Hey, Ross here:

Are we entering a pullback?

And is the market peaking – do stocks really have room to go up much further?

As I said yesterday, it’s still too early to tell whether we’re entering a pullback or not.

But, as for whether the market still has room to go up – the answer is absolutely yes.

And today’s chart helps show why.

Chart of the Day

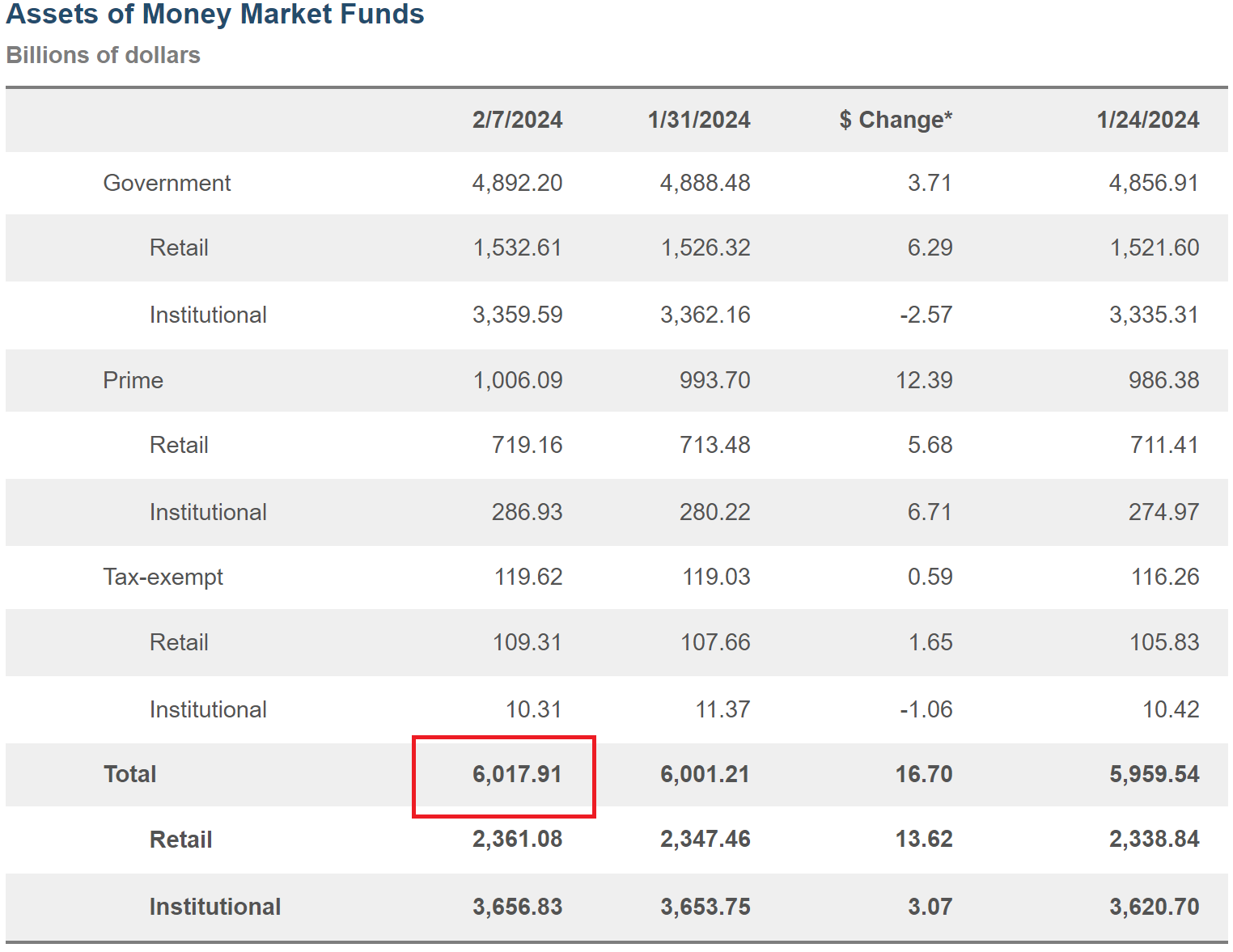

That’s a table showing over $6 trillion in cash still sitting on the sidelines – what we call “dry powder”…

Because it’s the fuel for the next big leg up.

When the pullback inevitably occurs, we may see even more cash flow into the sidelines.

That’s fine…

Because when the rally resumes after, this is the cash that will keep it going.

But as I said – you don’t want to wait for this money to start flowing back into the market…

Because that means you’ll miss all the opportunities out there right now.

Insight of the Day

Sitting out a market rally – even if it is getting overextended – carries heavy opportunity costs

As a trader, you want to participate in as many rallies as possible – even if these rallies are overextended.

Because the market rarely does what it “should” do – at least not on schedule…

And if you’re waiting for a pullback, you’ll miss out on the gains to be had right now.

Sure, you have to be a bit more careful in an overextended rally – such as by using tighter stop losses and more frequent profit taking.

But sitting out completely carries heavy opportunity costs, because the bulk of your gains as a trader will always be made in rallies just like this one.

So the issue isn’t whether you should participate in this rally – but how you’re going to do it.

And that’s why later today at 11 a.m. Eastern, I’m going LIVE for a masterclass that will allow you to target the highest-potential market leaders.

These are the stocks that could defy any pullback and keep going strong even if the rally falters…

Meaning you don’t want to wait to position yourself in these stocks.

Seats are filling up fast…

So please click here to confirm your spot in my live masterclass…

And watch for the login details in your inbox in a couple hours.

Ross Givens

Editor, Stock Surge Daily