Hey, Ross here:

The S&P 500 hit another new all-time high yesterday.

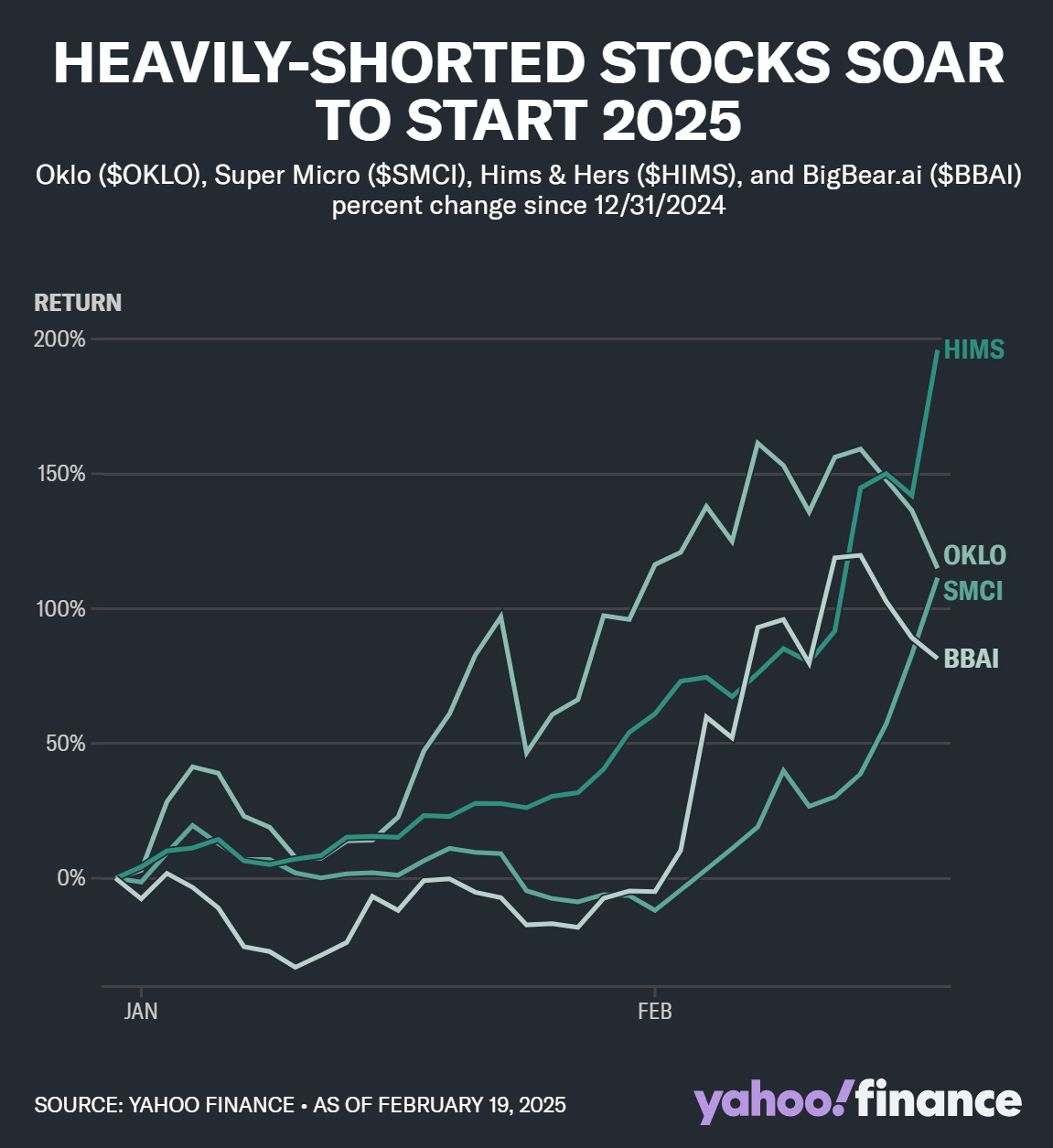

And as today’s chart shows – it’s a bad time to be a bear.

Chart of the Day

The first two charts ar

Some of the market’s most heavily shorted stocks have risen the most in 2025.

It’s not in the above chart, but data shows that short sellers have lost $73 billion since the start of the year.

That’s a huge wipeout…

And if the clear bullish pattern in the indexes is any indication – short sellers’ pain is only set to continue.

The reason why short sellers so often get it so drastically wrong?

I explain below.

Insight of the Day

You need a massive informational edge to succeed as a short seller…

And most short sellers simply do not have that kind of edge.

Fact is, it’s way harder to succeed on the short side than the long side.

That’s especially true in the US stock market, which largely just keeps going up over time.

That’s why all the strategies I teach are about targeted buying – not shorting.

It’s just way easier.

Plus, once you sprinkle in some of that informational edge…

The exact same edge most short sellers need – but don’t have…

You could do even better.

That’s why tomorrow morning at 11 a.m. Eastern…

I’m hosting a free LIVE training session to show you how to use this informational edge to supercharge your trading performance.

The key? Following the footsteps of the corporate insiders.

They already know, almost down to every last detail, what’s going to happen in their own companies…

And they’re blatantly trading off this inside info.

And tomorrow morning, I’m going to show you how to “borrow” their edge for yourself…

So you can use their insider access for your benefit.

Some of these inside plays have shot up by 1,000% or more – and triple-digit gains are not uncommon.

So don’t miss out…

Click here to register for my free insider training session tomorrow…

And I’ll see you Friday morning at 11 a.m. ET.

Customer Story of the Day

Ross is a great teacher! I love the family values he has, the way he explains and looks at investments, the weekly calls are amazing and you get to learn and ask about different stocks and what patterns to look for.

In 3 months I have learned more practical investment than in 2 years reading books and stuff. Also made more money! It is for anyone new and for anyone already good, just get on weekly calls for the best experience!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily