Hey, Ross here:

Yesterday, I talked about the signs of broad market strength in this newsletter.

Yesterday, the S&P 500 also dipped by 0.5%, with the Nasdaq falling over 1%.

But did you know that over 60% of S&P 500 stocks closed higher yesterday?

In short, the index fell – but most stocks rose. That’s a divergence.

And as the data shows – that divergence is historically good for stocks.

Chart of the Day

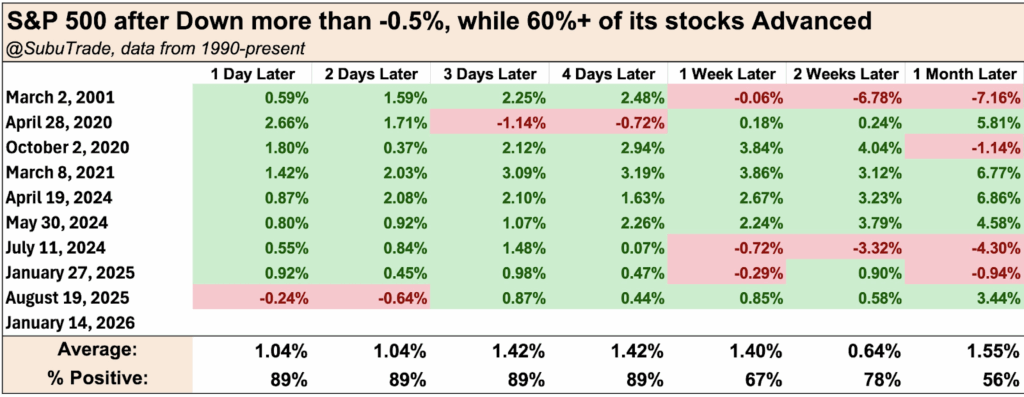

This table shows all the past times the S&P 500 fell more than 0.5% while 60% of its stocks rose.

As you can see, even in the short term – the data is overwhelmingly positive.

So am I worried about yesterday’s dip? Not in the least.

It was the big tech stocks that dragged the cap-weighted indexes down.

In fact, the Equal-Weight S&P 500 actually closed higher…

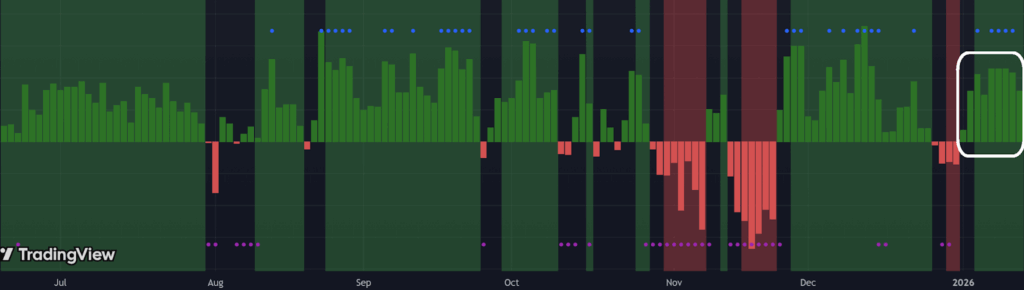

And the streak of net new highs we’ve seen since the start of 2026 remains unbroken.

All in all, this market is still giving me good signs.

But even if, for whatever reason, things take a sudden turn for the worse?

There’s still good news…

Because we’ve just entered one of the best stockpicking seasons there is.

I explain below.

Insight of the Day

Yesterday’s price action showed how most stocks can go against the market index – rising when the index is falling.

That can happen – but it’s rare (as the main table shows, it’s happened only 10 times in the past 35 years).

But during earnings season – a time when investors’ expectations of a company’s prospects get reset or confirmed…

You can have hundreds of stocks moving independently of the market.

The market can be down or stagnant – and individual stocks can be shooting up.

It truly becomes a stockpickers’ market.

And it’s the best time I know of to use my insider strategy…

Where we follow the corporate insiders – high-ranking executives like CEOs, CFOs, and Directors – snapping up their own company shares ahead of some major event.

A prime example is what happened to Alumis Inc. (ALMS) back in mid-November last year.

The stock got absolutely pummeled during earnings.

But right after, several key insiders bought in big.

I noticed, and issued a buy recommendation to my Insider Effect members.

And the result – well, take a look for yourself.

The stock exploded six weeks later after the company announced successful Phase 3 clinical trial results for its plaque psoriasis drug.

As of yesterday, that stock is now up 246% – more than tripling your money – from our buy alert price…

And those who took the option could be up over 1,250% – all in less than two months.

That’s the power of following this insider strategy during earnings season.

And tomorrow, Friday January 16, at 11 a.m. Eastern…

I’m going to walk you through exactly how this insider strategy works step-by-step…

Because the truth is – not all insiders are created equal…

And if you don’t know exactly what to look for, you could end up following the wrong insiders – and wrecking your portfolio.

I’ll show you the exact type of insider buying you want to follow – and the kind you want to avoid at all costs – during my walkthrough tomorrow.

Just click here to secure your free spot…

And I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and all the different services the Traders Agency offer are the best thing one can do if they would like education and trading tips, help and alerts on a daily basis.

Regardless of the level of trader that you are, they have you covered. Services are there for multiple different styles of traders.

Also Ross shares his experience and analysis when it comes to longer term investing as well when he broadcasts live for his members but every time he is asked the question on any other occasion as well.

His teaching style is outstanding and very very easy to understand and remember.

I am very grateful to have found them and have recommended them to multiple friends too.

Lots of people love them for the Insider trade alerts and analysis Ross sends out regularly and are exciting news for one’s portfolio but I personally would recommend every single service of the agency as evenly valuable assuming it fits one’s style of trading.

All the best always and forever to Ross and crew.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily