Hey, Ross here:

Welcome back.

Both the S&P 500 and the Nasdaq closed lower for the week – marking the second consecutive weekly decline.

This is the “worst” weekly performance since June last year.

And yet, as today’s chart shows…

We’re in a target-rich environment.

Chart of the Day

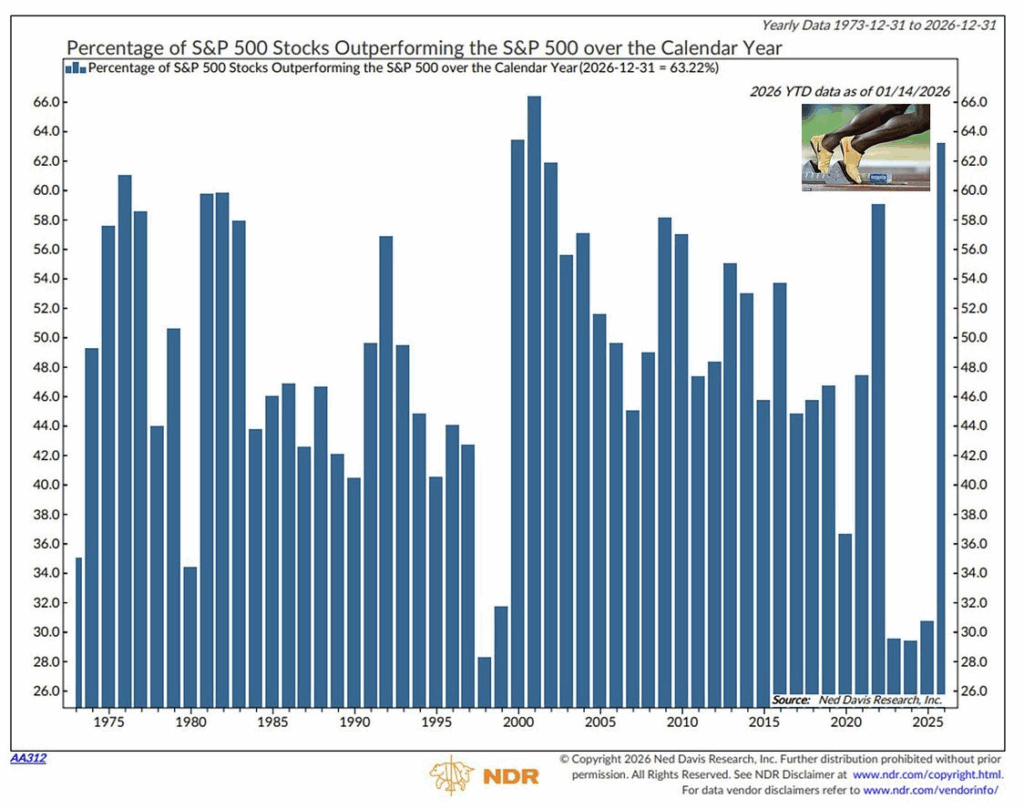

This chart shows the percentage of S&P 500 stocks outperforming the S&P 500 index dating back to 1975.

As of late last week, 65% of S&P 500 stocks were outperforming the index.

This is the highest level since 2001 and the second highest level in history.

This chart tells us two things.

One – market breadth is strong, which is always what we want to see in a bull market…

Because it creates a target-rich environment.

And second, it points toward the ongoing rotation that’s been happening for a while.

Because for the majority of stocks to outperform the index…

That would mean there’s a minority of stocks that are dragging down the entire index.

That lagging minority is the mega-cap tech stocks.

The money is flowing away from them…

And into other sectors – sectors that we want to target.

What is it that is causing the rotation?

I explain below.

Insight of the Day

When a trade gets too crowded, the “smart money” leaves in search of greener pastures.

The past few years have bid up the valuations of these mega-cap tech stocks to historic levels.

And while there are good fundamental reasons why these stocks deserve to be at the top of the heap…

The fact is that, in 2026 – the mega-cap tech trade has simply gotten too crowded.

And at their current size, their upside potential is necessarily limited.

Are these still great – even excellent – companies that will most likely continue to generate billions in profit for years to come?

Absolutely.

But remember, in trading – everything carries an opportunity cost.

Every dollar allocated to a Big Tech trade is a dollar not allocated elsewhere.

The smart money is always acutely aware of this – because their performance is always benchmarked.

So, when they see a trade is getting too crowded, they’re often the first to rotate away in search of greener pastures

And because they are the “big money” that moves stocks…

When they rotate away, it shifts the entire market.

We need to move with that rotation, so we can use their big money flows to our advantage (instead of getting stuck in yesterday’s trades, which many retail traders tend to do).

That’s why tomorrow, Tuesday January 27, at 11 a.m. Eastern…

I’m going LIVE to show you exactly how to track these institutional flows into today’s – not yesterday’s – most lucrative trades.

Just this month alone…

Every single trade this strategy has spotted is up double-digits – with one trade up over 70%.

This is all in a matter of weeks or days.

That’s the potential of following these big money flows.

I’ll walk you through everything in tomorrow’s free live session.

So just click here to let me know you’re coming…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross is a minefield of knowledge…

Really enjoying his live sessions – a lot of information to process being new enough to the game.

But I’m enjoying the teaching style as he breaks things down well and says it how it is – no fluff no messing about.

This man knows his onions recommend 10/10”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily