Hey, Ross here:

Yesterday’s Producer Price Index data came in hot – way above expectations.

However, option traders’ odds of a September rate cut still remain at 93%.

And while markets predictably dipped on the news…

The S&P 500 and the Nasdaq both closed essentially flat yesterday.

Meanwhile, retail investors are getting increasingly fearful.

Let’s take a look below.

Chart of the Day

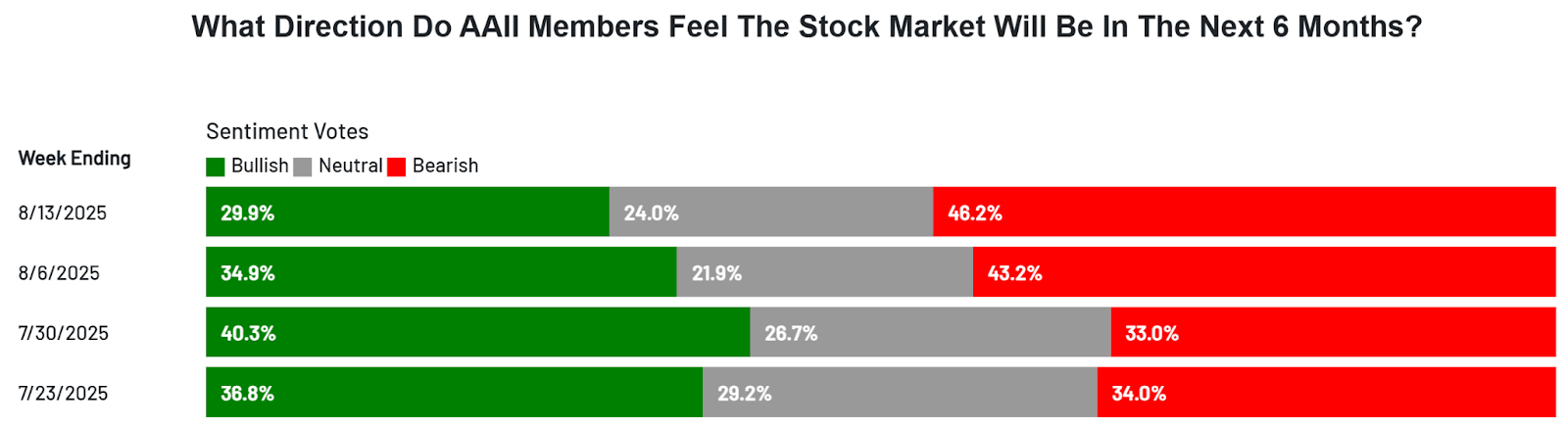

Regular readers will recognize this as the weekly sentiment survey conducted by the American Association of Individual Investors (AAII).

As you can see, as of this week – nearly half of AAII members are bearish, while less than a third are bullish.

The retail bears are now outnumbering the bulls by the most since May.

But keep in mind the market only kept shooting up in May.

And right now, even with the blistering PPI report, stocks are still holding up well.

I already mentioned the S&P 500 and the Nasdaq earlier.

But even the small-cap Russell 2000 is holding up…

With yesterday’s decline still bouncing off previous resistance, indicating it may now be effective support.

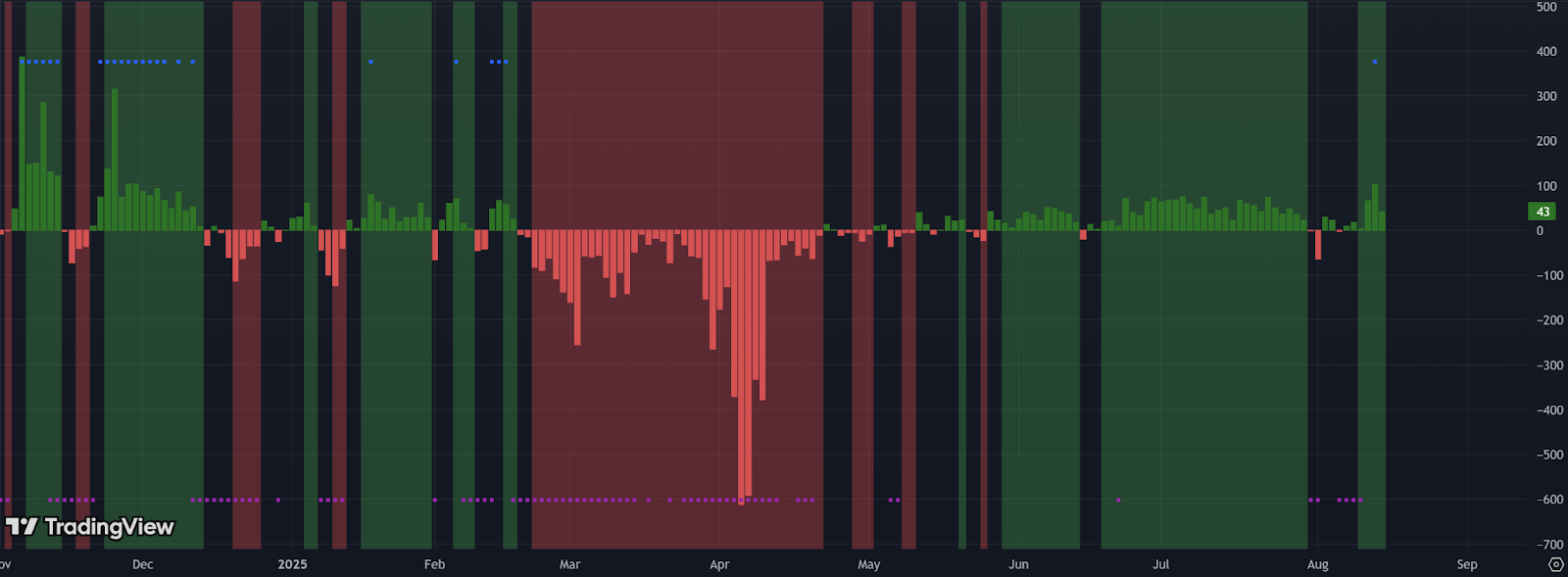

Plus, yesterday still saw more highs than lows.

With retail sentiment deteriorating while the market is still holding up…

We may see a “FOMO rally” on the cards.

I explain more below.

P.S. Stay up-to-date with the latest market insights by getting this newsletter straight to your mobile. Just text the word “trade” to 87858.

Insight of the Day

Corporate buybacks + higher liquidity + depressed retail sentiment = potential “FOMO rally”

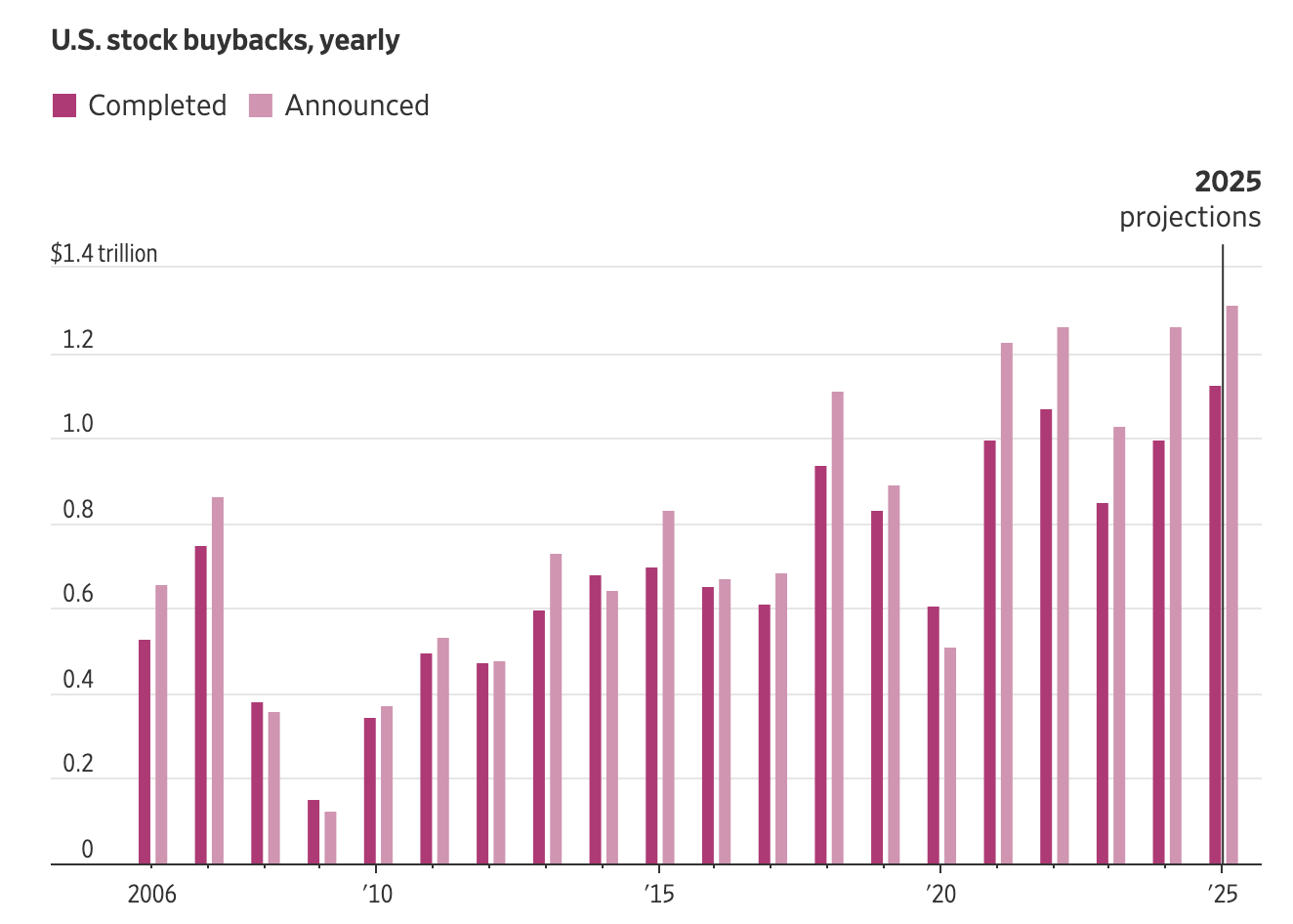

American companies are now buying back their own stocks at a record pace.

And as I showed yesterday, the market is flush with cash – with liquidity on a steady uptrend.

Both of these are fuel for the bull market.

And what do you think will most likely happen when the market keeps rising…

With more and more retail investors on the sidelines?

You get a “FOMO rally”…

Where the bears capitulate and flood back in…

Sending the market surging even higher.

That’s what happened back in May.

And that’s what could be happening again.

That’s why in just a few hours at 11 a.m. Eastern…

I’m going LIVE for a training session to demo my top breakout strategy to play the “FOMO rally”.

We’re up over 100% on average across all open positions with this strategy…

But with the incoming “FOMO rally”, this could be just the start.

You want to know how to target these blistering breakouts before that happens…

So click here to guarantee your spot for my live session if you haven’t already…

And I’ll see you in a bit at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Traders Agency is awesome.

I have motored through multiple online high-brow investment people with their proprietary methods and none match the insight, supportive instruction and explanations of the vagaries of stock trading as I find with Ross Givens.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily