Hey, Ross here:

I talked yesterday about how the dip in the small-cap Russell 2000 following the breakout was likely just temporary – and that it would keep going up after.

It looks like that’s exactly how it’s playing out right now.

So for today, with the election on everyone’s minds – let’s see what historical election year data has to say about what’s likely to come.

Chart of the Day

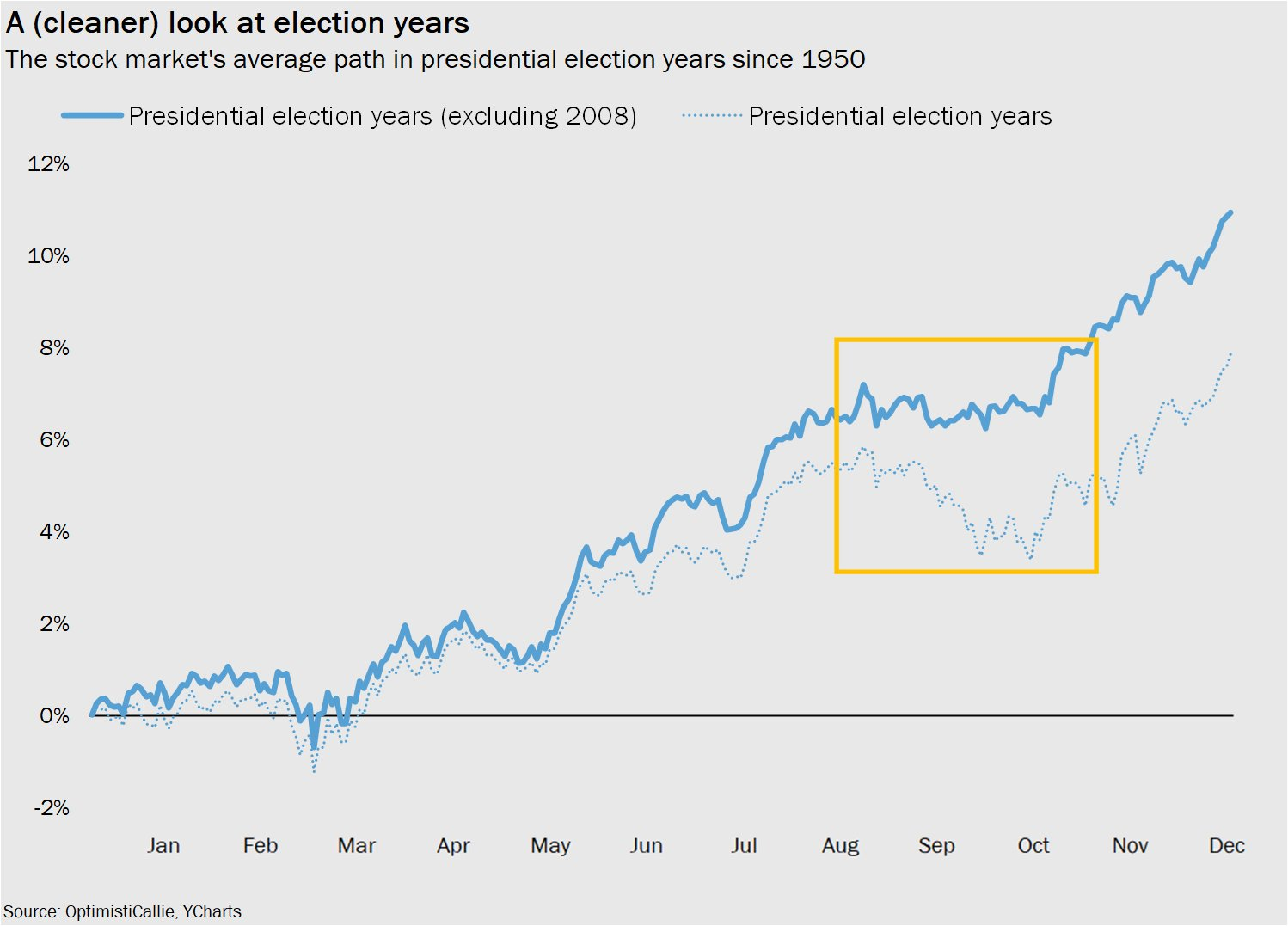

This chart shows how the S&P 500 has performed on average during all the past election years since 1950…

Except with data for 2008 being stripped out.

Why? Because 2008 had the Global Financial Crisis, which was caused by the banks failing – something that’s highly unlikely to be repeated today.

And as you can see, with 2008 taken out, the most likely “summer scenario” is a sideways performance (as opposed to a drop) for the S&P 500 – something which looks to be happening right now.

This is good news for the market as a whole – as large-cap stocks are the market’s bedrock.

But since small-cap stocks are also continuing to break out, savvy traders don’t have to wait for the end of summer to go after serious gains.

Insight of the Day

There are always opportunities in a healthy bull market – they just rotate their location

In a healthy bull market, there are always opportunities…

It’s just that the location of these opportunities tend to rotate around.

Large-cap stocks may go nowhere for a couple months.

But now, small-cap stocks are on the move.

With small-cap stocks as a whole having lagged behind their large-cap counterparts for many months, this is a refreshing – and necessary – shift.

And since individual small-cap stocks have greater return potential simply due to their size…

The last thing we want to do is miss out on a likely “small-cap summer”.

That’s why later this afternoon at 3 p.m. Eastern…

I’m going LIVE to show how anyone can use my unique “buying pressure” indicator to uncover the most explosive small-cap stocks…

And potentially position yourself in them right before they take off.

One stock this indicator pinpointed in late May shot up by 135% less than two months after…

But with small-caps breaking out – not to mention the ongoing uncertainty created by Biden stepping down…

I believe NOW is the best time to use this indicator in your own trading.

So, if you haven’t seen this indicator in action…

And if you haven’t registered for my masterclass, make sure you click here to guarantee your seat at my live masterclass later…

And my team will send you the login details in the afternoon.

See you at 3 p.m. ET, and get ready to discover:

- How to detect when buying pressure is building up in a specific stock…

- Why most traders are blind to this buildup of pressure (and miss out on big gains)…

- And how to use my “PSI Gauge” to determine the exact point to jump into one of these “pressurized” stocks for maximum gains.

Do login early if you can.

Customer Story of the Day

“I am new at trading and have bought many programs, Ross’ training is bar-none. Ross is the first one I actually placed trades with. I only do one contract at a time and I am up $500 my first week. My first trades were life changing to me! Thank you! Ross and your Team…”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily