Hey, Ross here:

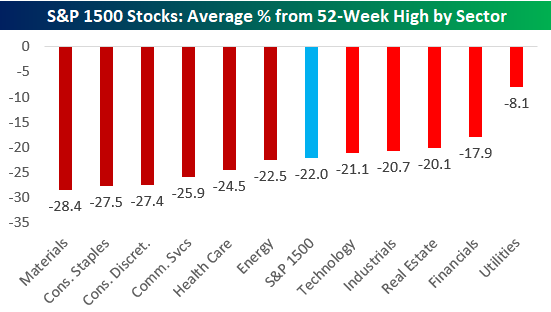

Yesterday, I talked about how the “average” stock is already trading more than 20% below its 52-week high…

Meaning they’re already in a pullback.

Today, I want to show you a chart that, at first, might seem to clash with the above.

But read on, and it’ll all make sense.

Chart of the Day

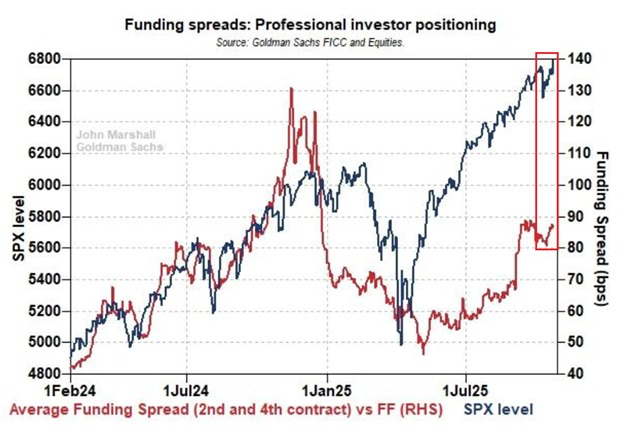

The line in red shows the average funding spreads being paid by the professional investors – aka the “smart money”.

Spreads are how the brokers make their money, while it’s a cost to investors.

So what do rising spreads mean?

It means that institutional investors are willing to pay higher spreads (aka costs) in order to hold stocks.

Right now, funding spreads are near the highest levels since December 2024.

The institutions are aggressively buying stocks.

And yet, as I showed you yesterday, the “average” stock is already in a pullback.

Contrary to what some may think, these two data points don’t contradict each other at all.

In fact, they point to one thing – opportunity.

I explain more below.

Insight of the Day

The “smart money” is likely aggressively buying certain pullback stocks

Think about it.

If you’re a fund manager with year-end targets to hit…

In a shaky market that’s still so close to all-time highs…

You’re going to want to target stocks that not only have a ton of upside potential remaining…

But also have the chance to realize that potential fast.

It’s the logical move.

And that’s what the data seems to be showing.

Many stocks have pulled back…

And yet, the “smart money” is ramping up their buys – because they’re targeting some of those stocks.

There’s no contradiction – just opportunity…

The opportunity to target the same stocks as these institutions…

Which would allow us to ride their institutional inflows to the top.

That’s why in just a few hours at 11 a.m. Eastern today…

I’m going LIVE to show you how to separate the signal from the noise…

Using a battle-tested strategy that’s pinpointed moves of 163% in seven weeks, 270% in 10 weeks, and even 177% in just 11 days.

I call this the “strategy of champions”…

And after my live presentation later this morning, you’ll see exactly why.

It’s perfect for current market conditions…

And if you don’t have it in your arsenal – you’re trading off your back foot.

So click here to guarantee your seat for my live session if you haven’t yet…

And I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“By FAR !! the best way to understand the workings in the stock market. Ross and the team are the real deal, no BS.

I’m a lifetime full subscription member and couldn’t be more satisfied.”

Ross Givens

Editor, Stock Surge Daily