Hey, Ross here:

Yesterday, I showed you how market participation is rebounding.

Today, let’s look at how individual investor sentiment is following suit.

Chart of the Day

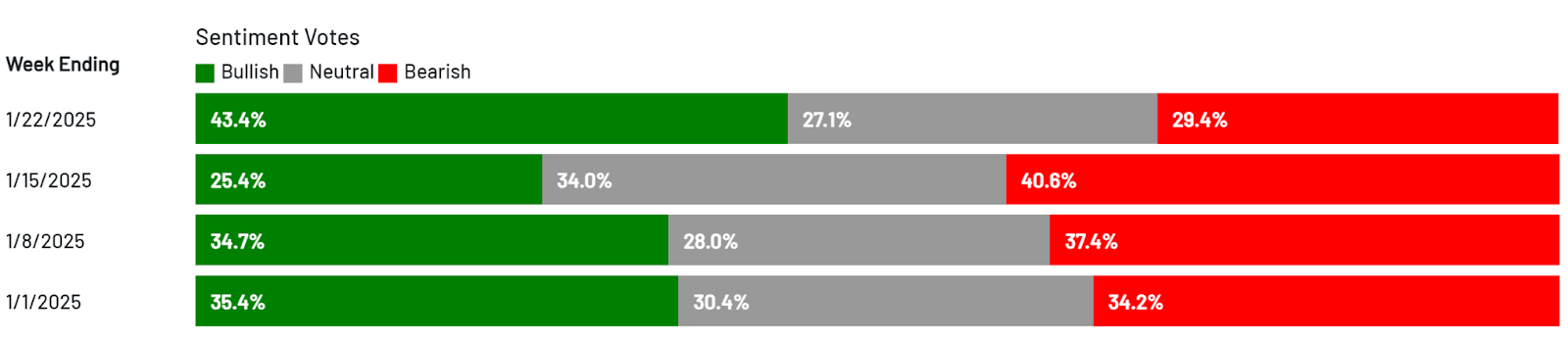

These are the results of the weekly market sentiment survey by the American Association of Individual Investors (AAII).

One week ago, bullish sentiment had retreated to 25% while bearish sentiment had spiked to 41%.

The bears significantly outnumbered the bulls.

Just one week later, that has completely flipped – 43% are now bullish while just 29% are bearish.

Let me be clear – this spells opportunity.

But there’s an important caveat, which I explain below.

Insight of the Day

You have to position yourself before the individual investors and traders catch on.

Notice how the spike in the individual investors’ bullish sentiment only happened after the market had bounced?

That’s how it is – they’re always one step behind.

It’s a harsh reality of the market.

That’s why many of them end up becoming the “exit liquidity” – the ones left holding the bag as the ones who got in first unload their positions.

You want to be part of the ones who get in first.

Right now, the AI sector is getting even hotter thanks to Stargate AI – the world’s largest AI project that’s already been endorsed by President Trump.

It’s a $500 billion shot in the arm for AI that’s going to be creating a lot of opportunities.

The key to capitalizing on it?

Getting in early – before the individual investors catch wind.

That’s why tomorrow morning at 11 a.m. Eastern…

I’m going LIVE to reveal a powerful signal that can tip you off to stocks set to surge as this boom plays out.

Click here now to secure your spot for this live session…

And get ready to take full advantage of AI in the new Trump era.

I’ll see you tomorrow at 11 a.m. ET.

Don’t be late.

Customer Story of the Day

“I joined TA on 7/25/24. When I joined I had no idea how transformative my trading journey would become since I started working with TA and Ross.

From the very first weekly group session, it became very clear to me that this program is not just about making trades; it’s about building a comprehensive understanding of the markets and developing skills that I have been missing in my trading plan for success.

These have revolutionized my trading success and I believe they will transform yours too!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily