Hey, Ross here:

Let’s start the day by looking at what the breakout in the small-cap Russell 2000 could mean for small-cap stocks moving forward…

And how Biden stepping down could play into it.

Chart of the Day

Nearly two weeks ago, the Russell 2000 broke out – surging more than 10% in the next five trading days.

Since that blitz, markets have indeed pulled back slightly.

But if you look at today’s chart – you shouldn’t be surprised.

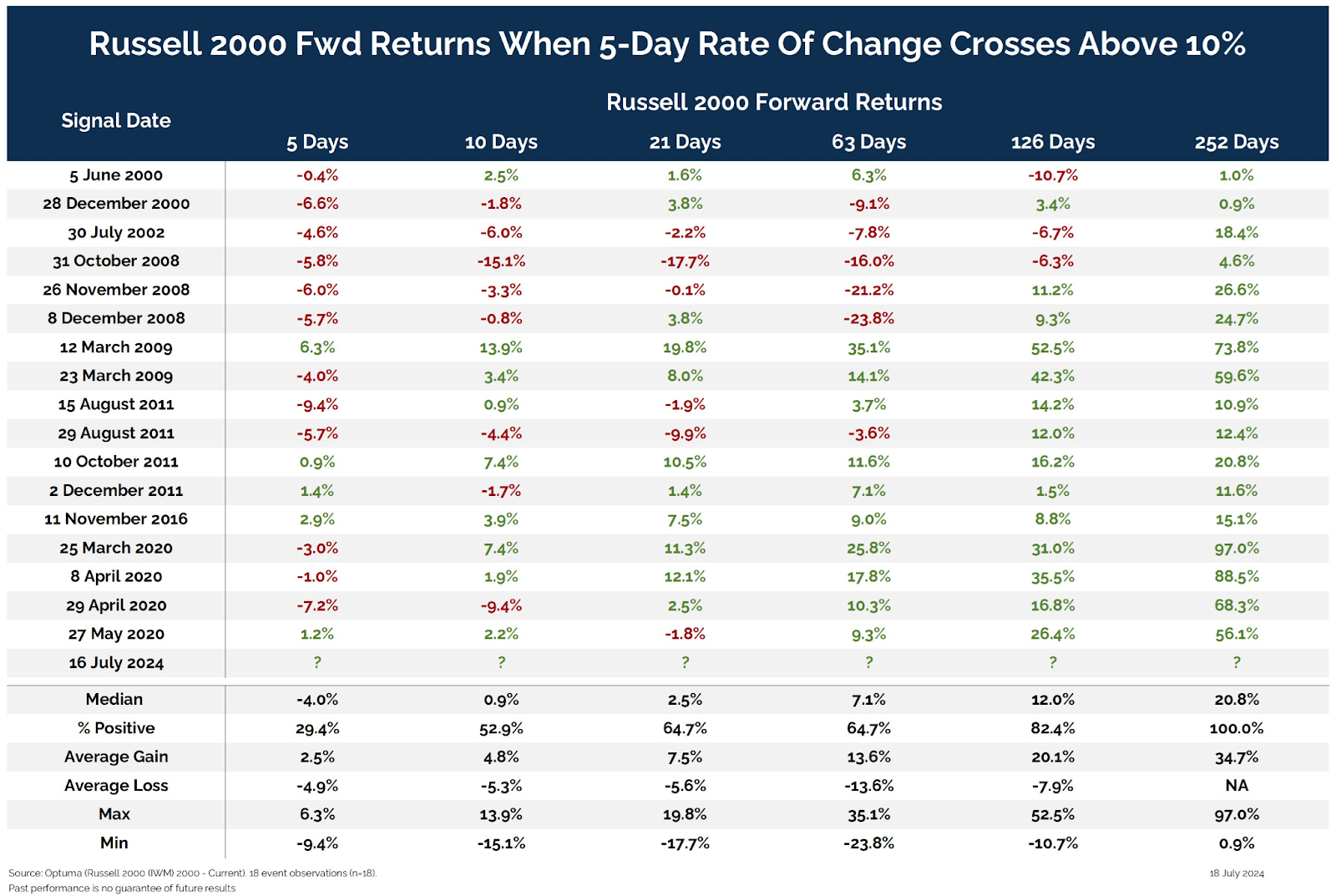

It shows how the Russell 2000 has performed in the past after five-day runs of over 10%.

And as you can see, in the days after the initial surge, the most common outcome is for the index to pull back – which is exactly what’s happening now.

But as we extend the time period, we see the expected returns turn more and more positive.

In fact, almost every single time, the index has been substantially higher about 8 months later.

I explain the implications below.

Insight of the Day

The bigger and faster the move, the more “indigestion” the market can get.

Markets always take time to “digest” a move.

During this digestion period, we typically see the stock oscillate back and forth – often even falling slightly.

But the bigger and faster the move, the more volatile this digestion period can be.

That’s what we’re seeing now – the “indigestion” after a rapid surge.

Biden dropping out and the uncertainty around the next Dem candidate will only add to this.

This can and will scare off many traders.

Don’t be one of them.

Because once this “indigestion” is over, the market is most likely to keep going up – especially the explosive small-cap stocks.

So use this period of indigestion to strategically position yourself.

Of course, as traders, our focus is on individual stocks.

That’s why later this morning at 11 a.m. Eastern later today…

I’m going LIVE to show you how to use my unique “buying pressure” indicator to position yourself in the highest-potential stocks…

Potentially right before they blast upwards for another huge move.

One stock this indicator pinpointed in late May shot up by 135% less than two months after…

But I believe that could just be the start.

So, if you haven’t yet, make sure you click here to guarantee your seat at my live masterclass later…

My team will send you the login details shortly…

And I’ll see you at 11 a.m. ET.

Do try to login early if you can, and get ready to discover:

- How to detect when buying pressure is building up in a specific stock…

- Why most traders are blind to this buildup of pressure (and miss out on big gains)…

- And how to use my “PSI Gauge” to determine the exact point to jump into one of these “pressurized” stocks for maximum gains.

Customer Story of the Day

“Ross is an excellent teacher. I have watched three zoom meetings being new to trading and am really impressed.

I have stage 4 kidney cancer which God is fighting for me while I’m learning from Ross on how to make good investments. Thankful that his research includes a wide scope of companies.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily