Hey, Ross here:

Volatility is back with a vengeance.

What with all the talk about potentially acquiring Greenland “no matter what”, additional tariffs, and now threats from Europe about dumping U.S. Treasuries.

So it’s no surprise that many people are seeing choppy waters ahead.

But today’s chart may surprise you.

Chart of the Day

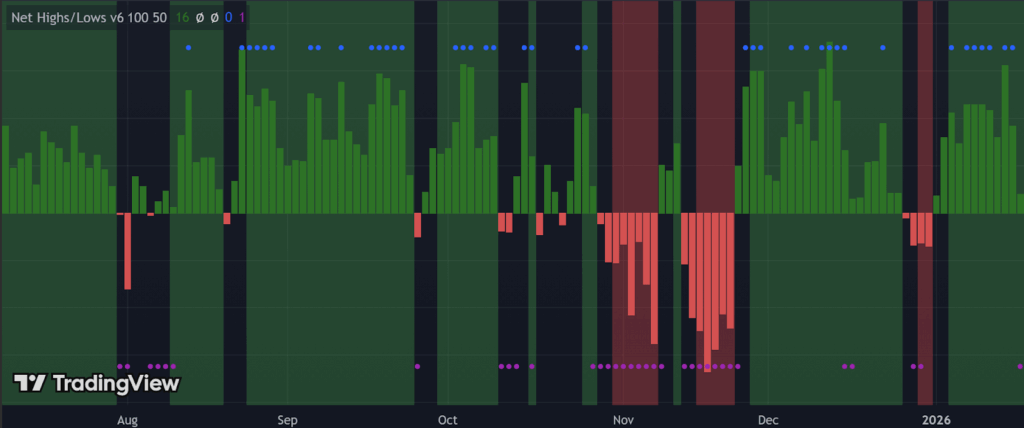

Long-time readers will recognize this chart – the Net New Highs/Lows for the U.S. market.

And as you can see, despite yesterday being the worst day for stocks in over two months…

There were still more stocks hitting new highs than new lows.

How is this possible?

I believe the likely answer is small-cap stocks.

In terms of market capitalization, small-cap stocks barely move the needle.

But in terms of the sheer quantity, there are far more small-cap stocks than large-cap ones.

And the above chart is just about measuring the number of stocks hitting new highs versus new lows – completely independent of market cap.

So even though the small-cap Russell 2000 did fall yesterday…

What likely happened is that there were more small-cap stocks hitting new highs versus new lows.

As I said nearly a couple weeks ago, small-caps have been on a tear relative to their larger cousins…

And this outperformance has only persisted.

So, back to the question I posed at the beginning – are we going to see choppy waters ahead.

Now that you have more context, I answer the question below.

Insight of the Day

Choppy markets are a buying opportunity (but you need to shift tactics).

Yes, there’s a lot of fear in the air.

And yes, there is a good chance we may run into a period of choppy markets as all these get ironed out.

In fact, I’m hoping we run into a spell of choppy markets…

Because I’m viewing it as a buying opportunity.

Overreactions always are.

But of course, some shifts in tactics are needed.

Because in choppy markets, the market’s trend can weaken substantially…

So we want to rely less on strategies that rely on trend following.

That’s why, later this afternoon at 3 p.m. Eastern…

I’m opening up my volatility playbook…

And hosting a free LIVE session where I’ll show you a tactical way to target high-conviction trades that can lead to explosive gains – especially in choppy markets.

It’s a unique method for finding trades that have made SERIOUS runs, like:

- 102% in 12 days…

- 118% in 2 days…

- 101% in 5 days…

- 207% in 5 days…

- And 519% in 60 days.

During some of the choppiest, most volatile markets in recent history (including the big tariff selloff of 2025).

If you’re even slightly worried about what you’re reading in the headlines…

You owe it to yourself to make it to this session.

So click here to guarantee your spot if you haven’t already…

Block off your calendar…

And I’ll see you later today at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Traders Agency is a great company to be associated with. Ross Givens does a fantastic job of explaining strategy in a way that’s thorough while also being easy to understand. I’m very happy I got on board. Additionally, the customer services have also been prompt and fantastic!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily