Hey, Ross here:

As of last Friday’s close, the Nasdaq is down 22.7%, while the S&P 500 is down 17.5%.

In short, the Nasdaq is already in a bear market…

And I expect the S&P 500 will likely follow in the next few days.

This is 100% due to President Trump.

I’m not a Trump hater (I voted for him) – and I don’t even disagree with using tariffs to compel fair trade.

But the way he went about it was completely reckless – and it’s wrecking the stock market.

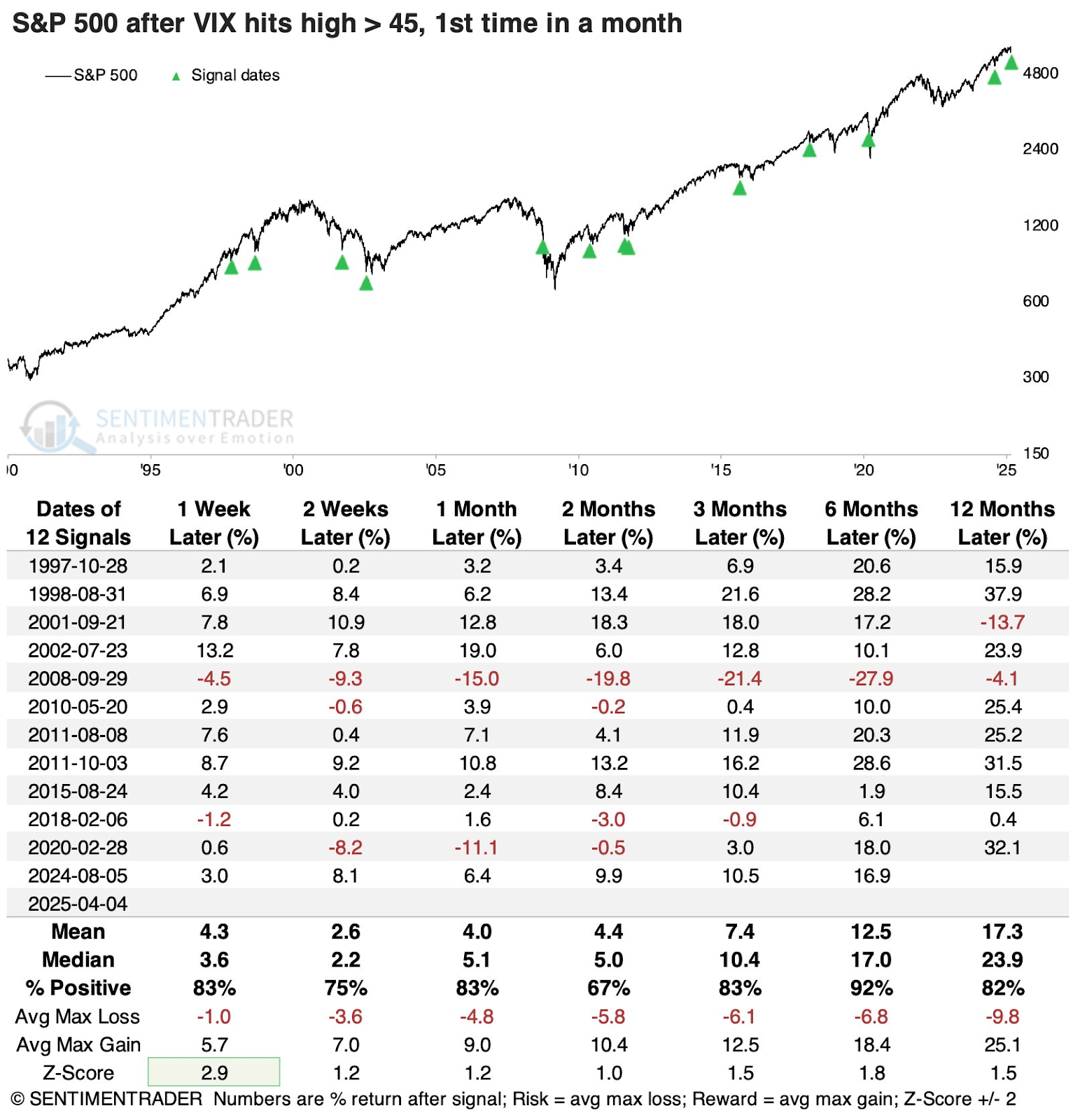

Volatility is now at the highest levels since the Covid crash of March 2020.

Chart of the Day

This is the Volatility Index (VIX).

And the only time it’s been higher in the past five years was during the Covid crash of March 2020.

That was an unexpected pandemic – this was completely different.

There are only two bright spots I can see amid this bloodbath.

The first is that VIX spikes to above the 45 market is typically preceded by positive returns.

The second bright spot?

As I explain below, it’s potentially extremely reversible with minimal resources.

Insight of the Day

Should Trump scale back these tariffs, the market will likely come roaring back.

It took the Fed taking interest rates to zero and printing trillions of dollars out of thin air to launch us out of the Covid crash.

To a lesser extent, it took the Fed cutting interest rates to lift us out of the 2022 bear market.

But the 2025 bear market?

All it will take is Trump scaling back on these tariffs in a single announcement. That’s it.

During the weekend, the administration reported that over 50 countries have reached out to negotiate these tariffs.

Hopefully, this is a sign that the massive tariff announcement was just a way to force them to the negotiating table.

And hopefully, once those negotiations start bearing fruit, Trump will start scaling back these tariffs.

But until I see that happening, I’m going to keep my long exposure minimal.

I’ll also be going LIVE tomorrow, Tuesday morning at 11 a.m. Eastern to show you one of the few strategies that even has a chance in this market right now…

Because it allows you to profit even when the markets are going down.

If you’re interested, just click here to let me know you’re coming.

I’ll also be sharing my view on the current markets in more detail, so it’ll be valuable even if you don’t think the strategy I’ll be showing is right for your situation.

I hope to see you tomorrow at 11 a.m. ET.

Customer Story of the Day

“Ross just gave one of the best enlightening reviews of the current trading market.

It was thorough, easy to understand, reviewed indicators that can help any trader and very attentive to our question to clear up any misunderstandings of the market.

Recommended for a Newbie to a more sophisticated Trader. Thank you.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily