Hey, Ross here:

Last week, I talked about the return of a “risk-on” mood in the markets.

With the Fed likely to cut again today, let’s look at more evidence that this risk-on sentiment is continuing to surge.

Chart of the Day

First, let’s look at the Russell Microcap Index – composed of the very smallest of public companies.

As you can see, the Microcap Index is now at its highest levels in years.

Remember, these are the smallest, riskiest stocks on the markets.

If they’re blasting off, you can be sure that risk appetite is as well.

Next, let’s look at XLP/SPX…

Which is the ratio of the Consumer Staples sector (XLP) to the broader S&P 500.

Remember, consumer staples is a traditionally defensive sector…

One that tends to do well when risk appetite is low, and vice-versa.

As the chart above shows, compared to the broader market…

The Consumer Staples sector has been steadily falling since the April lows.

And if you zoom in at the end of the chart, you can see that after a spike in November (aka the November pullback)…

The XLP/SPX ratio has continued falling again.

That’s another sign that risk appetite is returning.

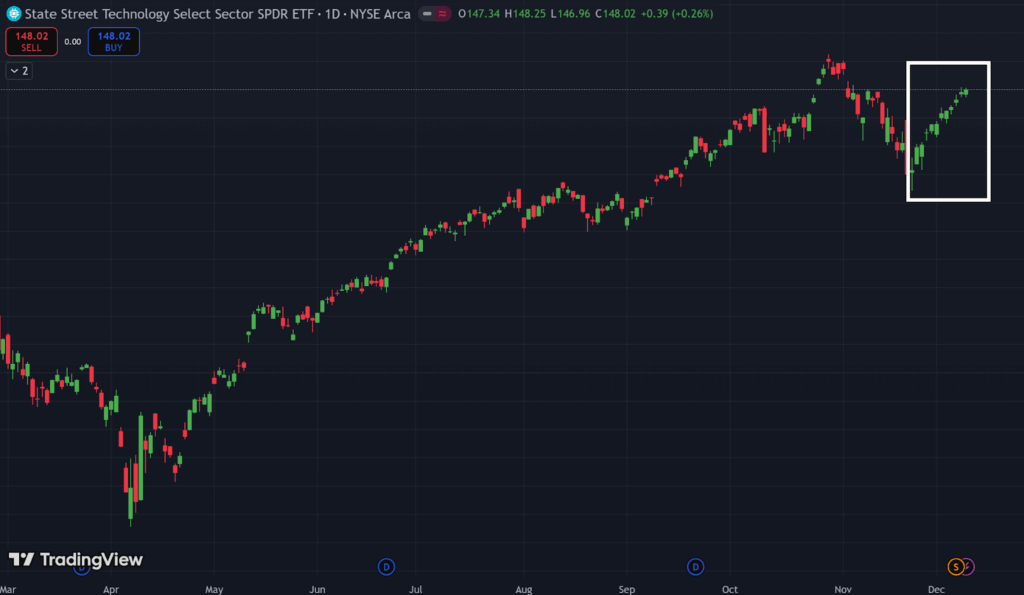

Finally, let’s look at how one of the most offensive sectors in the market is doing.

I’m talking, of course, about the tech sector…

Which as you can see above, has now logged 12 consecutive trading sessions of gains…

The second longest streak in history.

To sum up, we’re seeing offensive sectors flourishing – and defensive sectors fading.

Risk-on. Stay in the game.

Insight of the Day

A critical skill for traders is being able to determine the ACTUAL level of risk appetite in the markets.

Because knowing the actual level of risk appetite tells us how to size our positions…

And more importantly – where to look for opportunities.

The thing is, most traders – especially retail traders – have absolutely no clue how to do this.

I mean, just look at retail sentiment.

Sure, there’s been a clear rebound in retail sentiment.

But based on the data I’m seeing…

Retail risk appetite is still lagging behind actual risk appetite.

And that means most of them will be missing out on the opportunities right in front of them.

Don’t let that be you.

There’s one group of stocks that are making a comeback right now.

It has nothing to do with technology – but everything to do with AI.

Click here to watch me break it all down.

Customer Story of the Day

“Ross and all the different services the Traders Agency offer are the best thing one can do if they would like education and trading tips, help and alerts on a daily basis.

Regardless of the level of trader that you are, they have you covered. Services are there for multiple different styles of traders.

Also Ross shares his experience and analysis when it comes to longer term investing as well when he broadcasts live for his members but every time he is asked the question on any other occasion as well.

His teaching style is outstanding and very very easy to understand and remember.

I am very grateful to have found them and have recommended them to multiple friends too.

Lots of people love them for the Insider trade alerts and analysis Ross sends out regularly and are exciting news for one’s portfolio but I personally would recommend every single service of the agency as evenly valuable assuming it fits one’s style of trading.

All the best always and forever to Ross and crew.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily