Hey, Ross here:

Hope you had a great New Year’s weekend. I know 2022 was quite a ride in the markets, but don’t worry – I’ll be with you every step of the way this year.

So, without further ado, here’s your first actionable trading idea for 2023!

Chart of the Day

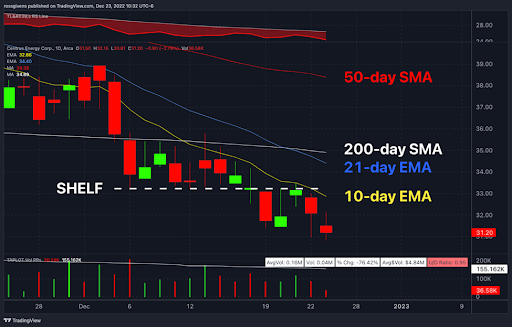

One of the easiest short trade setups is what I call a shelf break.

You want to focus on stocks that are down big in clearly defined downtrends trading below their moving averages.

After a significant move lower, the stock will find support for 1–3 weeks and form a “shelf” (see white line on graph).

Notice how Centrus Energy (LEU) was unable to rally – even after falling 15% in three days. There was only one attempt at getting above its 10-day moving average and even that was rejected on the same day.

The chart is telling you that no one wants it. There are no buyers, and the stock cannot rally.

Insight of the Day

Solid foundations – not forecasts – are the key to a successful 2023 in the markets

Scan the news today and you’ll be bombarded with headlines selling their “forecasts” for 2023 – whether it’s the economy, market sectors, specific stocks, or what have you.

A few of those forecasts will inevitably come true – it’s just statistics. But the last thing you want this year is to rely on these random forecasts. Unless you have the in-depth knowledge to question all the assumptions behind these forecasts, relying on them is a bad strategy.

Instead what you want is to rely on the foundations of trading – having a proper system with defined targets, clear rules, and proper risk mitigation.

Every consistently successful trader I know uses a system. None of them rely on these so-called forecasts.

For example, consider my flagship Stealth Trades system. It relies on detecting when the big institutional money is about to make a major move – and then getting in right before to profit alongside them (something I learned during my days on Wall Street).

There’s no “forecasting” involved whatsoever. And there’s a reason over 18,000 people have all signed up for this system. Learn more about it by clicking here.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily