Hey, Ross here:

There’s been lots of talk in this bull market about “narrow leadership” and market concentration.

And while I won’t deny that these have been notable issues…

As today’s chart shows – we’re actually moving into broader strength.

Chart of the Day

Last FridTh

This chart shows how the tech sector, the S&P 500, and the S&P 500 minus the tech sector has been performing from end-October till now.

You can see a clear divergence there.

Tech has been pulling back – while the other sectors have been accelerating forward.

Considering that lots of the market concentration concerns have been from tech, this is a good sign.

And that’s not all.

Look at this chart here.

This chart shows the percentage of S&P 500 (large-cap), S&P 400 (mid-cap), and S&P 600 (small-cap) stocks trading above their 50-day moving averages.

As you can see, there’s a clear breakout in this ratio for all three indexes…

Indicating improving broad-based strength across the entire American stock market.

And that’s just the American stock market.

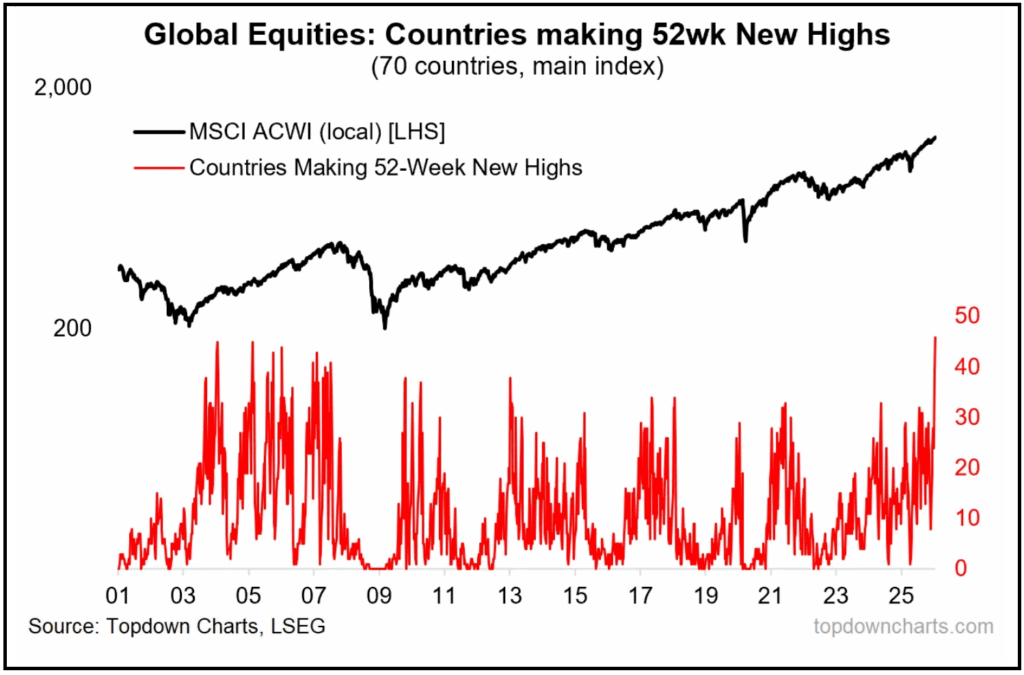

Because as today’s final chart shows – it’s not just America.

We’re now seeing the most number of countries making new 52-week highs in their main stock market indexes.

This is the highest number dating back decades.

As you may know, even though the S&P 500 did pretty well in 2025 – many international markets did better.

And that performance appears to be continuing in 2026.

In short, we’re seeing broad-based market strength – both across America and the rest of the world.

Stay in the game.

Insight of the Day

The broader the strength the more diverse the opportunities.

Sure, there are opportunities in every type of market.

But the best kind of markets for traders, in my opinion, are the ones seeing broad strength.

For instance, in a narrow strength market…

By definition, targeting strength means limiting yourself to a much smaller subset of opportunities.

But in this kind of market, you have the most diverse opportunities available.

And that means a wider range of strategies become more effective.

And not only that – but the strategies tend to pay out faster too.

Basically, this is the kind of environment that supercharges almost every trading strategy.

And it doesn’t come around that often – even in a bull market.

So when it does, you want to take full advantage of it.

That’s why my team and I go LIVE every week to break down the juiciest trade setups in real time.

If you want to join us, it’ll only cost you $5 (that’s right, just five bucks) for an entire year.

And you can click here to get all the details (including my top AI picks for 2026).

Customer Story of the Day

“Ross and all the different services the Traders Agency offer are the best thing one can do if they would like education and trading tips, help and alerts on a daily basis.

Regardless of the level of trader that you are, they have you covered. Services are there for multiple different styles of traders.

Also Ross shares his experience and analysis when it comes to longer term investing as well when he broadcasts live for his members but every time he is asked the question on any other occasion as well.

His teaching style is outstanding and very very easy to understand and remember.

I am very grateful to have found them and have recommended them to multiple friends too.

Lots of people love them for the Insider trade alerts and analysis Ross sends out regularly and are exciting news for one’s portfolio but I personally would recommend every single service of the agency as evenly valuable assuming it fits one’s style of trading.

All the best always and forever to Ross and crew.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily