Hey, Ross here:

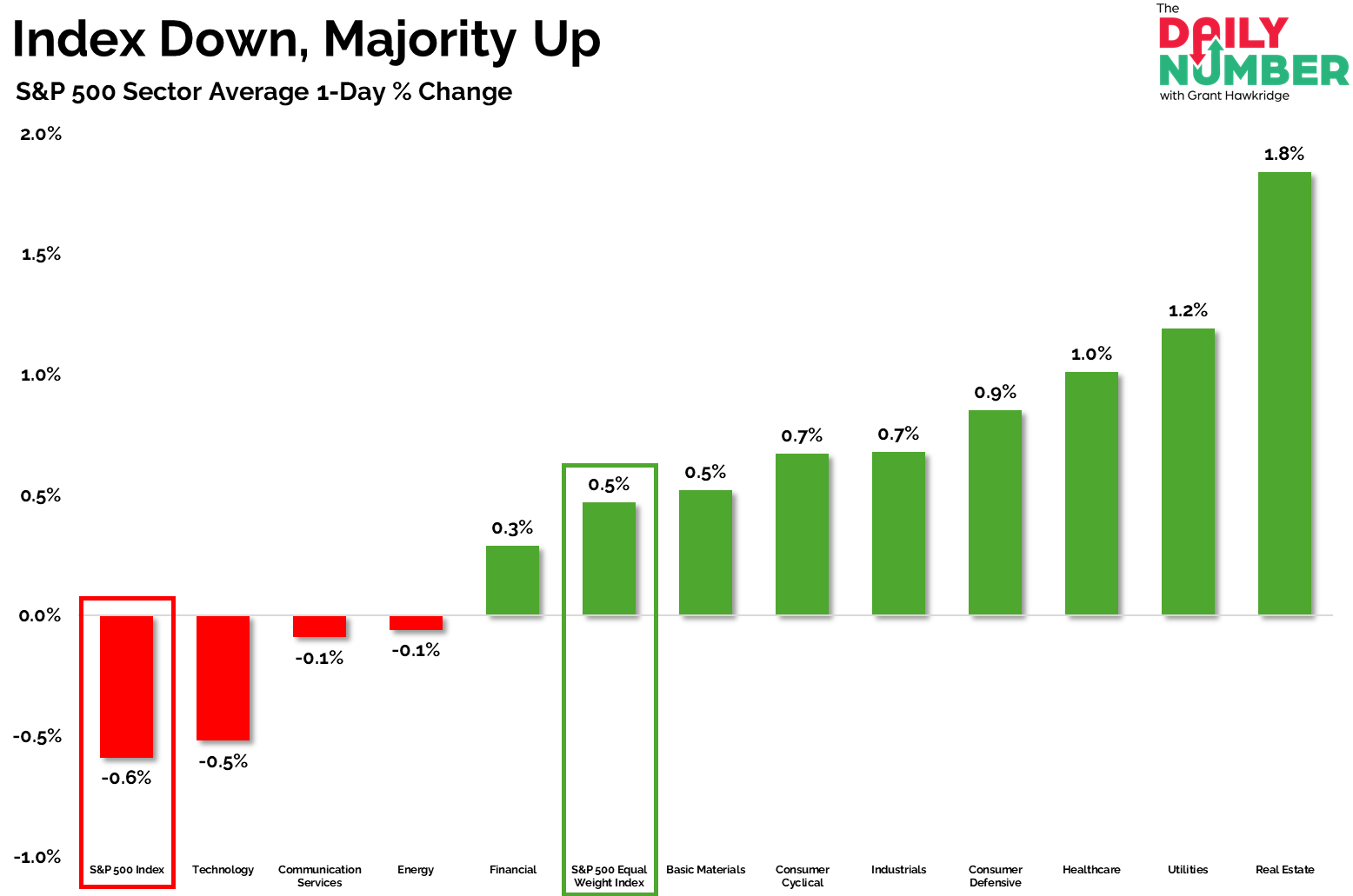

The Nasdaq was down 1.5% yesterday while the S&P 500 closed 0.6% lower.

Bloomberg immediately printed this headline.

Just look at the wording in the headline. A “faltering rally”… a “tech slump”.

It’s designed to exaggerate the situation and pump up the fear.

Because the truth is, while tech stocks did stumble a bit yesterday…

The rest of the market did fine.

Take a look below.

Chart of the Day

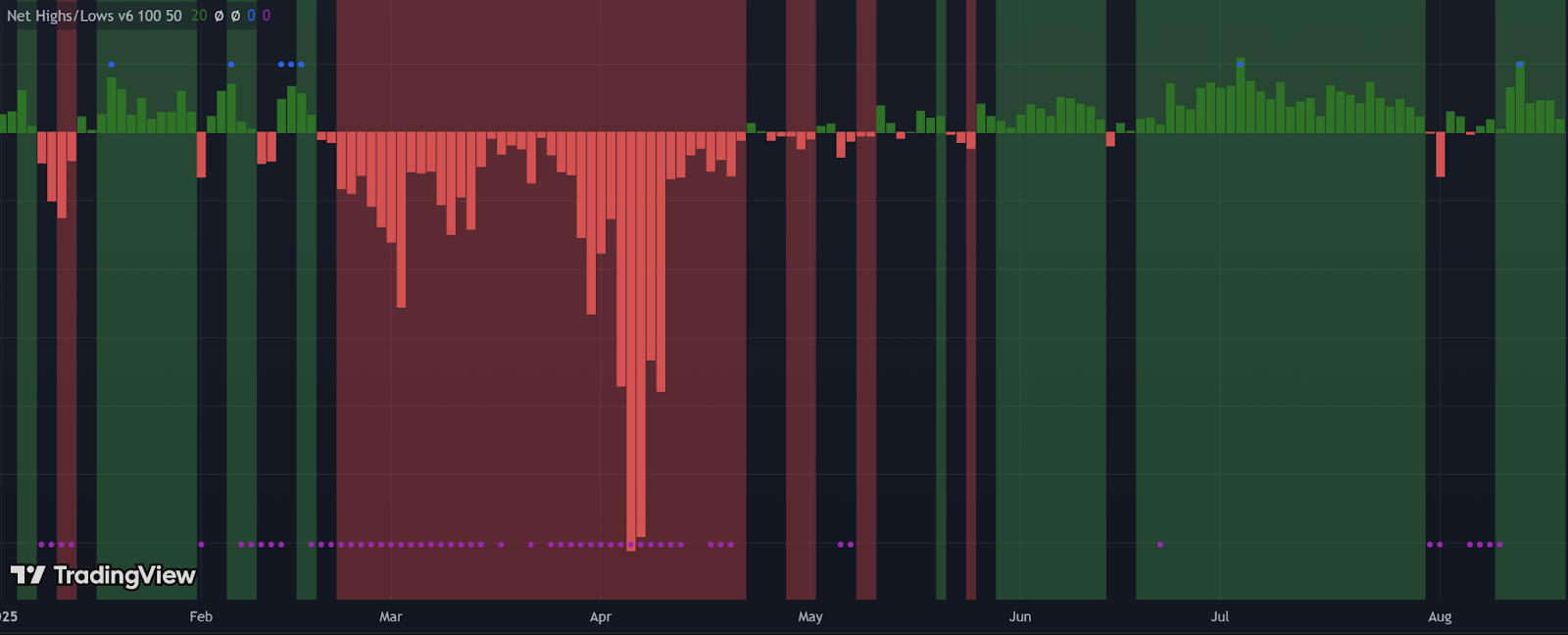

This is the Net New Highs indicator, which shows how many US-listed stocks have made new highs versus new lows at the end of each day.

A green reading means there were more new highs than new lows (and vice versa).

Despite tech’s underperformance yesterday, we still saw more new highs than lows.

And we can confirm this by looking at the equal-weight S&P 500 index, which actually rose by 0.5% yesterday.

And if we do a sectoral breakdown of the S&P 500, the picture reveals clear opportunities.

I’ve said it before and I’ll say it again…

Don’t be fooled by the media trying to pump up the fear.

P.S. Did you miss my latest edition of 2 Trades in 2 Minutes yesterday? If you did, just text the word “trade” to 87858 and get the next edition straight to your mobile when it’s out.

Insight of the Day

The broader market may be stumbling – but certain sectors are exploding.

There have been times where the broader market was flying, but underneath the surface, many sectors were struggling.

But there have also been times where the broader market was stumbling, but certain sectors were surging.

We’re likely entering one of those times now.

Sure, the tech sector may indeed be faltering.

And since the biggest names are all in that sector, it will cause the broader market to stumble as well.

But this doesn’t mean there aren’t other sectors that are surging beneath the surface. You can see that for yourself in the last chart.

That’s why later this afternoon at 3 p.m. Eastern…

I’m going LIVE to show you how to target triple-digit setups in these surging sectors…

Using a strategy that could have delivered a 148% gain in 2 days on Iris Energy.

Don’t succumb to the manufactured fear – that’s how people end up leaving money on the table.

Join me live later this afternoon, and let’s go after the top setups in the market right now.

Click here to guarantee your spot if you haven’t already…

And I’ll see you live at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I guess I have been a newbie in the stock market for years. Buying a stock and just letting it ride.

Yes, I made a little money, but after finding Ross Givens and his educational methods a few months ago, I have moved the stocks in my portfolio to ones with more potential than ever before.

I am so impressed I purchased a lifetime membership and learned a new selection method daily.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily