By now, most of you have likely heard about the collapse of digital currency exchange FTX.

While it was once the world’s third-largest digital currency exchange by volume, the company has now filed for bankruptcy.

Even if you haven’t been following the story, you’ve probably seen the recent collapse in the price BTC and other major coins.

Well, I hate to say, “I told you so!”

Beat the BTC Bubble

Back when BTC was trading around $50,000, I wrote that the price action “looks like every other bubble we have seen for the last 500 years.”

Think about the “Tulip mania” bubble that took place in the Dutch Republic during the 17th century…

Or the The South Sea Bubble of 1720 that led to the collapse of the South Sea Company — the hottest stock in England.

With this month’s collapse in digital currency prices, I think it’s safer than ever to say BTC has a lot of similarities to bubbles of the past.

Just last month, I said, “The market is still hovering just above a key support level that stems from the 2017 peak, which I think will crack sooner or later.”

Well, it happened sooner than I expected following the collapse of FTX…

As you can see in the weekly chart above, the BTC plunged through that key support level last week.

It lost 22% of its remaining value as it traded back into the $15,000 range for the first time since November of 2020.

Expert Insight

Now, you know my opinion on BTC… I still think it’s going much lower.

But don’t take my word for it. I recently caught up with my colleagues here at Traders Agency to get their own take on this market.

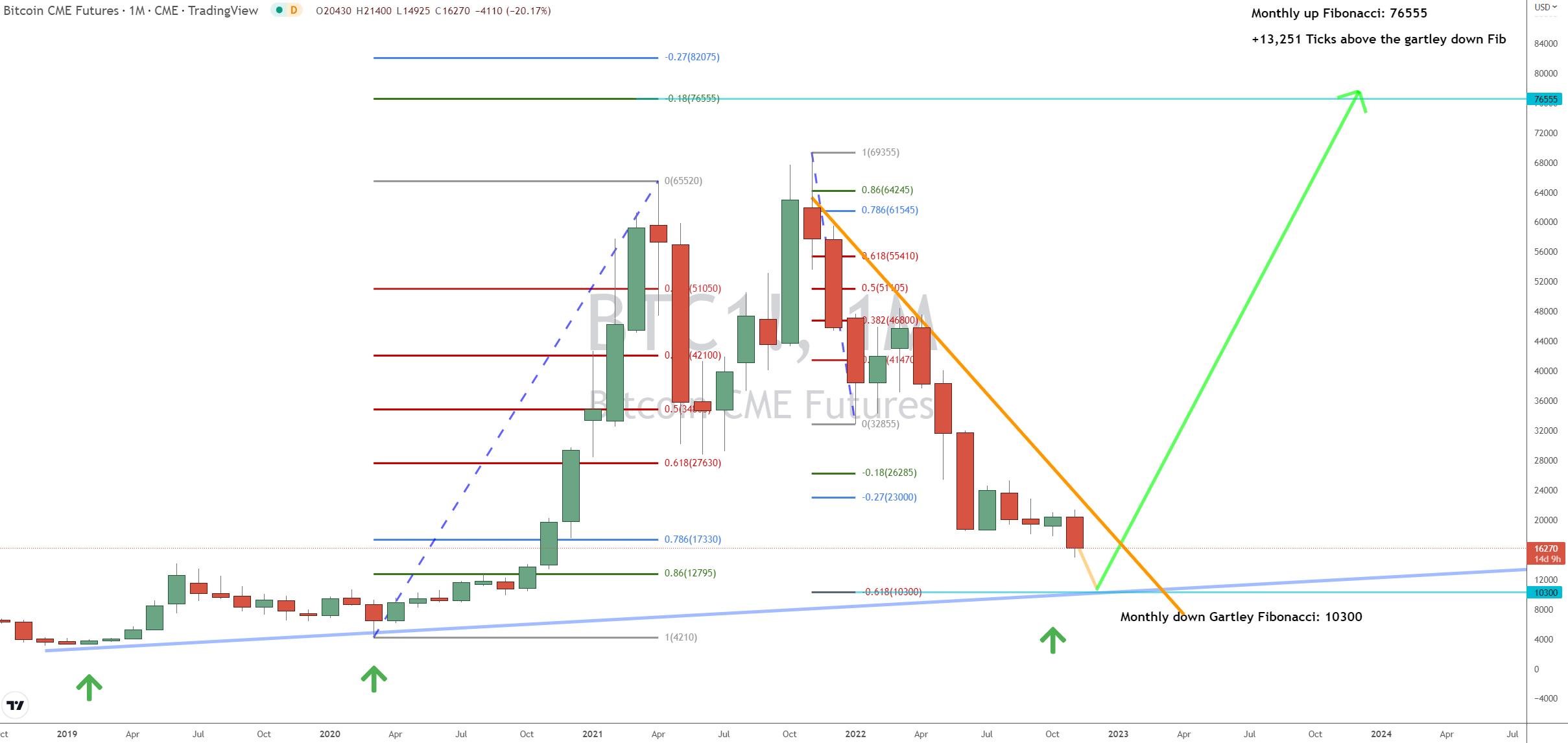

Expert futures trader Josh Martinez sent me this chart showing his outlook for BTC via the CME futures market.

As you can see, Josh has a major upside target for BTC futures.

However, he first expects BTC futures to fall toward the long-term trend line and the month down Gartley Fibonacci at $10,300.

That represents a further potential decline of over 37%…

Here’s another take from energy and commodities expert Anthony Speciale…

According to Anthony’s channel structure analysis, he sees initial support at current levels around $16,000.

But if that breaks, he expects the next support levels will come into play at the Fibonacci retracement around $10,000, followed by longer-term support around $5,000.

Yikes! That means BTC could drop as much as 70% from current levels.

Join the “Powerhouse Trio” Today at NOON!

Regular readers may be familiar with the stellar work that Josh and Anthony put in here on a daily basis.

I’ve brought some of their ideas to you here and in past issues, but if you really want to get to know them and their trading styles, join us for a long-form conversation this afternoon!

As three of the top trading experts in the industry, we are identifying opportunities in the market right now that are some of the biggest we’ve seen in years.

That’s why today at noon ET…

Josh Martinez, Anthony Speciale and I – the trading world’s “powerhouse trio” – are hosting a special LIVE broadcast to reveal $150,000 worth of opportunities we’re seeing right now.

I’m so looking forward to sitting down with them this afternoon, and I really hope you’ll join us as we discuss these timely opportunities.

To register for the FREE $150k Trading Challenge event today at 12 p.m. ET, click here now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily