Good Morning, Trader,

People love to brag about their option trades.

It’s easy to do.

Because when you make the right option move, you can achieve triple-digit gains on 5-10% moves in the underlying stock.

And that happens a LOT.

My trade recommendations have netted wins as high as 1,091%.

In fact, my option trading service is averaging a 23% gain per trade. That’s a net of wins and losses.

The trick is knowing when to BUY options and when to SELL them.

If you don’t want to read the whole article let me give you the cliff notes – buy options when the VIX (Volatility Index) is low and sell when the VIX is high.

There is a little more to it.

But that’s the basic concept.

For Example…

I recently did a trade with options on Brunswick Corporation (BC):

You see, options are leveraged instruments.

This is how I was able to make 318% on a 25% move in the stock.

But stock options aren’t all roses and sunshine…

Small moves in the wrong direction can lead to large percentage losses.

Heck… sometimes the stock goes in your direction and you still lose money!

It’s all about knowing when to be a buyer and when to be a seller.

I won’t get into the nitty gritty on delta, expiration dates and time decay right now.

I’ll save that for another day.

But if you haven’t read my special report on options: How To 10X Your Stock Surge Gains you need to read it now.

As a subscriber to my Stock Surge Daily, you can download it right here at zero cost.

But if you are going to trade stock options, there is one thing you MUST understand – VOLATILITY.

Specifically, IMPLIED VOLATILITY.

You see, option prices are determined by several factors like the strike price and time left before expiration.

But the most significant force is implied volatility.

This number represents how much the market maker expects the underlying stock to move.

Source: ThinkorSwim trading platform, TDAmeritrade

You’ll see it as a percentage on the right side of your broker’s option chain.

The number in parenthesis is the expected move in dollars per share between today and the date of expiration.

Some stocks are more volatile than others.

Coinbase (COIN) options have implied volatility of 113%.

Walmart (WMT) is closer to 24%.

So, options on COIN are going to cost more than those for WMT.

But even those numbers can change drastically.

The culprit?

The VIX.

VIX stands for volatility index.

It represents the perceived downside risk of the overall market.

Normally, the VIX reads somewhere around 20.

In good times, it gets as low as 10.

In bad times, like the COVID selloff last March, it hit 85.

When volatility, i.e. the VIX, is high, option prices are high as well.

That goes for calls and puts.

When volatility is low, options are cheaper.

The goal with options is the same as with stocks – buy low and sell high.

So, during these periods of high volatility, you want to be a SELLER of options… not a buyer.

That’s one of the secrets to successful options trading.

You have to know when to buy and when to sell.

You’re never going to time it perfectly.

But if the VIX is at 40, do yourself a favor – sell options. Don’t buy them.

If you buy, volatility will be working against you.

Regardless of whether you buy puts or calls, the price you pay will be high.

Even if things go in your direction, you could still lose money if volatility goes down since it will drive down the price of those options as well.

On the other hand, if the VIX is down at 15, you don’t want to be selling credit spreads.

Option prices are cheap.

You won’t collect much premium.

This is when you want to be buying.

If volatility increases, which it almost certainly will, your options will automatically be worth more.

If you’re right on the direction of the underlying stock AND volatility picks up, the win will be twice as big.

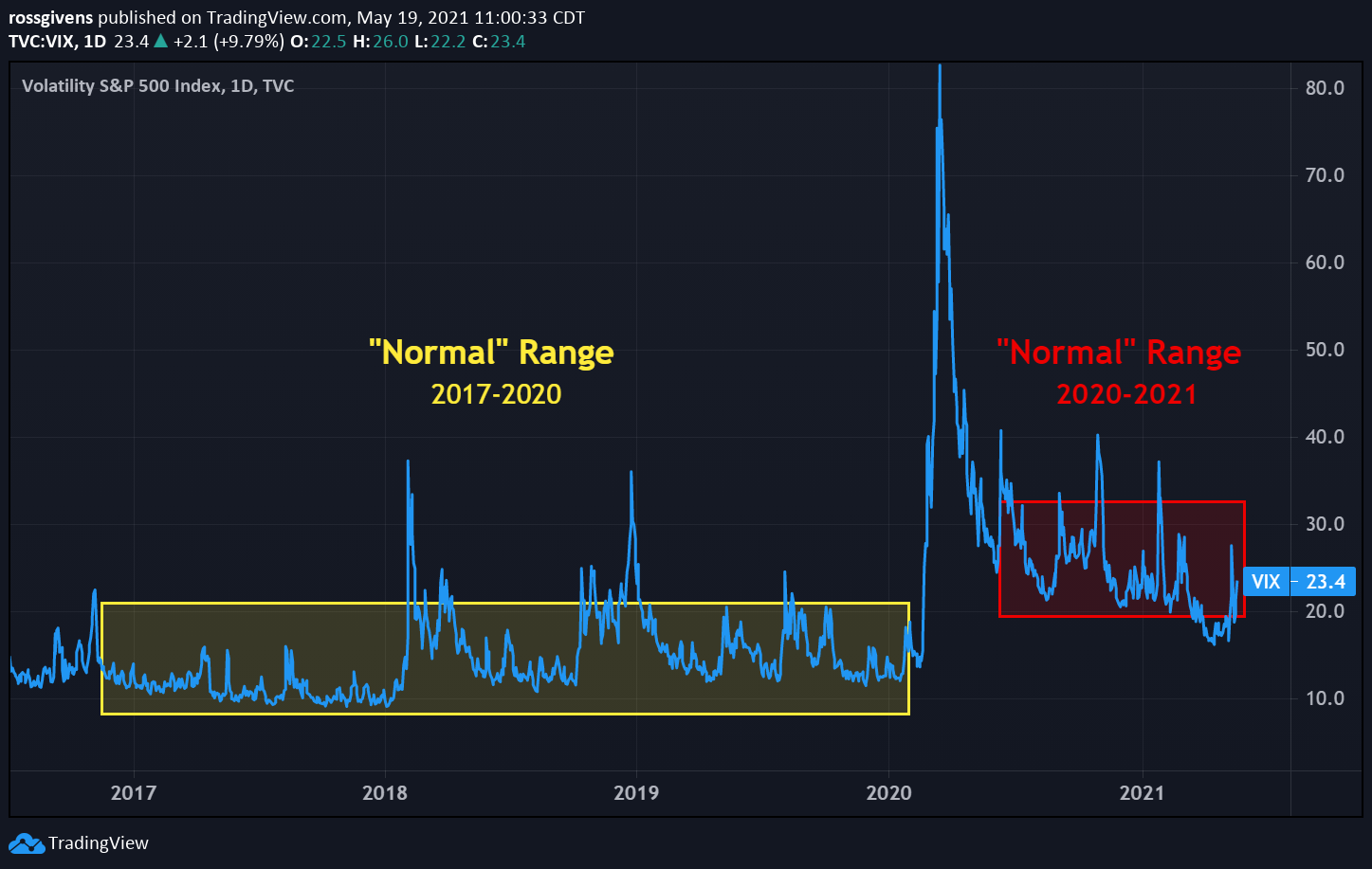

For the last year and a half, the VIX has traded in a higher range than previous years.

This is the new normal.

Today, a “low” VIX is anything below 25.

That should be your buy range.

Above that, either be a seller or avoid buying options.

Do that, and you’ll see a lot better results with your options trading.

P.S. One of the stocks on my watchlist, Deswell Industries (DSWL) is trying to breakout as it’s up by 5.25% over the past week. It got a huge surge in volume Wednesday morning to 183 thousand shares – so keep an eye on it. I’ll keep you in the loop and let you know if it does become a true Surge Stock.