Paul Tudor Jones is one of the greatest traders who ever lived.

In 1987, he predicted the Black Monday crash and tripled his money in a single day – earning an estimated $100 million.

His success has continued for more than three decades.

Today, the hedge fund titan has a net worth of ~$7.5 billion.

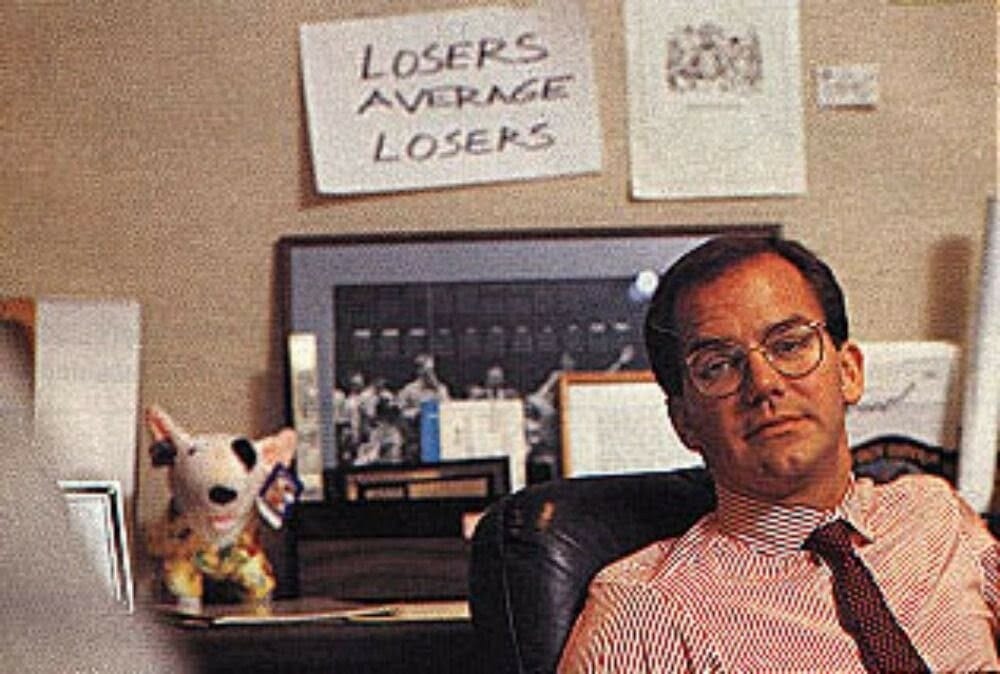

But there is a famous picture of Paul Tudor Jones in his office from his earlier years.

Behind him, a single sheet of paper is tacked on the wall with a simple phrase…

“LOSERS AVERAGE LOSERS”

Advice from a Market Wizard

This image always struck me.

Here is this market legend… a billionaire trader… a certified Market Wizard…

And even he has to remind himself of this simple truth – Losers average losers.

Jesse Livermore explained this phrase and warned against averaging down on losing trades 100 years ago.

He said, “Of all the speculative blunders, there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.”

Here’s an example…

You buy a stock for $20.

A week later, it’s trading at $15.

If you liked it at $20, you should love it at $15, right?

Wrong.

Fatal Flaw

This is a fatal flaw and one many of us are guilty of.

It doesn’t matter that the stock is 25% cheaper than it was a week ago.

The market is always right. Price is all that matters.

Regardless of our perception of a stock’s value, it is only worth what someone else is willing to pay for it.

Averaging down is the quickest route to the poor house.

This is how day trades turn into swing trades and swing trades turn into long-term positions.

We get attached to a stock. Our ego doesn’t want to accept the loss.

“I’ll get out as soon as I’m back to break-even,” we say.

But it doesn’t come back. It falls lower.

Throwing good money after bad in order to lower your cost basis does little more than turn a small loss into a big one.

Sure, the market will bail you out on occasion.

But it only takes one big loss to destroy months or years of good trading.

Don’t Be Afraid to Take a Loss

Here’s another example…

Your friend buys XYZ stock at $100 a share.

A few months later, it’s down by half, trading at $50 a share.

You buy at a “discount,” thinking you’ll double your money when the price bounces back.

A year later, it has fallen to $10.

Your friend is down 90%. You’re down 80%.

You bought at $50 – half the price your friend paid. Yet, your loss is still 80%.

We call these “bear traps” – stocks that look cheap based on where they traded in the past.

But stocks going down are doing so for a reason.

Maybe sales and profits are on the way down. Maybe the company lost a major contract. Maybe their product has fallen out of favor.

Peloton Interactive, Inc. (PTON) is a great recent example…

Don’t be that trader…

Don’t be afraid to take a loss.

After all, you can’t win if you are not willing to lose.

My Latest Research Project

Regular readers know I have years of experience following the stock trades of corporate insiders, but I’m now looking for even bigger gains by following the insiders in Washington DC.

We all know that those in power are making millions with their uncanny knack for buying into stocks ahead of massive moves.

It’s enough to make you think that the system is tilted against the individual investor.

But not to worry… There are legal ways to follow these transactions by DC insiders without ever being accused of insider trading…

My brand new Undercover Trader research service focuses on exactly that, and I’ve just put the finishing touches on my latest presentation.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily