Hey, Ross here:

The market can recover – and the perma-bears will still say stuff like “the stock market does not reflect the economy”.

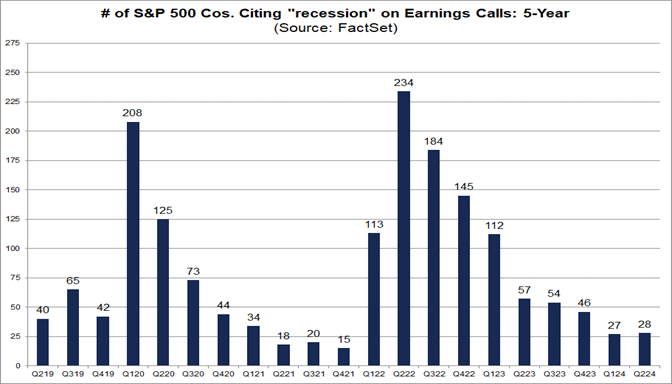

So let’s start the day with a chart that shows what businesses are thinking about the chances of a recession.

Chart of the Day

This shows the number of S&P 500 companies mentioning recession fears on their earnings calls.

And as you can see – companies are actually much less worried about recession risks now than at any time in 2023.

Does this guarantee that a recession won’t happen? Of course not.

But companies are the ones “on the ground” doing business – so their input is worth more than any talking head.

And right now, they don’t seem worried.

So we shouldn’t blow it out of proportion either.

Insight of the Day

When expectations get reset, opportunity gets created.

Right now, the bears still have plenty of traders scared that a recession is just around the corner (and that everybody else is just too “blind” to see it).

These perma-bears are like a broken record – and on the extremely rare occasion they’re right, they ride on that “win” for years.

Listening to them is a guaranteed way to miss out 99% of the time.

It’s only a matter of time before most of these scared traders catch on – and their expectations of a recession get “reset”.

And when expectations get reset, opportunity gets created.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a masterclass on a strategy that will allow you to take advantage of “expectations resets” in individual stocks.

Because this strategy is about following the corporate insiders – high-ranking executives exploiting an SEC loophole to trade their own company stock.

These insiders know better than any Wall Street analyst about what big news could be coming down the pipe for their own companies…

News that could “reset” the expectations of investors – and send its price surging.

One “insider” stock the strategy I’ll be showing tomorrow shot up over 50% in a matter of days at the end of July…

And with the market recovery accelerating, gains like this could just be the start.

So, if you haven’t yet, make sure you click here to lock in your spot for my LIVE insider masterclass later…

And get ready to discover:

- How to access the database containing the records of all these insider trades…

- The subtle yet dangerous mistakes traders make when trying to follow these insiders…

- And the 3 counterintuitive insider buying signals you must know about.

The login details will be in your inbox shortly.

See you in a bit at 11 a.m. ET – try to login earlier if you can.

Customer Story of the Day

“Great Educational Webinars! Ross is a great educator. Explains things clearly and succinctly. Very good stock picks. I learned a lot! And I profited greatly! Thank you Ross”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily