Hey, Ross here:

Just a quick reminder that our offices will be closed for the week starting tomorrow, so expect the next edition of this newsletter next Monday.

But for the final newsletter of the year…

Let’s look at a strange collapse – one that’s actually highly bullish.

Chart of the Day

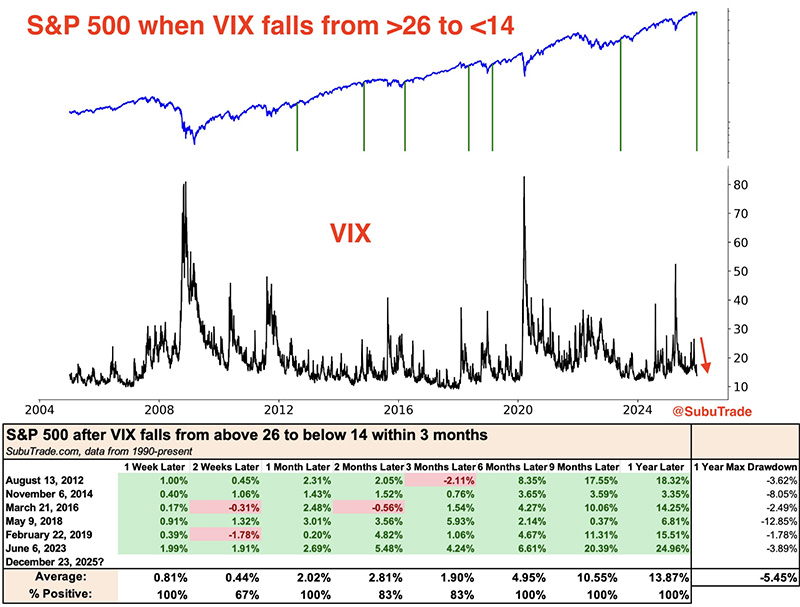

This is the Volatility Index – the VIX.

Just over a month ago, it was trading at above 26.

Since then, it has fallen by nearly half – falling below the 14 mark, for the first time in over a year.

In other words, in a timespan of just over a month…

We’ve gone from a high volatility to a low volatility environment. It’s a volatility collapse.

And as the chart below shows…

This type of collapse is highly bullish for the markets.

This chart shows how the S&P 500 has subsequently performed over various timeframes after the VIX collapses from above 26 to below 14.

As you can see, the data is overwhelmingly positive…

Further supporting my bullish outlook for stocks in 2026.

But ask the man on the street…

And they’ll likely give you the completely opposite picture.

Insight of the Day

Perception about volatility and actual volatility can be miles apart.

Go up to a regular retail trader and tell them that stock volatility is now the lowest it’s been in a year…

And most of them will look at you like you have two heads.

Because it feels like we’re in a highly uncertain and volatile market right now…

Even though the objective data says the complete opposite.

Remember, we’re not talking about economic uncertainty or “vibes” here…

We’re talking about objective price-based stock volatility measures.

And based on those measures, we’re in a low-volatility bullish environment.

There’s a big disconnect…

And that’s something we can – and should – take advantage of.

That’s exactly why in just a few hours at 11 a.m. Eastern later this morning…

I’m going LIVE for my exclusive members-only State of the Market briefing.

I’ll dive deep into what’s really going on in the markets right now…

The key drivers powering stocks forward in 2026…

Where I’m seeing the smart money positioning themselves…

And most importantly…

The keys to targeting the next wave of opportunities before everyone else catches on.

It’s all happening live at 11 a.m. ET, exclusively for members.

So if you haven’t already…

Click here to lock in your free seat…

And I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“By FAR !! the best way to understand the workings in the stock market. Ross and the team are the real deal, no BS.

I’m a lifetime full subscription member and couldn’t be more satisfied.”

Ross Givens

Editor, Stock Surge Daily