Hey, Ross here:

Many traders think of today’s Fed rate decision as a “sure thing”.

And sure, a rate cut is almost a foregone conclusion.

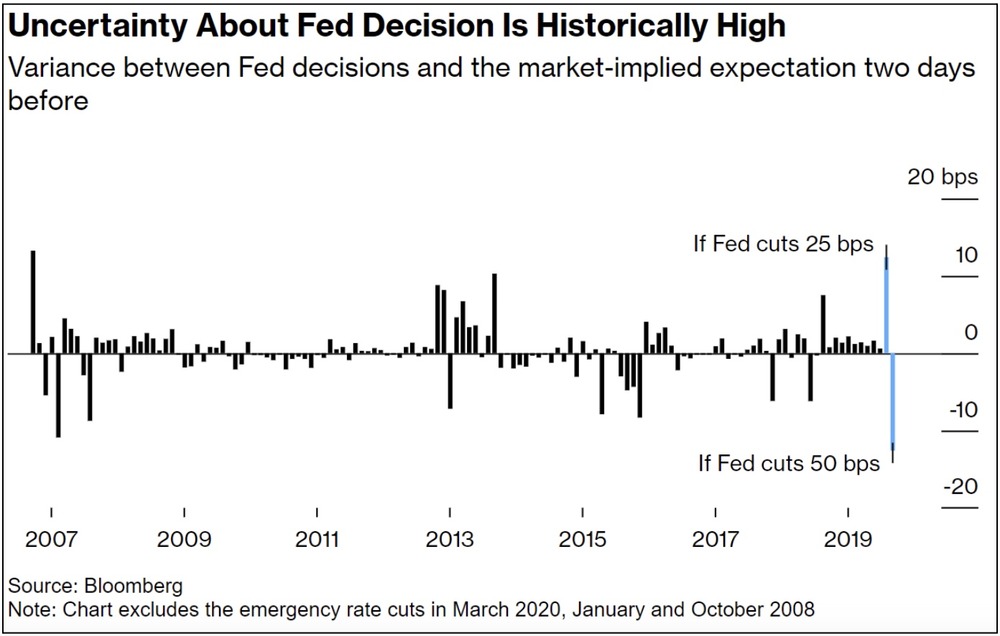

But as today’s chart shows – the size of that rate cut is still very much in doubt.

And this has led to the highest uncertainty around a Fed rate decision since the Global Financial Crisis.

Chart of the Day

Essentially what this chart shows is a quantifiable measure about the level of doubt surrounding the size of the Fed rate cut.

There’s very little consensus in the market, with it being split almost 50/50 between a 0.25% or 0.50% rate cut.

So no matter how much the Fed cuts, a lot of traders will be caught off guard.

And as I explain below – that’s actually an opportunity.

Insight of the Day

Just knowing there’s volatility ahead increases your odds of success

We don’t know how much the Fed will cut later today.

But we do know that it will likely set off a wave of volatility as half the market scrambles to adjust.

And we also know that we’re still firmly in a bull market.

This means this volatility is an opportunity for us to position ourselves in the highest-potential stocks at lower prices.

So that’s why later this afternoon at 3 p.m. Eastern…

I’m going LIVE for a masterclass that will show you how to spot these stocks by using the most powerful informational edge I know…

Analyzing the trading activity of the corporate insiders.

As insiders, they already know what’s coming down the pipeline for their own companies.

So we can analyze their trading patterns to uncover high-potential trades in practically any market condition.

There’s a reason this insider strategy has never had a losing year, and has had a compounded return of over 1,900% since inception.

After this afternoon’s masterclass, you’ll have everything you need to start using this strategy to take advantage of the Fed-induced volatility spike.

I’ll show you:

- Where you can find the complete records of all these insider trades…

- The obscure SEC loophole these insiders are exploiting…

- What compels these insiders to buy…

- Why so many traders fail when trying to follow these insiders (not all insiders are worth following)

- And the 3 most powerful – yet counterintuitive – insider buying signals you must know about to be successful

So if you haven’t yet, make sure you click here now to “lock in” your slot for my masterclass later…

And watch out for the login details later this afternoon.

I’ll see you at 3 p.m. ET today.

Customer Story of the Day

“Ross and his team are the real deal. There are no promises to make you an overnight millionaire but to work with you long term. They are honest, down-to-earth, and extremely knowledgeable. I am glad I made the decision to join them.”

Ross Givens

Editor, Stock Surge Daily