Hey, Ross here:

There’s been so much going on in the markets lately…

That I forgot to wish the bull market a happy birthday.

So, happy 4th birthday to the bull market.

And as today’s chart shows – it tends to bring good news.

Chart of the Day

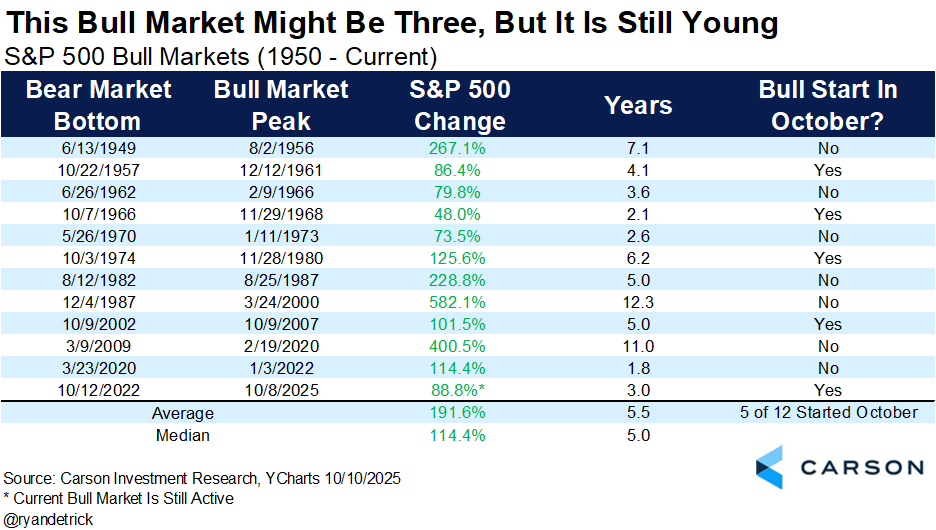

The above table shows the length of all past secular bull markets and how much the S&P 500 rose during each one.

We just entered the fourth year of the secular bull market that began with the end of the 2022 bear market.

At its most recent high on October 8, the S&P 500 was up an impressive 88.8%.

But as you can see from the table above, we still could have a long way to go.

The average bull market runs 5 years or more – and returns 115% at the median and 192% on average.

Sure, there are real concerns about overvaluations.

But as I shared a few days ago, trying to call the top based on valuations is not a game you want to play.

I believe this bull market could easily run another year or more.

So don’t let yourself get shaken out.

Stay long and stay in the game.

When it’s time to shift gears – I’ll let you know.

Insight of the Day

Expect to hear even MORE people calling for a market top in the coming weeks and months

Even though the Fed is cutting rates…

Even though the market trend has been incredibly strong…

Even though company earnings keep growing…

You can expect more and more people calling a market top in the coming weeks and months.

As you’ve just seen, most of those people will be wrong again and again.

And when they’re finally right (likely well over a year from now)…

They’ll conveniently “forget” all their poorly-timed calls…

And keep harping on the one rare time they (finally) got it right.

Listening to these “top callers” is a guaranteed recipe for missing out.

Now, the thing is, with the volume of “top calling” set to increase…

Every time the market starts pulling back – there will be hordes of people who think the top is in, and that it’s time to run for the exits.

The “smart money” loves taking advantage of those people…

Using their exits as a chance to pile in at cheaper prices.

That’s just the way things go, unfortunately.

As much as we’d like, we can’t really change that.

So the intelligent play here is to use it for our benefit.

Every time the “smart money” moves to take advantage of the traders getting shaken out…

We can move in as well to target the exact same stocks they’re positioning themselves in…

And use their capital inflows for our gain.

They take advantage of the scared traders…

And we take advantage of them.

It’s all fair play.

And tomorrow, Friday October 24 at 11 a.m. Eastern…

I’m hosting a LIVE briefing explaining exactly how we can do just that…

Using a strategy that has spotted trades that could have returned as high as 500% during similar periods.

I’ll walk you through it step-by-step tomorrow (it’s far simpler than you might think).

So click here to save your spot for my live briefing…

And I’ll see you Friday morning at 11 a.m. ET sharp.

Customer Story of the Day

“Ross Givens & Traders Agency have helped me learn & identify market patterns with analysis as to WHEN and how to properly enter and exit trades, with profit!

It’s been 6 months so far, and the education has been excellent, with the profitable trades following!”

Ross Givens

Editor, Stock Surge Daily