I’ve said before that the best performing stocks from one cycle are often the same stocks you might want to short when they finally top out and start to fail.

Why?

Well, stocks that get caught up in the bullish hype often rise to insanely overvalued levels.

And that means they have a lot of room to fall.

I call these stocks “broken leaders,” and one that I’ve had on my radar for a while now is starting to set up on the short side again.

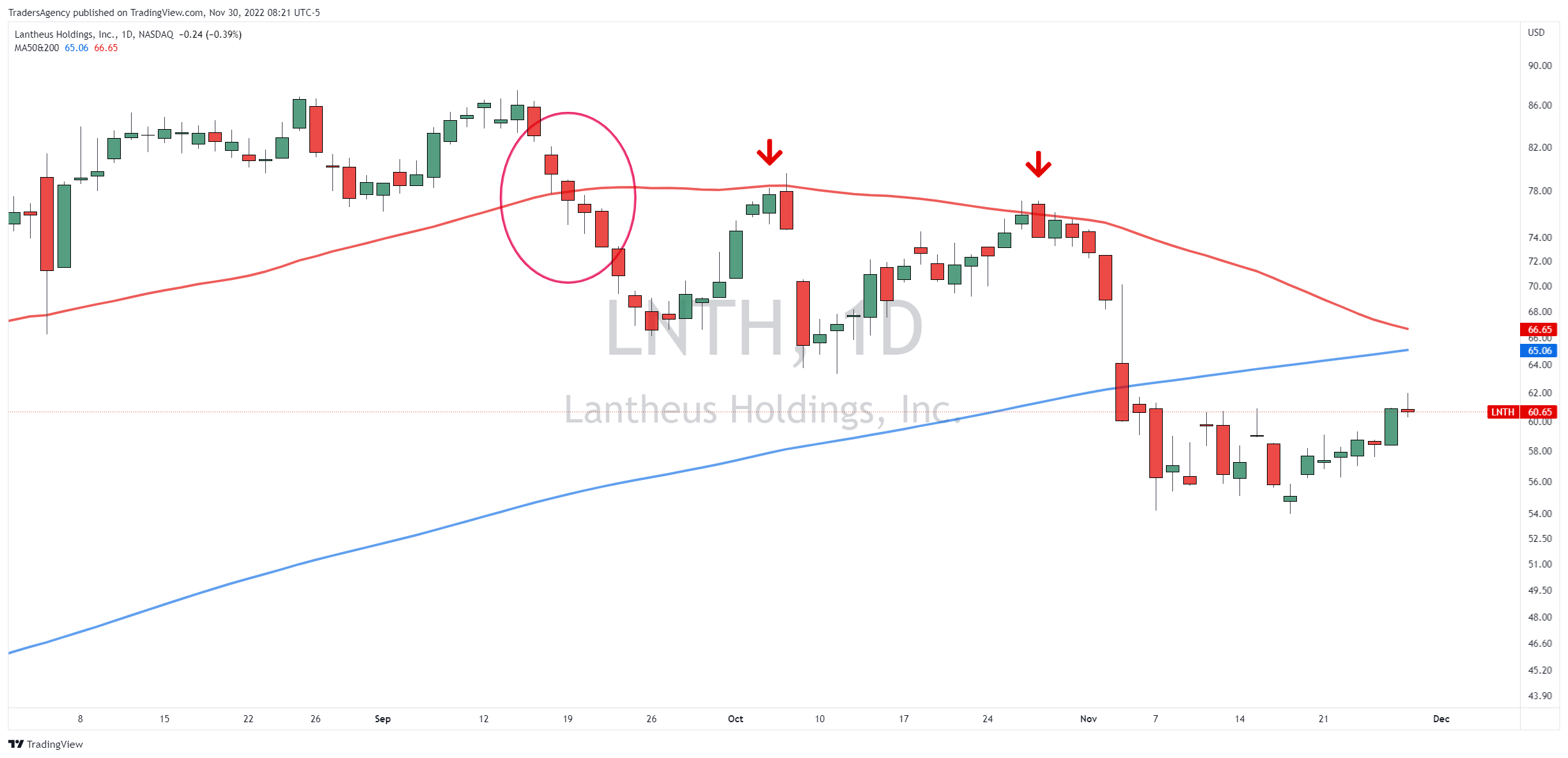

Let’s take a look at the chart…

The Party’s Over

Broken leaders make for ideal short targets when they bounce up into resistance.

Take Lantheus Holdings, Inc. (LNTH), for example, which I first brought to your attention in late September.

Lantheus is a medical device company that rose over 200% from the start of 2022 to mid-September.

But when it started to show weakness, breaking below its 50-day moving average (MA), I knew the party was over…

As you can see in the daily chart above, LNTH first broke below its 50-day MA (red line) on Sept. 19.

It subsequently traded lower for several days in a row, but then it started to bounce back right back up to that level again.

And when it hit the 50-day MA from underneath, that marked the first good opportunity to sell the stock short.

Right on cue, the LNTH dropped 16% in just two days. It then started to bounce back again…

When the stock hit the 50-day MA from underneath for a second time, that was the second good opportunity to sell the stock short.

This time, the technical weakness combined with a disappointing earnings report sent the stock below its 200-day MA (blue line).

Go Back for More?

At this point, LNTH is once again approaching its 50- and 200-day MAs from underneath.

Together, they should act as a strong resistance level for the stock…

These moving averages also happen to be converging right at the previous lows, marked by the horizontal black line, which should also act as resistance.

While this is not an official recommendation to short the stock, I would certainly keep this setup in mind.

This seems like a fairly obvious place to get short, and the market doesn’t always reward traders who take the obvious route.

However, as I said at the start, these broken leaders have a lot of room to fall…

So I wouldn’t be surprised to see resistance hold and the stock make another leg to the downside.

Looking for More Short Ideas?

If you’ve been struggling in this wild stock market environment, with the major indexes down double-digits and many of last year’s leading stocks down over 50%…

Consider checking out my Alpha Stocks trading service.

We have plenty of long ideas for the right stocks, but we’re also not afraid to go short.

In fact, we actually traded LNTH on the short side in Alpha Stocks using the methodology I covered above…

Not only do we short stocks, but we also provide option alternatives if that’s more your style.

And we get together every Monday for an hour-long live session so that subscribers can ask questions and get guidance about our trades.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily