Hey, Ross here:

We’re now in a 5%+ correction for the market.

But here’s what most traders don’t realize.

The way markets have been progressing this year?

It’s pretty much on par with how it tends to go in post-election years.

Chart of the Day

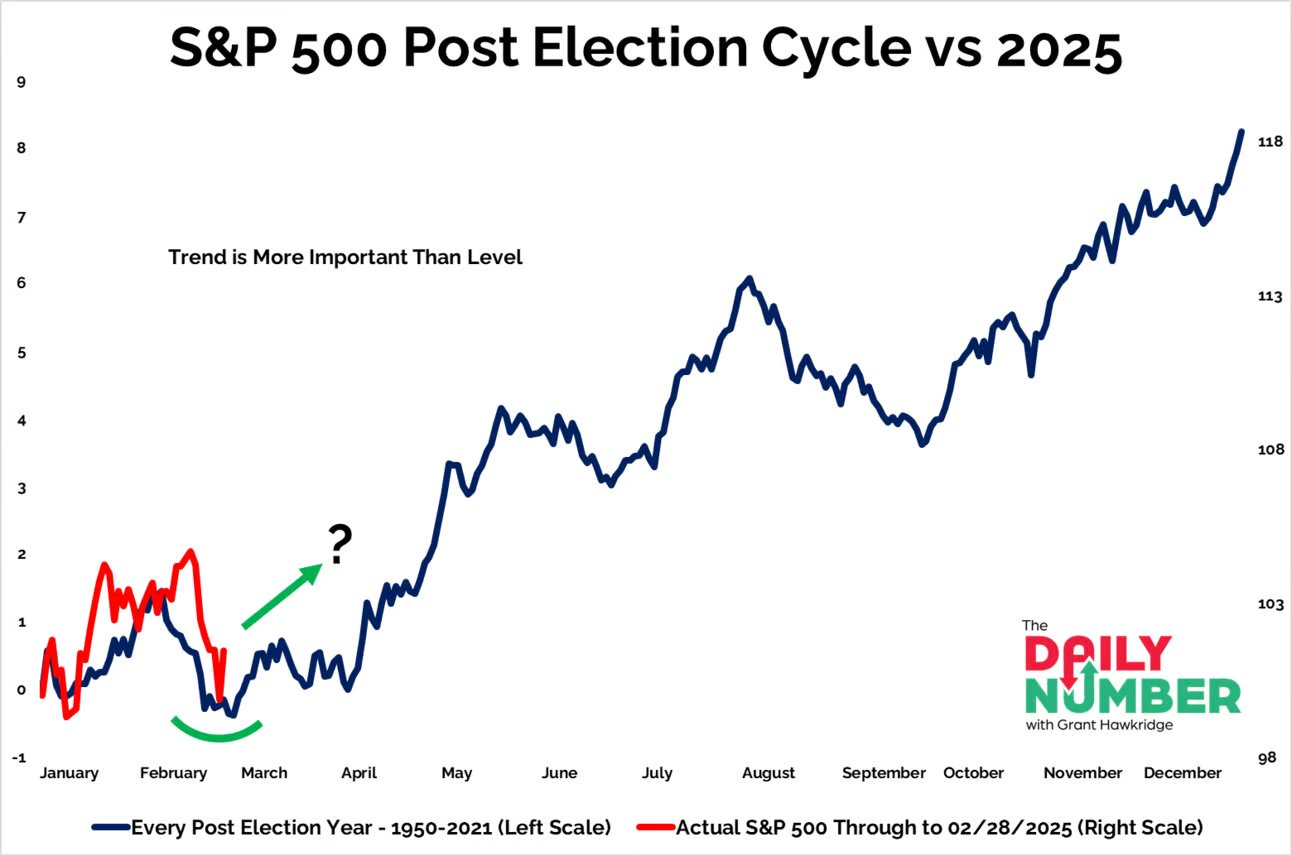

This chart shows how the S&P 500 has moved in aggregate in post-election years.

The choppiness and correction we’ve seen?

It’s actually on trend for the typical post-election year scenario.

Now, of course, this is not to say that Trump won’t make another surprise announcement that affects the market.

He’s going full steam in fulfilling his campaign promises, so we should expect short-term volatility.

My point is, solely based on the price action, there hasn’t been anything particularly special about 2025…

And if things play out as they normally do…

A sharp rebound could be in the cards.

Position yourself now.

Insight of the Day

The playbook for navigating market uncertainty and sharp selloffs? Using it to time your entry points.

I talk a lot about the broader markets on this newsletter.

But ultimately, we’re traders – not index investors.

We buy high-potential individual stocks…

And while there’ll always be some form of correlation with the market…

The truth is, there are always stocks that advance even as the market declines.

These stocks are able to defy the market because of the strength of their individual price catalysts.

These are the stocks we want to target…

And we can even use the market sell offs to better time our entry points.

That’s why later this afternoon at 3 p.m. Eastern…

I’m going LIVE to reveal my playbook for finding these stocks…

So you can still target profitable opportunities despite the bloodletting.

If you haven’t already, click here to guarantee your seat for the live reveal…

And I’ll see you at 3 p.m. ET later today.

Customer Story of the Day

“Ross and Jean are real pros.

They absolutely know what they’re talking about and provide real strategies and information on how to make educated and informed trades with no sugar coating.

They are up front about the risks and enable you to take a lot of the emotion out of the process.

If you’re serious about trading, you should check them out.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily