Hey, Ross here:

Everyone’s talking Big Tech earnings. Yes, they’re important.

But if you focus too much on them, you could be ignoring the small-cap opportunity staring you right in the face.

And as today’s Chart shows, that opportunity is much larger than most think.

Chart of the Day

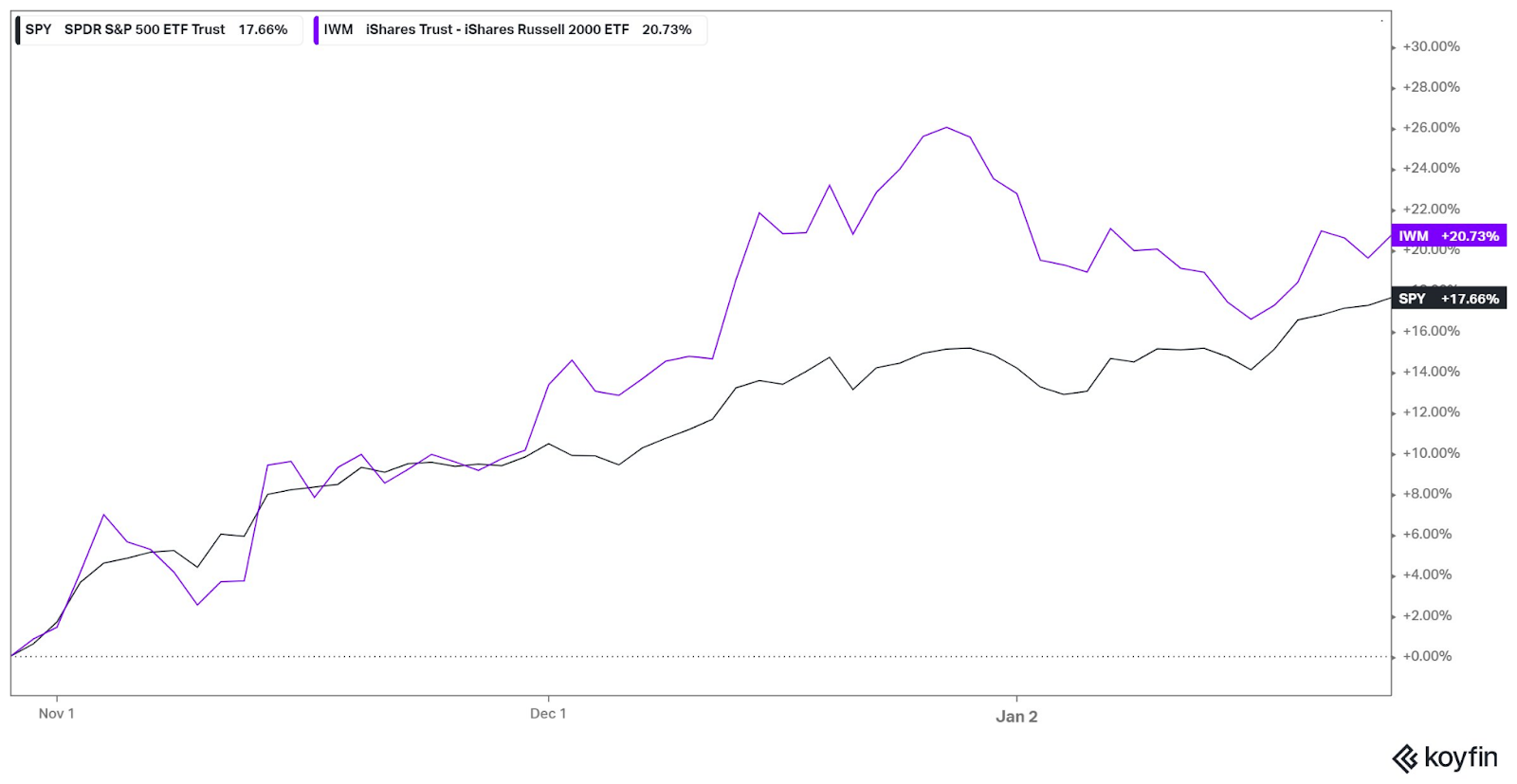

With all the talk about small-caps lagging their larger counterparts, here’s an interesting chart showing that they’ve actually done better since their October lows.

With the latest figures, the S&P 500 is up 19.7% from its October lows – but the Russell 2000 is up 22%.

And with the market looking towards the Fed’s comments later today to gauge the direction and magnitude of the promised rate cuts…

Expect stocks to move.

Insight of the Day

Small-caps contain the biggest opportunity for individual traders – but they’re also the most ignored.

Why are small-cap stocks so ignored? A few reasons.

One, volume. They’re just so many small-cap stocks in comparison to large-cap ones.

Two, laziness. People who write for the mainstream financial news don’t want to do the hard work of digging deep into small-cap stocks – not when they can just keep reporting on Big Tech instead.

And three, many small-cap stocks are simply too small for the big institutional investors to buy.

All these create a feedback loop that keeps most small-cap stocks “off the radar”…

And stocks which are off the radar tend to have pricing anomalies – which equals opportunity for savvy traders.

This is a huge opportunity most are ignoring.

Many of my members have made absolute killings in little-known small-cap stocks over the past year.

So, if you want to take advantage of this ignored small-cap opportunity while it’s still there…

Then click here to find out more about my top strategy for doing so.

I’ll see you soon.

Ross Givens

Editor, Stock Surge Daily