Hey, Ross here:

To close out the trading week, here’s an interesting chart that shows why you should be wary about who you listen to about the markets.

Chart of the Day

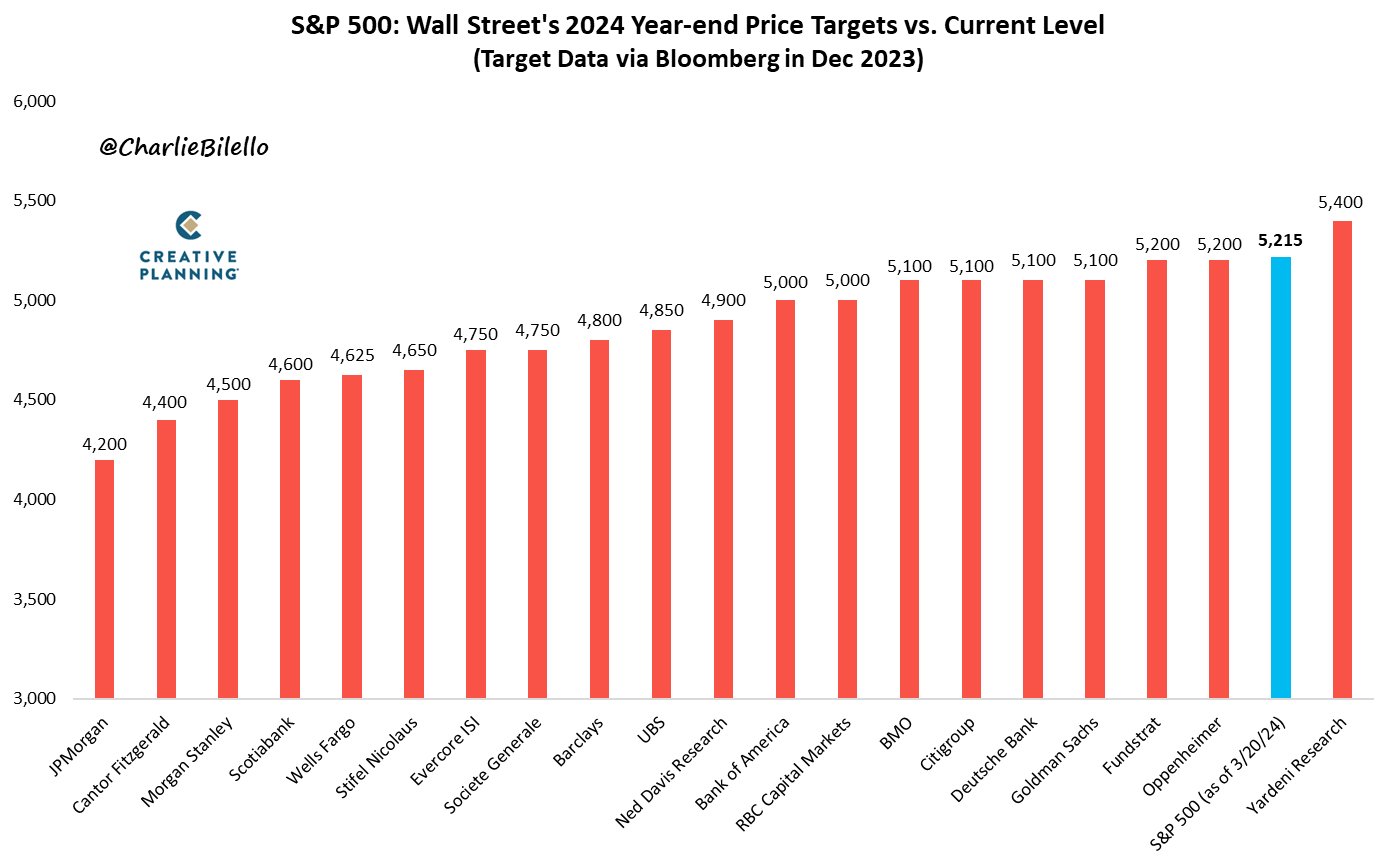

This is Wall Street’s 2024 year-end price targets for the S&P 500 – taken in December 2023 – versus where the S&P 500 actually is this week.

As you can see, it’s already higher than almost all of them.

Now, of course, we still have a long way to go until the end of the year, and there is a chance the market could end 2024 lower than it is right now.

But based on the way things are going, I find that unlikely.

And even in the off chance that’s the case – it still doesn’t change how we should act today.

Insight of the Day

As traders, we have the advantage of being able to quickly adapt to any shifts in market conditions.

Compare this with the long-term buy-and-hold investors who only start selling long into retirement.

If the market ends the year lower than it is today, that means they’ll have essentially “wasted” a whole year.

Not so for us traders.

We can take advantage of the hot market now – and just exit our positions (or even go short) if things start to dip.

That’s why it doesn’t really matter where the market will be at the end of the year…

What’s important is that right now, market momentum is positive – and we can ride that wave as long as it lasts.

That’s why, to close out the week, I’m going LIVE for a masterclass in just a bit at 10 a.m. Eastern.

This masterclass will allow you to target the stocks at the forefront of this market wave, so you can make the most out of this rising market.

Seize the opportunity while it’s there.

Click here to lock in your spot for my masterclass now…

And my team will send you the login details shortly.

See you there.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily