Hey, Ross here:

Before we head off for the long Labor Day weekend, let’s look at a chart that celebrates the greatest investor of all time…

And the main thing we as traders can learn from him (it’s not what you think).

Also, a quick reminder that markets are closed on Monday, so this newsletter will resume early Tuesday morning.

Chart of the Day

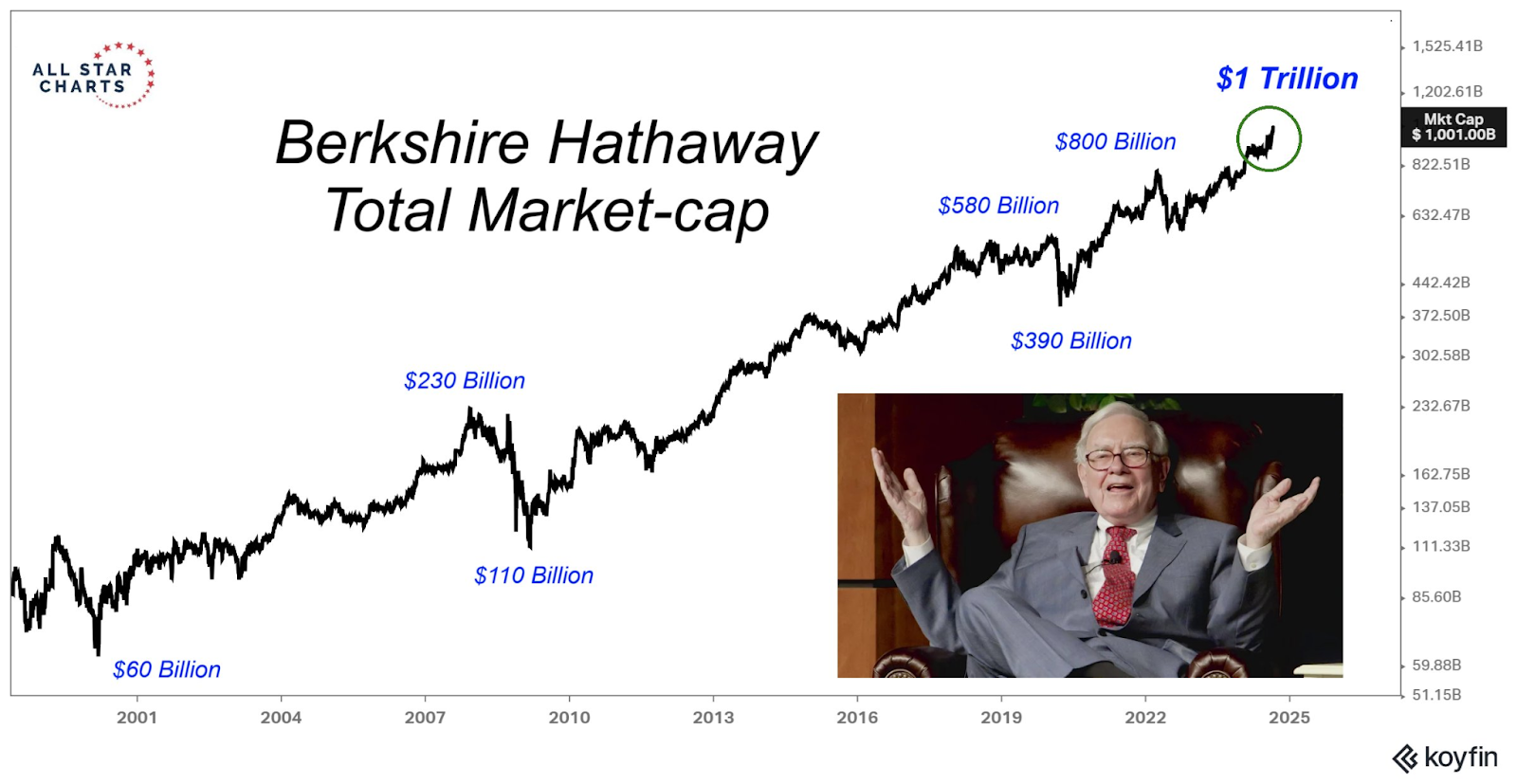

Berkshire Hathaway IPO’ed in March 1980.

Twenty years later, the company had a market cap of $60 billion.

Twenty years after that it was about half a trillion.

And two days ago, it hit the $1 trillion milestone – joining Nvidia, Microsoft, Alphabet, Apple, Amazon, Meta, and Saudi Aramco.

Buffett is probably the most-celebrated investor of all time, with possibly millions of investors trying (and largely failing) to follow his footsteps and philosophies.

But we aren’t long-term investors – we’re traders.

So the most important lesson we can learn from him? I explain below.

Insight of the Day

Recognize that different traders/investors are all playing different games.

There are many games you can play in the market.

None of them are necessarily better or worse than the other – it’s all about what you are looking to get out of the markets.

Buffett is playing the ultra long-term value game. It fits his skills, personality, and goals.

There’s nothing wrong with that game. But it’s critical to recognize that we’re playing a very different game.

We’re looking for outsized returns in shorter time frames.

We’re not looking to hold a stock for years. When a stock hits our targets, we systematically sell into strength and “lock in” our gains on the way up.

And here’s the cool part…

One of the best ways to find these opportunities is to look at what other games are being played – games most traders don’t even know exist.

For instance, there’s the “insider money” game – where corporate insiders systematically take advantage of their informational edge to

If you know how the game works, you can take advantage of it as well.

This week, we sold several of these insider positions for 30–40% gains each – gains that were realized in weeks or even days instead of months or years.

And I’m seeing even more insider opportunities pop up on my radar.

That’s why later today at 12 p.m. Eastern…

I’m going LIVE for a masterclass that will give you my complete playbook for spotting these insider opportunities.

I’ll show you:

- How to access the database containing the records of all these insider trades…

- The subtle yet dangerous mistakes traders make when trying to follow these insiders…

- The 3 counterintuitive insider buying signals you must know about…

And much more.

So, if you haven’t already, make sure you click here to guarantee your slot for my live masterclass later this morning…

And I’ll see you in just a bit at 12 p.m. ET.

Go into the Labor Day weekend armed with the tools you need to win the trading game.

See you soon.

Customer Story of the Day

“I’m still learning but Ross is the man I wish I had the knowledge he has and I’m so thankful he is willing to share it with us. I’m sure, like me, most of you aren’t natural stock gurus but the more I listen to him the more I learn.

I still have a very long way to go but the more time I put into it the more I learn under his guidance. Thanks Ross.“

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily