Hey, Ross here:

The feud between President Trump and Elon Musk is weighing on the markets.

I expect retail sentiment to be further impacted.

Let’s examine the implications.

Chart of the Day

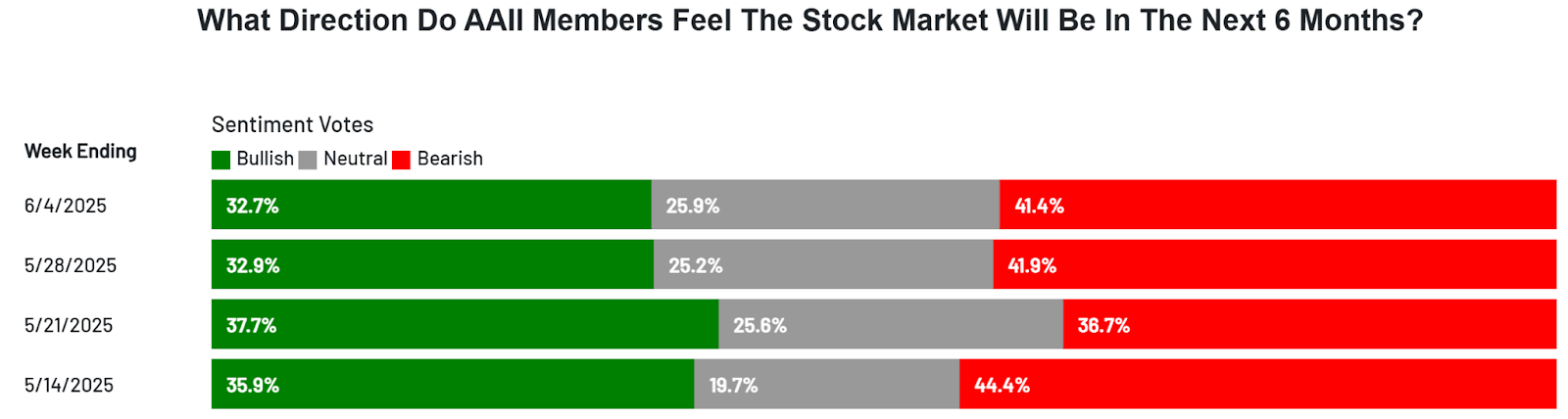

This is the latest results of the weekly sentiment survey conducted by the American Association of Individual Investors (AAII).

As of Wednesday, market sentiment has remained largely unchanged from the week before.

The bears are still outnumbering the bulls.

This is despite the market being spitting distance of all-time highs…

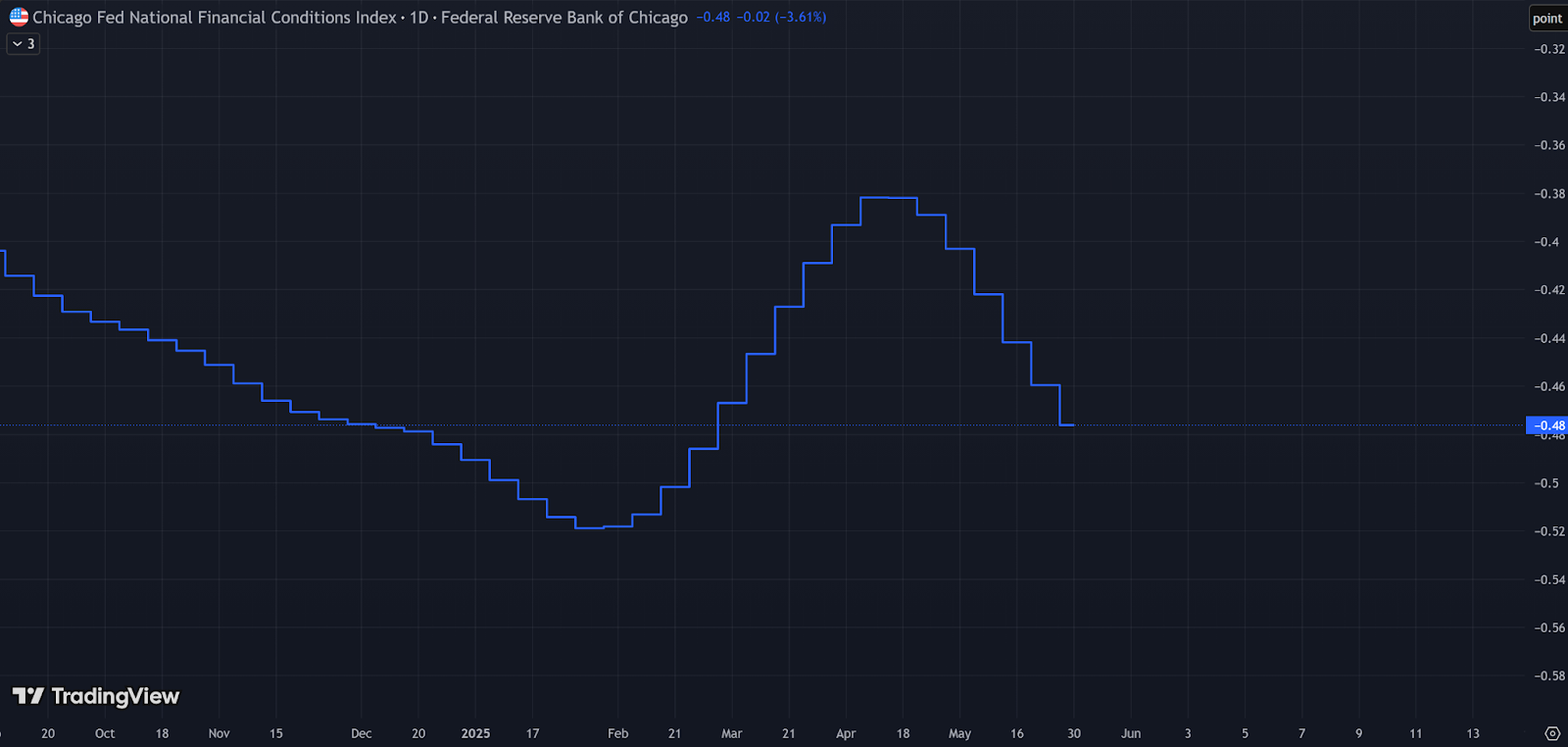

And despite financial conditions continuing to get looser.

The above is the Chicago Fed National Financial Conditions Index – a measure of how much liquidity there is in the system.

The lower it is, the more money there is sloshing around – and the higher stocks tend to go.

You can see the index rising from February to April as stocks tanked…

And the index falling from mid-April onward as the market recovered.

Right now, financial conditions continue to get looser. This is good for stocks.

And yet, the bears still outnumber the bulls…

And as the feud between Trump and Musk escalates – and is amplified by the headlines – I expect to see retail sentiment dip further.

But this is great news for the informed crowd.

Insight of the Day

Headline-driven markets create divergence opportunities.

Most traders – especially retail traders – react very strongly to the headlines.

And considering just how sensationalist the headlines have become nowadays…

Short-term market movements have become very headline-driven – which leads to solid divergence opportunities.

The market fundamentals and price action are solid…

And yet, because of the headlines, retail sentiment is still more bearish than bullish – and it’s likely about to get even worse.

That’s why the most informed traders love to play the headlines.

Because they recognize the opportunity they create.

And in just a few hours at 11 a.m. Eastern later this morning…

I’ll be going LIVE to show you how to take advantage of this headline-driven market…

By following these informed traders straight into the highest-potential trades.

This strategy works through both bull, bear, and sideways markets…

But it’s particularly strong during times like these, when sentiment diverges away from the fundamentals.

Don’t wait for sentiment to catch up with reality.

Click here to guarantee your seat for my live session if you haven’t done so already…

And I’ll see you in just a bit at 11 a.m. ET sharp.

Customer Story of the Day

“By FAR !! the best way to understand the workings in the stock market. Ross and the team are the real deal, no BS.

I’m a lifetime full subscription member and couldn’t be more satisfied.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily