When corporate insiders put down their own hard-earned money to buy shares of their own companies, I tend to take notice.

These insiders know more about their companies’ prospects that any Wall Street analyst and certainly more than Main Street investors.

But if you know how to follow alongside the trades these corporate insiders make, you can potentially generate massive gains with less risk…

Technically speaking, “insider trading” is illegal when it is based on information that’s not offered to the public.

If someone were to act upon and financially benefit from such information, that is in fact illegal. But that’s not what we’re talking about here…

The Real Insiders

First, let’s define who these market “insiders” are given the context in which we’ll be discussing them today…

The insiders we’ll discuss today are company insiders, such as CEOs, CFOs, COOs, marketing directors or board members.

These are folks who work for publicly traded companies that are required by law to disclose when they purchase or sell stock in the company they work for.

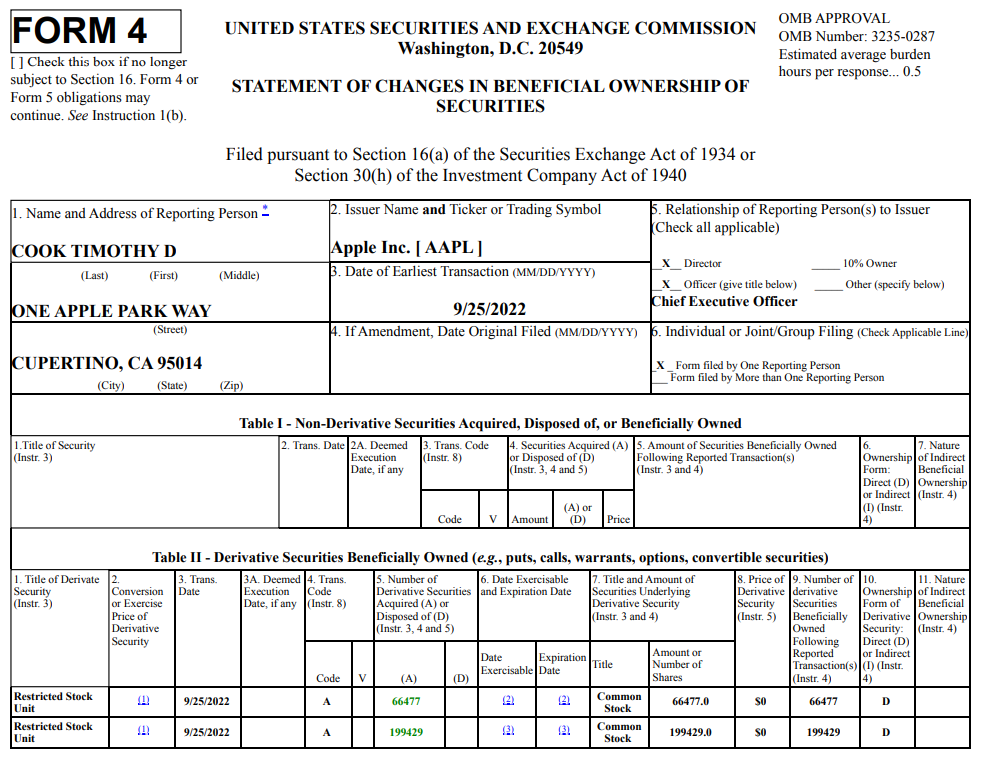

For example, when the CEO of a publicly traded company decides to invest their own funds by purchasing or selling shares of the company they’re employed by, they’re required by law to fill out what’s called a “Form-4.”

In the image above, you can see a recent Form 4 filed by Apple Inc. (AAPL) CEO Tim Cook.

These forms are filed within the U.S. Securities and Exchange Commission (SEC) and are made public almost immediately.

What does it tell you about how an insider must think about their company if they’re willing to invest their own hard-earned money into buying shares?

Well, quite a lot actually…

Follow the Money

Perhaps they know something we don’t? There could very likely be something in the pipeline for the company that could cause the price of the stock to rise.

The benefit we as individual investors have is that we’re able to act upon this information freely!

On the other hand, the employee of the company who purchased stock must have a written plan for their intent of what they’re going to do with their holdings and must maintain the position for at least six months.

Let’s just say Tim Cook goes in and buys $1,000,000 of Apple (AAPL) stock with his own cash… He’ll need to file a Form-4. And we, the public, have the opportunity to know about it.

If the stock then proceeds to run up 30% in the next 60 days or so, we can gladly cash in on our gains.

But Cook is required to continue to hold those shares for at least six months.

The Insider Effect

You see, we have the edge when it comes to leveraging company insiders, as we can follow their buys and cash out before they can.

So, whenever I’m analyzing a company I’m looking to buy, I look for insider buying.

Here’s one recent example from my premium trading service, The Insider Effect, that resulted in a nice, quick gain…

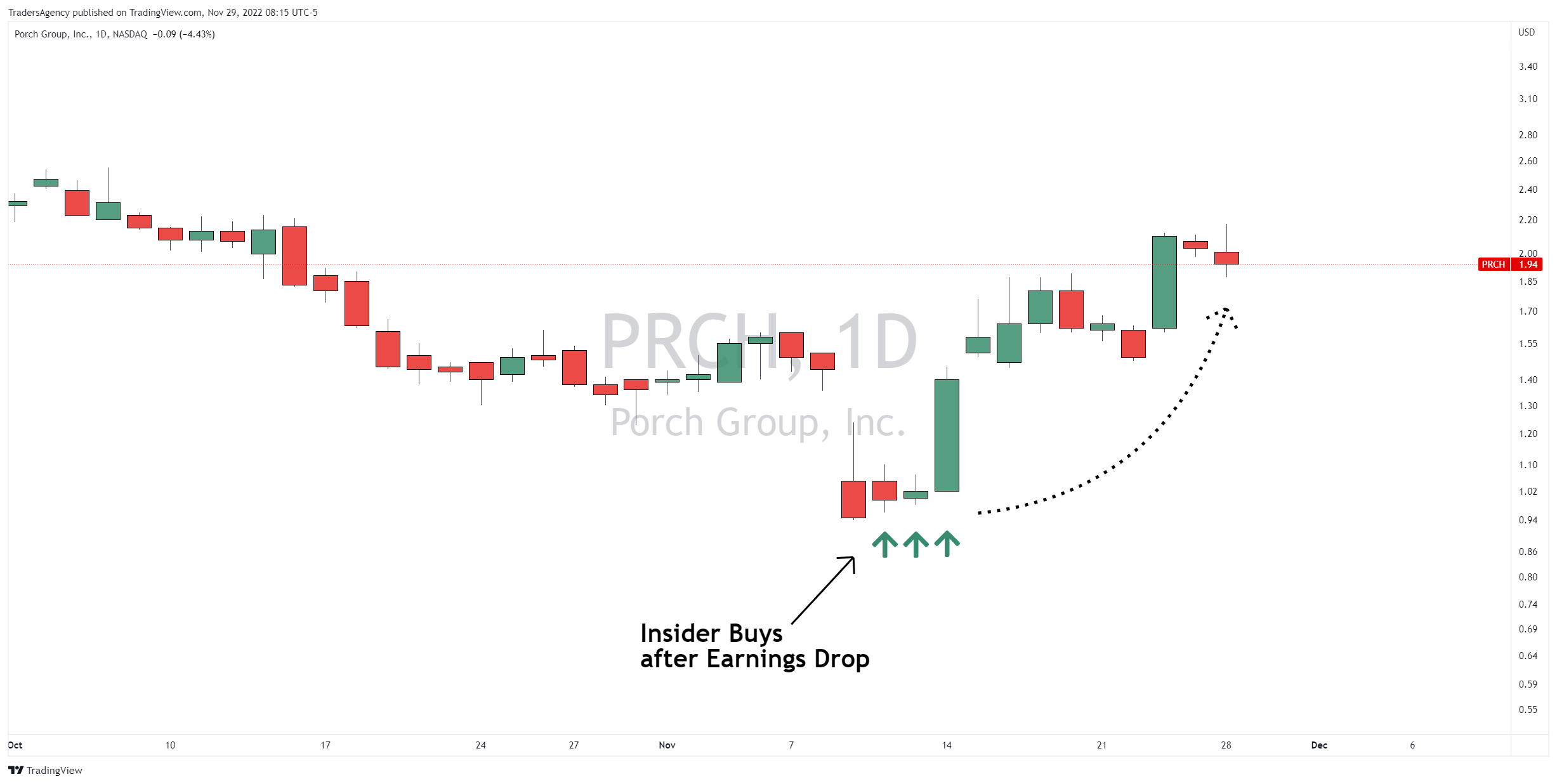

I recently alerted members to Porch Group, Inc. (PRCH), a vertical software platform that offers products for a variety of home service industries.

Following the latest quarterly report, the stock dropped sharply. But I saw that three top insiders at PRCH acted fast to buy the dip.

Two board members, along with the Chief Operations Officer, invested a combined $443,647 in PRCH…

Within days of these insider buys, the stock began to rally. And since the open on Nov. 10 to yesterday’s close, the PRCH is up over 80%…

Members who acted on this alert are sitting on solid gains right now and have already started to take profits on the position.

As I said in my original alert, “Nothing is ever guaranteed” in the market.

But when those in the C-suites put down their own hard-earned money to buy stock in their own companies, it’s a huge vote of confidence.

Follow the Big Money

Now, if you want to learn all about my Insider Effect strategy and some of the amazing success our members have had following company insiders, today’s the day!

It’s absolutely free to attend, so I really hope you’ll join me.

I’ll cover my strategy for trading alongside corporate insiders and generating potentially massive gains with less risk.

I look forward to seeing you there!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily