Hey, Ross here:

After Friday’s sharp dip, we saw an equally sharp rebound yesterday.

What’s going on?

Today’s chart will shed some light.

Chart of the Day

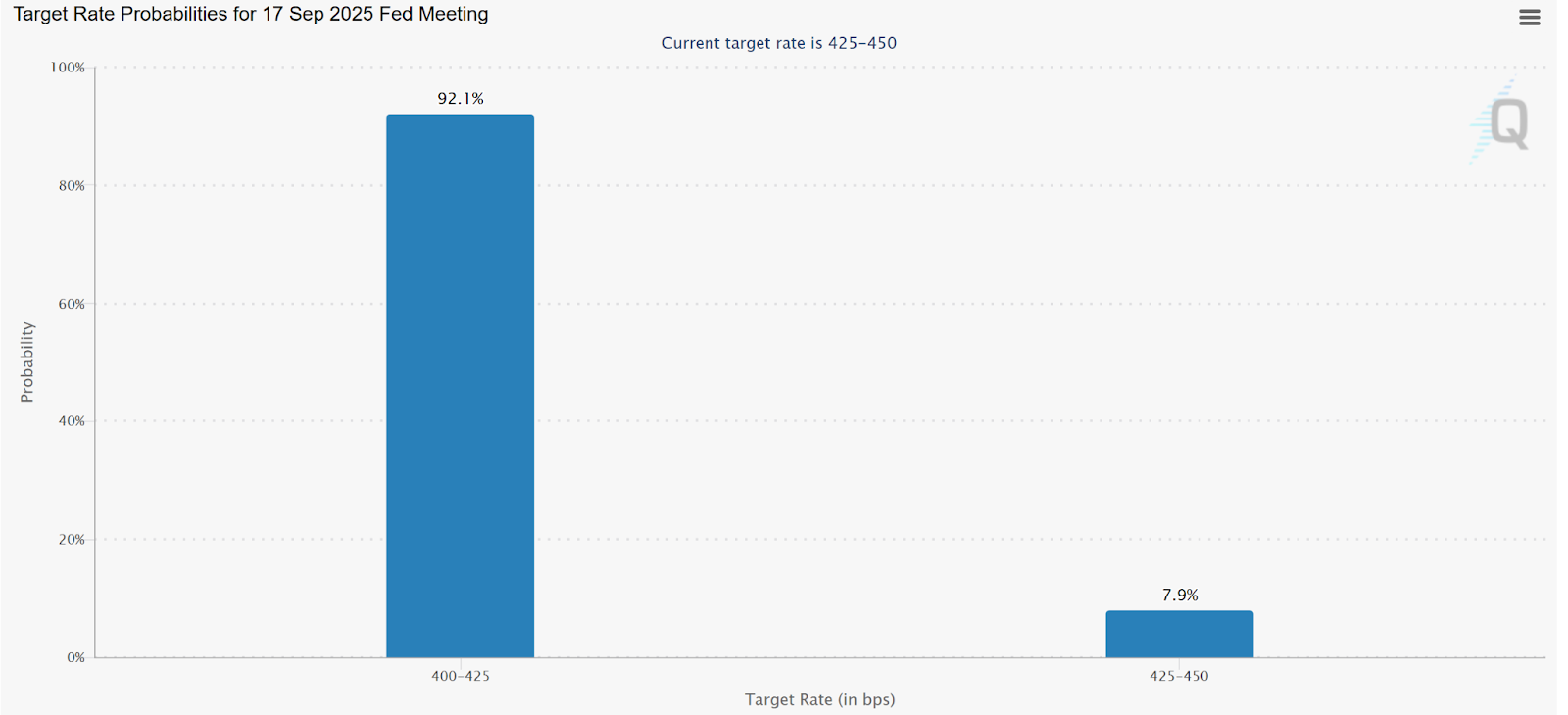

This chart shows the probabilities of a rate cut – as implied by Fed Funds futures contracts – at the next Fed meeting in September.

As of yesterday, it was standing at a staggering 92%.

Just one week ago, this probability was just 63%.

What happened?

It all has to do with the jobs growth data being revised sharply downward – not just for last month, but for the prior two months as well.

It’s why Trump fired the head of the Bureau of Labor Statistics. That kind of inaccuracy is inexcusable when it comes to figures as crucial as these.

One of the reasons the Fed has been hesitant to cut – other than inflation still running above target – is the so-called stability of the labor market.

But the revised numbers are now painting a much bleaker picture of the labor market.

And that could give the Fed the reason they need to finally cut rates…

Which would obviously be a positive for the stock market.

That’s why stocks are rebounding.

The question is – can it last?

I explain something counterintuitive that could stop this rebound dead in its tracks below.

P.S Later today, I’m sending out my next weekly edition of 2 Trades in 2 Minutes. Text the word “trade” to 87858 and we’ll text you the link the moment the trades are ready. It’s completely free.

Insight of the Day

Positive economic data releases may have a good chance of sending the market into a pullback.

As I explained above, right now, it’s the expectations of a Fed rate cut that is keeping the market up.

Should rosy economic data come out in the subsequent days…

It would give the Fed less reason to cut – which would counterintuitively be a negative for stocks.

Even in the absence of this, though, I still believe we’re in for a pullback.

So I suggest you prepare yourself for that.

The thing is, preparing for a pullback doesn’t always mean going on the defensive.

In fact, I suggest you do the opposite – and go on the offensive instead.

I’m seeing some explosive setups forming in the market right now…

And later this morning at 11 a.m. Eastern…

I’m going LIVE to show you my #1 strategy for playing this volatile situation.

We’ve already used this strategy to hit open gains of 82% in 60 days, 94% in 84 days, 212% in 98 days, and even 434% in less than a year.

But with the way things are unfolding, I believe this could just be the start.

So click here to guarantee your spot for my live strategy session if you haven’t already…

And get ready to put my top strategy for the moment to work for you.

See you in a few hours at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross is very honest and makes sure you understand what he is reviewing. If you ask a question in the chat box, he WILL answer it and review the specific stock answer. Ross is one of the best to learn from.

Thank you, Ross. I can see why you left Wall Street. You are helping real customers in the real world.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily