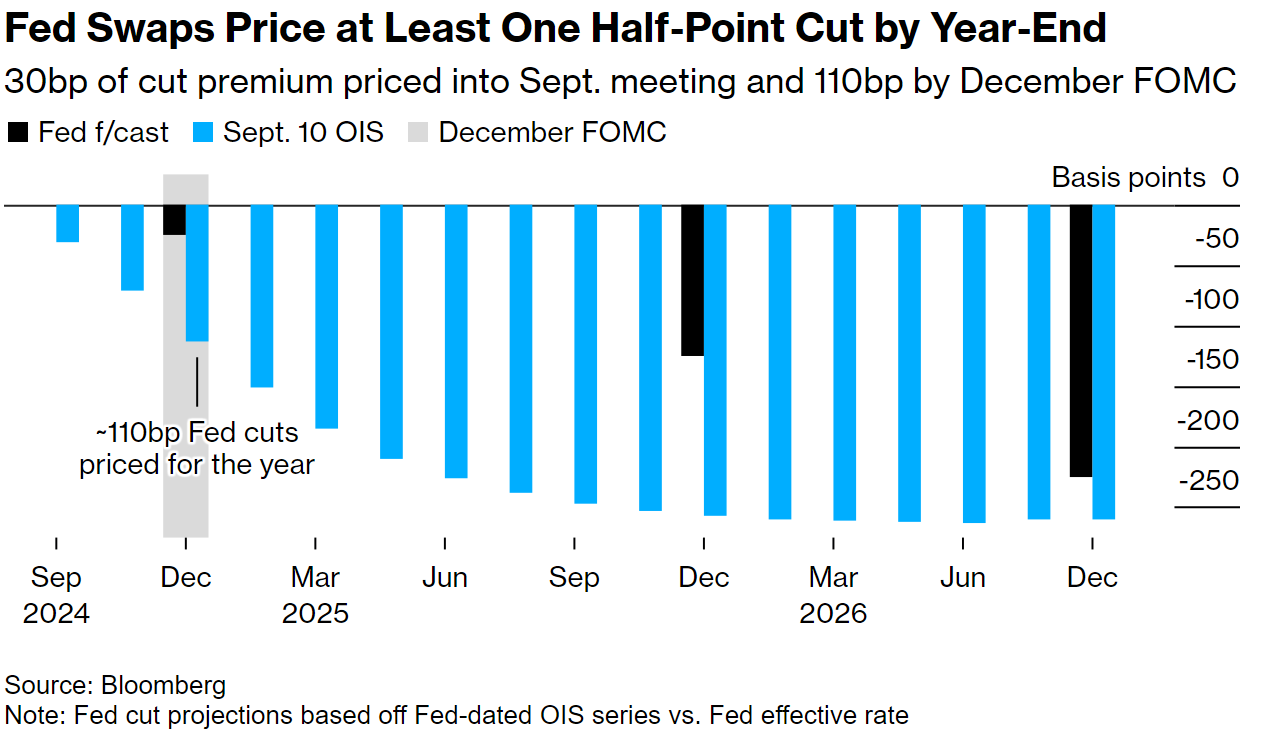

So let’s look at a chart that tells us the depth of the cuts the swap market is pricing in.

Chart of the Day

The swap market is pricing in 0.3% of cuts after the September meeting and 1.1% of cuts by the end of the year.

Of course, since the Fed cuts in increments of 0.25%, we’ll never actually see 0.3% or 1.1% of cuts.

The point is – the swaps market is pricing in at least four rate cuts by the end of the year.

But the big question is – how much rate cuts is the stock market pricing in?

The only way to tell is to look at how the market reacts following the Fed meeting next week.

If the Fed cuts by 0.25% – and the stock market barely budges – we’ll know it has already been priced in.

Insight of the Day

Money is made by knowing what hasn’t been priced in.

If something’s already been priced in – and you buy in based on that – you won’t make much money.

The biggest profits always come from buying based on what hasn’t been priced in yet…

Which of course, is much easier said than done.

That’s why I’m such a fan of following the corporate insiders, which is one of the biggest “cheat codes” I know in trading.

Because, when it comes to their own companies, they’re the best source for telling you what hasn’t been priced in yet.

That’s why following these insiders could have allowed you to lock in fast 30 – 40% profits even as the market sold off last month.

Why September could present yet another shot at such gains…

And why later this afternoon at 3 p.m. Eastern…

I’m going LIVE for a masterclass that will hand you everything you need to start following these insiders right now.

I’ll show you:

- What compels these insiders to buy…

- The warning signs you need to know when following the insiders…

- The most powerful – yet counterintuitive – insider buying signals there are…

And basically hand you my complete insider trading playbook that I’ve painstakingly built up over the past 7 years.

So if you haven’t already, please click here to guarantee your slot for my live masterclass this afternoon…

And I’ll see you at 3 p.m. ET later today.

My team will send you the login info before it starts, so keep an eye out for that.

Customer Story of the Day

“Well I had a slow start (not their fault, my fault), but then I picked up what I could when I could and I did pretty good on the sidelines just watching and doing pretty much what they did.

Now I’m just ready to get some time off so I can really get into it. Because if I made what I made so far just barely knowing anything – I’m curious of what I can do if I really get into it. Great teacher!”

Ross Givens

Editor, Stock Surge Daily