Hey, Ross here:

We’re already seeing a bit of technical dip buying come in after last week’s sharp decline.

So let’s look at how much cash is just waiting on the sidelines.

Chart of the Day

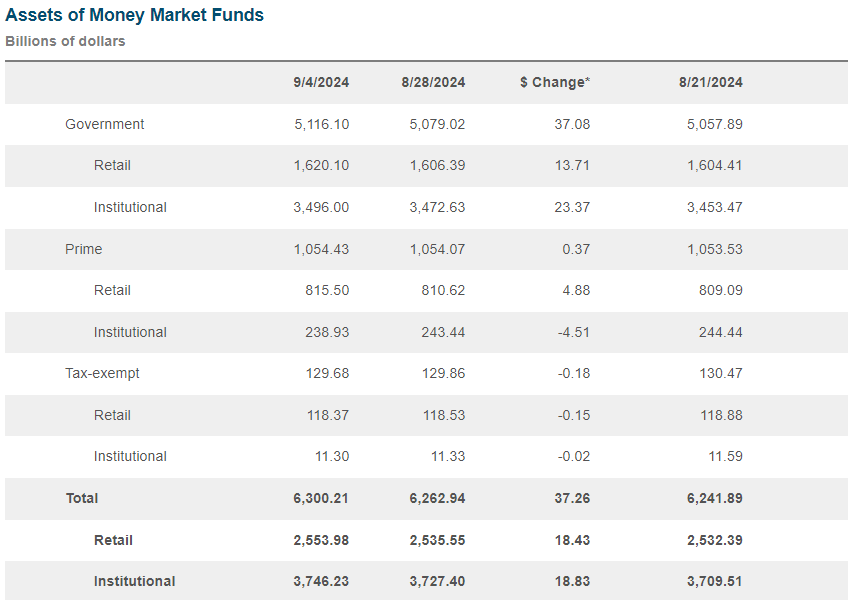

This is the amount of cash sitting on the sidelines of the market, parked in money market funds.

At $6.3 trillion as of last Wednesday, this is the highest level we’ve seen in many months.

With risk appetite dropping, it’s not surprising to see the giant pile of cash on the sidelines grow even larger.

But what this also tells us is that when the Fed starts cutting – and risk appetite comes roaring back…

We could potentially see a much faster surge in the markets than what would expect.

Don’t get caught off guard if that happens.

Insight of the Day

More accurate expectations = better trading

The market’s consensus expectations are reflected in the current price.

As expectations change, so does the price.

This means the more accurate your expectations are, the better your trading will be.

That’s what trading edges are all about.

And when it comes to getting more accurate expectations…

I know of no better edge than following the corporate insiders.

They have far more accurate expectations about their own company stock prices than any analyst…

Which is why following their trades is so effective – especially now, because this trading edge is not dependent on market momentum (which is currently negative).

And later this morning at 11 a.m. Eastern….

I’m going LIVE for a masterclass that will show you how to use this insider edge in your own trading right now.

You could have used this edge to sidestep Nvidia’s recent wipeout…

As well as to lock in fast 30 – 40% profits even as the market sold off last month.

So, if you haven’t yet, make sure you click here to guarantee your slot for my live insider masterclass later this morning…

And get ready to have everything you need to start using this insider edge for yourself, including:

- What compels these insiders to buy…

- The warning signs you need to know when following the insiders…

- And the most powerful – yet counterintuitive – insider buying signals there are

See you at 11 a.m. ET in a bit.

The login info will be in your inbox shortly – do try to log in earlier if you can.

Customer Story of the Day

“I’m still learning but Ross is the man I wish I had the knowledge he has and I’m so thankful he is willing to share it with us. I’m sure, like me, most of you aren’t natural stock gurus but the more I listen to him the more I learn.

I still have a very long way to go but the more time I put into it the more I learn under his guidance. Thanks Ross.”

Ross Givens

Editor, Stock Surge Daily